7 Tips Tax Papers

Introduction to Tax Papers

Tax papers can be a daunting task for many individuals and businesses. The process of filing taxes can be complex and time-consuming, and it’s easy to make mistakes that can lead to delays or even audits. However, with the right approach and preparation, tax papers can be managed efficiently and effectively. In this article, we will provide 7 tips for managing tax papers, including how to stay organized, what documents to keep, and how to avoid common mistakes.

Tip 1: Stay Organized

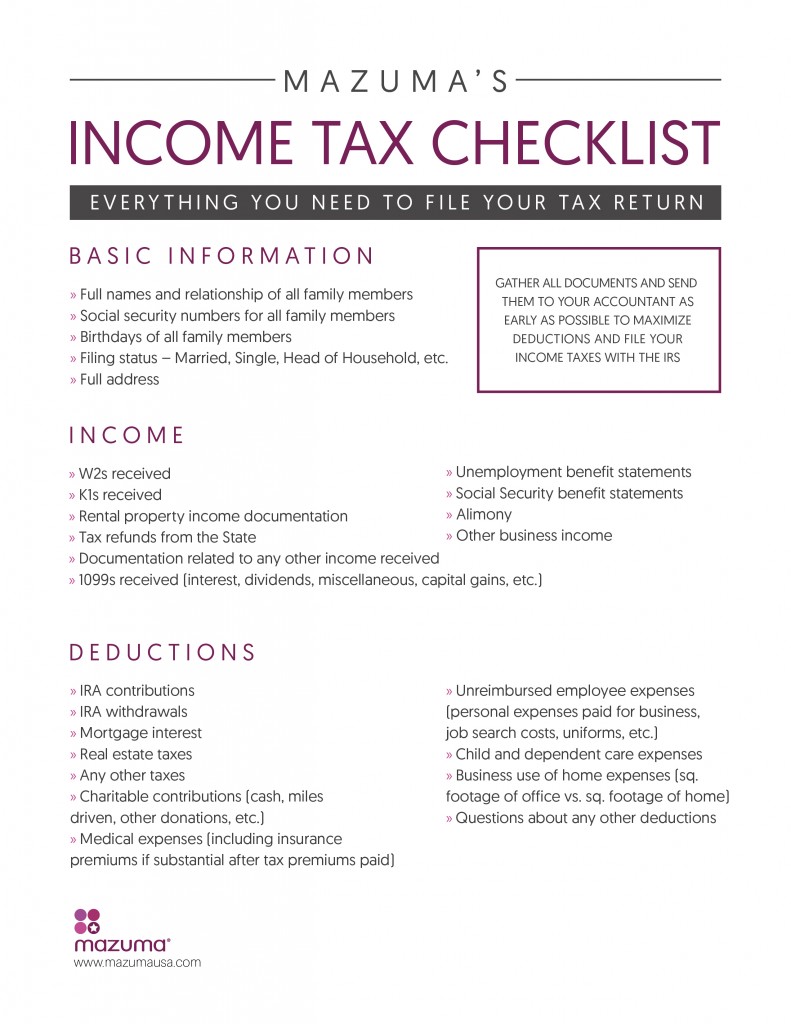

Staying organized is key to managing tax papers effectively. This means keeping all relevant documents in one place, such as a file folder or digital storage system. It’s also important to keep track of deadlines and important dates, such as the tax filing deadline. Using a calendar or planner can help individuals and businesses stay on top of their tax obligations. Additionally, creating a checklist of necessary documents and tasks can help ensure that nothing is missed.

Tip 2: Keep Accurate Records

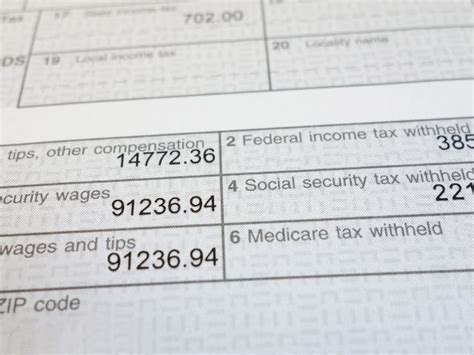

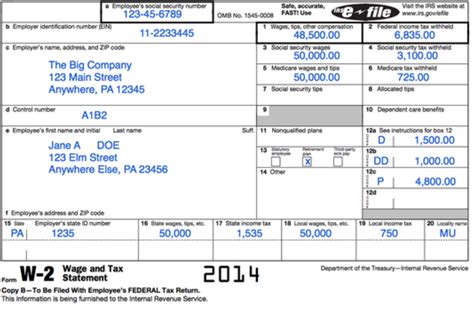

Keeping accurate records is crucial for tax purposes. This includes income statements, expense reports, and receipts for deductions. It’s also important to keep records of business expenses, such as travel expenses and equipment purchases. Using accounting software can help individuals and businesses keep track of their finances and ensure that their records are accurate and up-to-date.

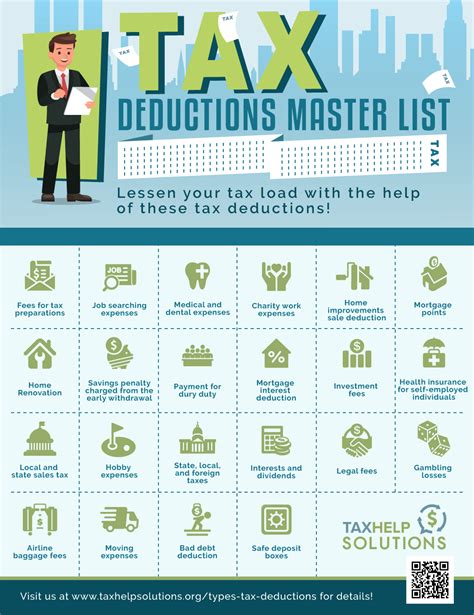

Tip 3: Understand Tax Deductions

Tax deductions can help reduce the amount of taxes owed, but it’s important to understand what deductions are available and how to claim them. Common deductions include charitable donations, medical expenses, and business expenses. It’s also important to keep records of these deductions, including receipts and bank statements. Consulting with a tax professional can help individuals and businesses understand what deductions they are eligible for and how to claim them.

Tip 4: Avoid Common Mistakes

There are several common mistakes that individuals and businesses can make when filing tax papers. These include math errors, incomplete information, and missing signatures. It’s also important to double-check all information and calculations to ensure that they are accurate. Using tax software can help individuals and businesses avoid these mistakes and ensure that their tax papers are filed correctly.

Tip 5: Stay Up-to-Date with Tax Laws

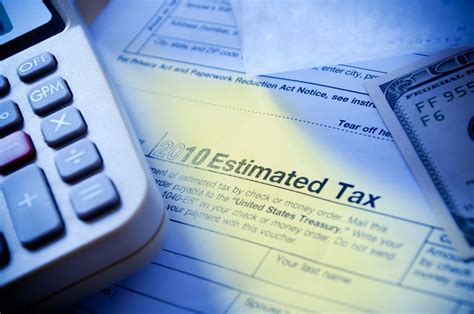

Tax laws and regulations are constantly changing, and it’s important to stay up-to-date with these changes. Following tax news and updates can help individuals and businesses understand how changes in tax laws may affect them. Consulting with a tax professional can also help individuals and businesses understand how to navigate these changes and ensure that they are in compliance with all tax laws and regulations.

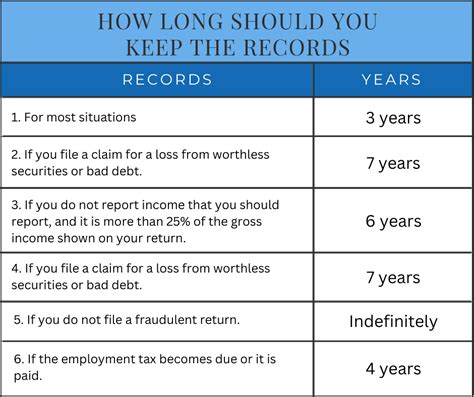

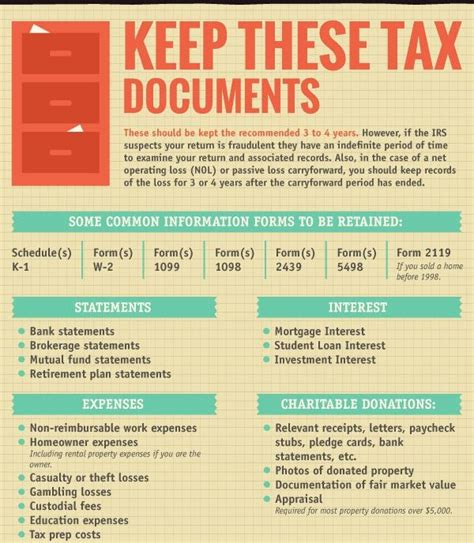

Tip 6: Keep Supporting Documents

Keeping supporting documents is crucial for tax purposes. This includes receipts, bank statements, and other documentation that supports tax deductions and credits. It’s also important to keep these documents organized and easily accessible in case of an audit or other tax inquiry. Using a digital storage system can help individuals and businesses keep their supporting documents organized and easily accessible.

Tip 7: Seek Professional Help

Finally, seeking professional help can be beneficial for individuals and businesses that are struggling with tax papers. Tax professionals can help with everything from tax preparation to audits and appeals. They can also provide expert advice on tax planning and strategy. Researching and finding a qualified tax professional can help individuals and businesses ensure that their tax papers are filed correctly and that they are taking advantage of all available tax deductions and credits.

💡 Note: It's always a good idea to consult with a tax professional if you're unsure about any aspect of the tax filing process.

In summary, managing tax papers requires a combination of organization, attention to detail, and knowledge of tax laws and regulations. By following these 7 tips, individuals and businesses can ensure that their tax papers are filed correctly and that they are taking advantage of all available tax deductions and credits. With the right approach and preparation, tax papers can be managed efficiently and effectively, reducing stress and saving time and money.

What is the deadline for filing tax papers?

+

The deadline for filing tax papers varies depending on the country and type of tax return. In the United States, the deadline for filing individual tax returns is typically April 15th.

What documents do I need to keep for tax purposes?

+

You should keep all documents that support your tax deductions and credits, including receipts, bank statements, and other documentation.

Can I file my tax papers electronically?

+

Yes, you can file your tax papers electronically using tax software or by visiting the website of your country’s tax authority.