5 Health Insurance Tips

Introduction to Health Insurance

Health insurance is a vital aspect of our lives, providing financial protection against medical expenses. With the rising costs of healthcare, having a health insurance plan can help alleviate the burden of unexpected medical bills. In this article, we will discuss five essential health insurance tips to help you navigate the complex world of health insurance.

Understanding Your Health Insurance Needs

Before purchasing a health insurance plan, it’s crucial to understand your needs. Consider factors such as your age, health status, and financial situation. If you have a pre-existing medical condition, you may want to opt for a plan that provides comprehensive coverage. On the other hand, if you’re relatively healthy, a basic plan with lower premiums might be sufficient. Assessing your needs will help you choose a plan that provides the right balance of coverage and affordability.

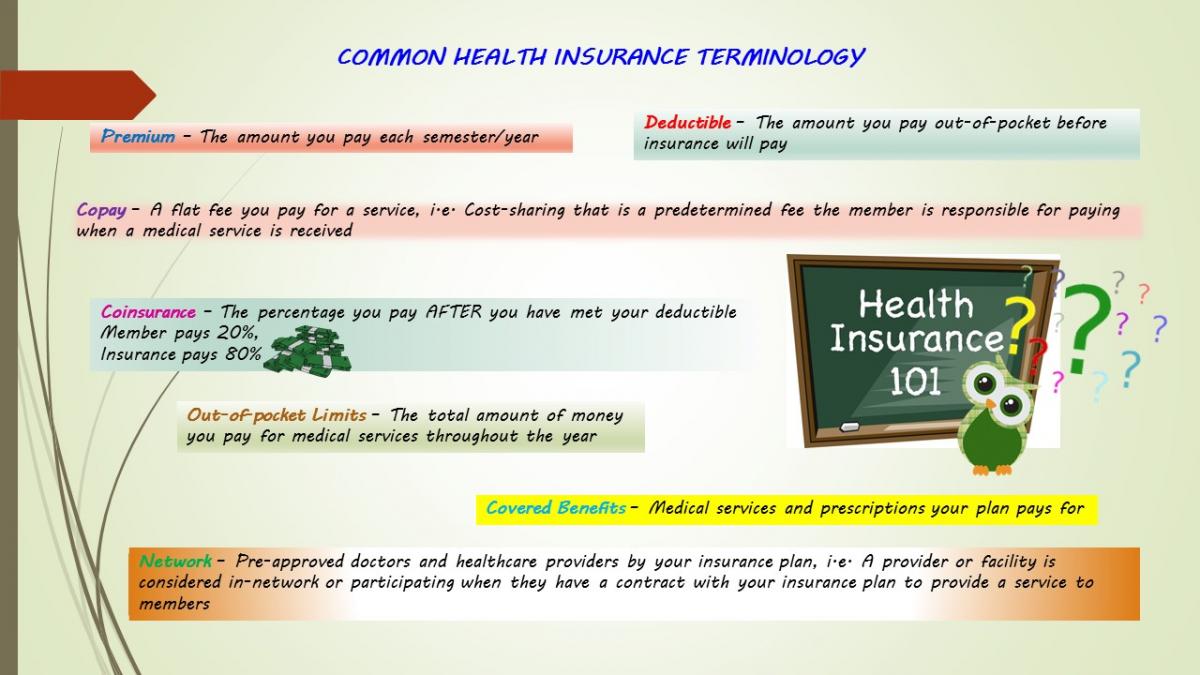

Comparing Health Insurance Plans

With numerous health insurance plans available, comparing them can be overwhelming. Here are some key factors to consider when comparing plans: * Premiums: The monthly or annual cost of the plan * Deductible: The amount you must pay out-of-pocket before the insurance kicks in * Copayment: The amount you pay for each medical service or prescription * Coinsurance: The percentage of medical expenses you pay after meeting the deductible * Network: The list of healthcare providers and hospitals that participate in the plan Create a table to compare these factors and determine which plan best suits your needs.

| Plan | Premiums | Deductible | Copayment | Coinsurance | Network |

|---|---|---|---|---|---|

| Plan A | $300 | $1,000 | $20 | 20% | Narrow |

| Plan B | $400 | $500 | $30 | 30% | Wide |

Maximizing Your Health Insurance Benefits

To get the most out of your health insurance plan, it’s essential to understand the benefits and limitations. Here are some tips to help you maximize your benefits: * Preventive care: Take advantage of free preventive services, such as annual check-ups and screenings * Network providers: Choose healthcare providers and hospitals within your plan’s network to reduce out-of-pocket costs * Claims submission: Submit claims promptly and accurately to ensure timely reimbursement * Appeals process: Understand the appeals process in case your claim is denied

📝 Note: Always review your plan's documentation and ask questions if you're unsure about any aspect of your coverage.

Avoiding Common Health Insurance Mistakes

When navigating the complex world of health insurance, it’s easy to make mistakes. Here are some common mistakes to avoid: * Insufficient coverage: Failing to purchase adequate coverage, leaving you vulnerable to unexpected medical expenses * Inadequate network: Choosing a plan with a limited network, reducing access to healthcare providers and hospitals * Non-disclosure: Failing to disclose pre-existing medical conditions, which can lead to claim denials or policy cancellation * Non-renewal: Failing to renew your policy, leaving you without coverage

Staying Informed About Health Insurance

The health insurance landscape is constantly evolving, with changes in legislation, regulations, and plan offerings. To stay informed, follow these tips: * Industry news: Stay up-to-date with the latest news and developments in the health insurance industry * Plan updates: Regularly review your plan’s documentation and updates to ensure you understand any changes * Customer support: Take advantage of customer support services, such as phone or online chat, to address any questions or concerns

In summary, health insurance is a vital aspect of our lives, providing financial protection against medical expenses. By understanding your needs, comparing plans, maximizing benefits, avoiding common mistakes, and staying informed, you can navigate the complex world of health insurance with confidence.

What is the difference between a deductible and copayment?

+

A deductible is the amount you must pay out-of-pocket before the insurance kicks in, while a copayment is the amount you pay for each medical service or prescription after meeting the deductible.

Can I change my health insurance plan at any time?

+

No, you can typically only change your health insurance plan during the annual open enrollment period or if you experience a qualifying life event, such as a change in employment or marriage.

What is the purpose of a health insurance network?

+

The purpose of a health insurance network is to provide a list of healthcare providers and hospitals that participate in the plan, reducing out-of-pocket costs for policyholders.