Keep Loan Paperwork

Understanding the Importance of Keeping Loan Paperwork

When you take out a loan, whether it’s a mortgage, car loan, or personal loan, you’re likely to receive a significant amount of paperwork. This paperwork can be overwhelming, but it’s essential to keep it organized and easily accessible. Loan documents contain crucial information about your loan, including the terms, conditions, and repayment schedule. In this article, we’ll explore the importance of keeping loan paperwork and provide tips on how to stay organized.

Why Keep Loan Paperwork?

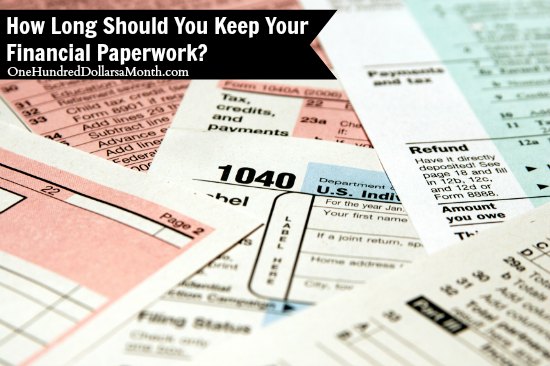

Keeping loan paperwork is vital for several reasons: * Reference purposes: Loan documents serve as a reference point for your loan details, including the interest rate, repayment terms, and any fees associated with the loan. * Tax purposes: You may need to provide loan documents as proof of interest paid when filing your tax return. * Dispute resolution: If you have a dispute with your lender, having access to your loan paperwork can help resolve the issue quickly. * Loan consolidation or refinancing: If you decide to consolidate or refinance your loan, you’ll need to provide your loan documents to the new lender.

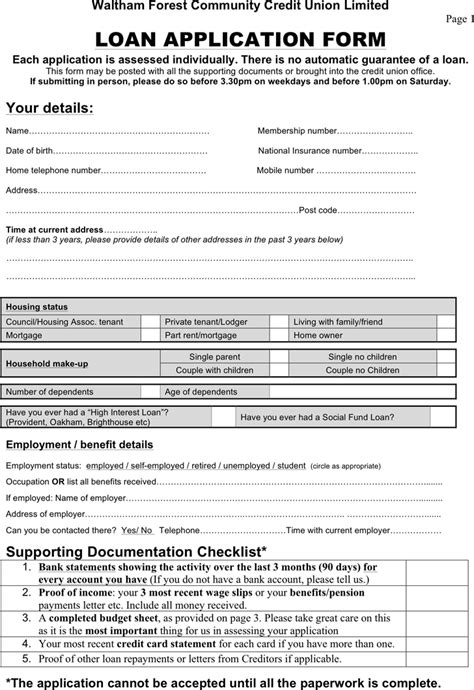

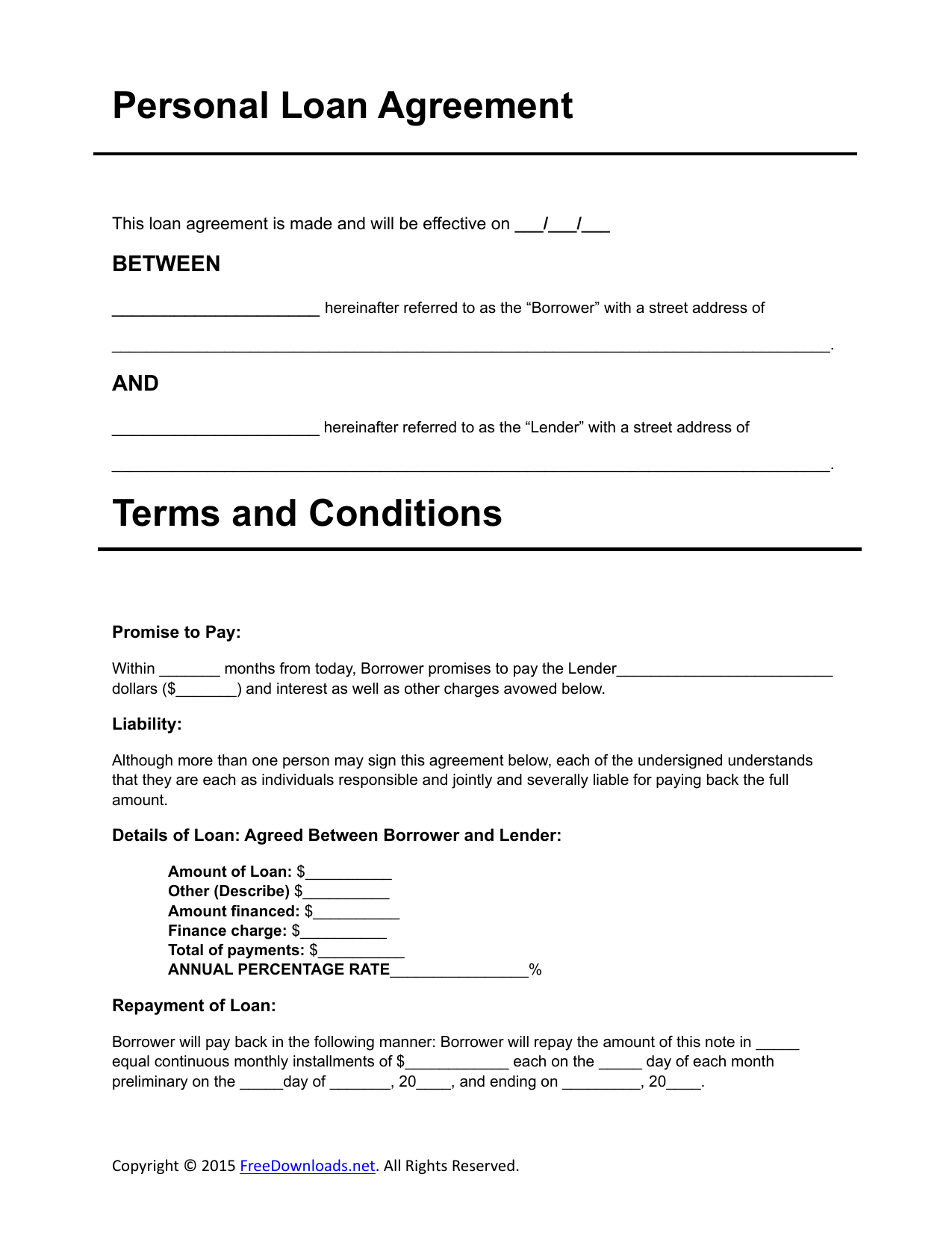

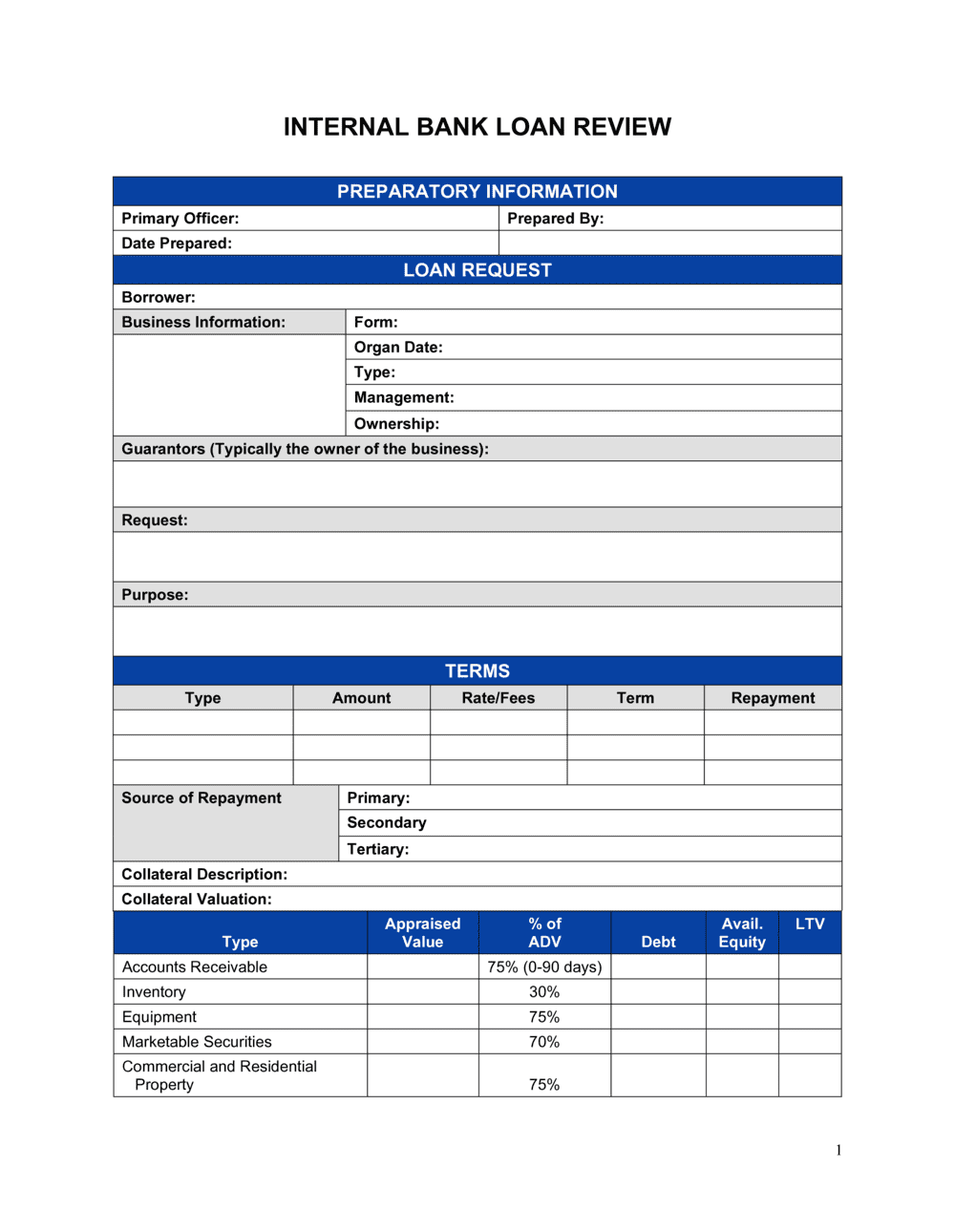

What Loan Paperwork Should You Keep?

It’s essential to keep the following loan paperwork: * Loan agreement: This document outlines the terms and conditions of your loan, including the interest rate, repayment schedule, and any fees. * Loan statement: This document shows your loan balance, payment history, and any outstanding fees. * Payment receipts: Keep receipts for all loan payments made, including checks, online payments, or automatic transfers. * Correspondence with your lender: Keep a record of any communication with your lender, including emails, letters, or phone calls.

How to Organize Your Loan Paperwork

To keep your loan paperwork organized, follow these tips: * Create a dedicated file for your loan documents, either physical or digital. * Use clear labels and categories to categorize your documents, such as “Loan Agreement,” “Payment Receipts,” and “Correspondence.” * Scan and digitize your documents to create a backup and make them easily accessible. * Review and update your files regularly to ensure they’re up-to-date and accurate.

Best Practices for Keeping Loan Paperwork

To ensure you’re keeping your loan paperwork effectively, follow these best practices: * Keep your documents in a safe and secure location, such as a fireproof safe or a secure online storage service. * Make copies of your documents and store them in a separate location, such as with a trusted friend or family member. * Shred unnecessary documents to prevent identity theft and reduce clutter. * Stay informed about any changes to your loan terms or conditions by regularly reviewing your loan documents.

| Document Type | Importance | Retention Period |

|---|---|---|

| Loan Agreement | High | Until loan is paid off |

| Loan Statement | Medium | Until loan is paid off |

| Payment Receipts | Low | Until loan is paid off |

📝 Note: It's essential to keep your loan paperwork organized and easily accessible to avoid any potential issues or disputes with your lender.

In the end, keeping loan paperwork is crucial for maintaining a clear understanding of your loan terms and conditions. By following the tips and best practices outlined in this article, you can ensure you’re keeping your loan paperwork effectively and avoid any potential issues. Remember to stay organized, keep your documents in a safe and secure location, and regularly review your loan documents to stay informed. With a little effort, you can maintain a clear and accurate record of your loan paperwork and enjoy peace of mind knowing you’re in control of your finances.

What is the importance of keeping loan paperwork?

+

Keeping loan paperwork is essential for reference purposes, tax purposes, dispute resolution, and loan consolidation or refinancing. It provides a clear understanding of your loan terms and conditions, and helps you stay organized and in control of your finances.

What loan paperwork should I keep?

+

You should keep your loan agreement, loan statement, payment receipts, and correspondence with your lender. These documents provide a clear understanding of your loan terms and conditions, and help you stay organized and in control of your finances.

How long should I keep my loan paperwork?

+

You should keep your loan paperwork until your loan is paid off. This includes your loan agreement, loan statement, and payment receipts. It’s also a good idea to keep a record of any correspondence with your lender, as this can help resolve any disputes or issues that may arise.