Paperwork

Keep Paperwork How Long

Introduction to Record Keeping

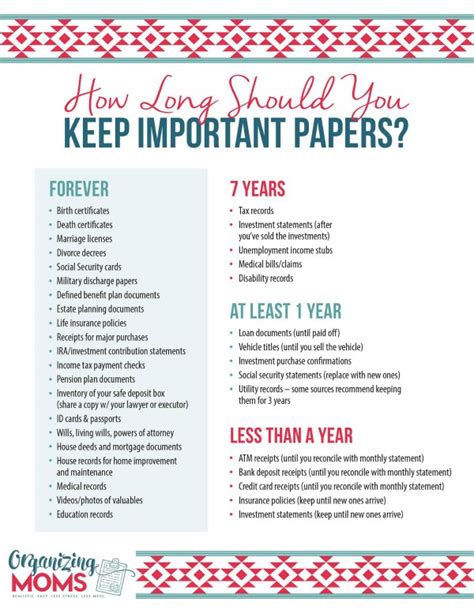

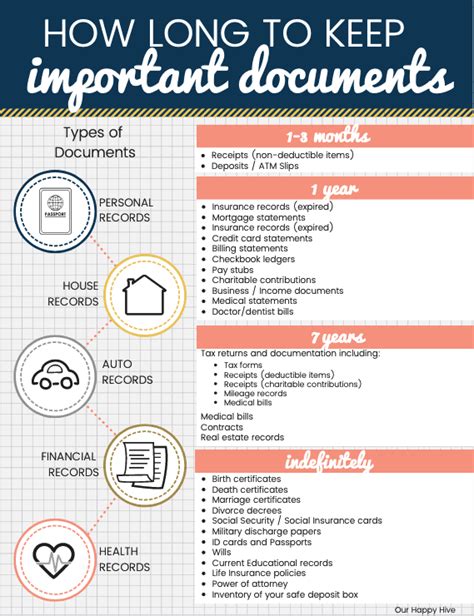

When it comes to managing paperwork and documents, one of the most common questions people ask is how long they should keep their records. The answer to this question varies depending on the type of document, its significance, and the purpose it serves. In this article, we will delve into the world of record keeping, exploring the different types of documents, their importance, and the recommended retention periods.

Understanding Document Types

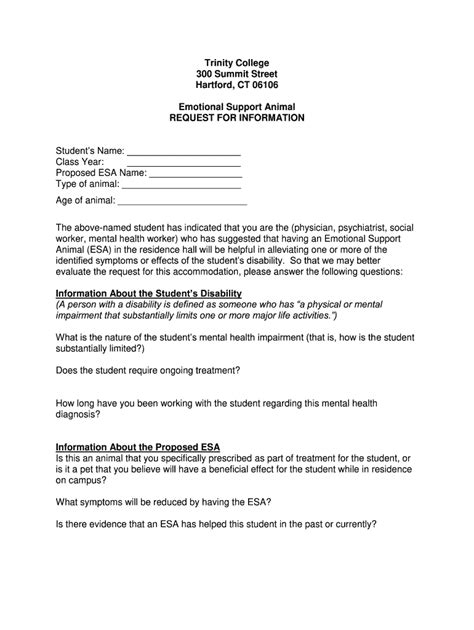

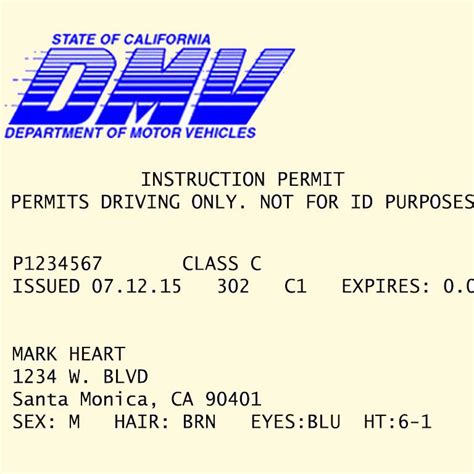

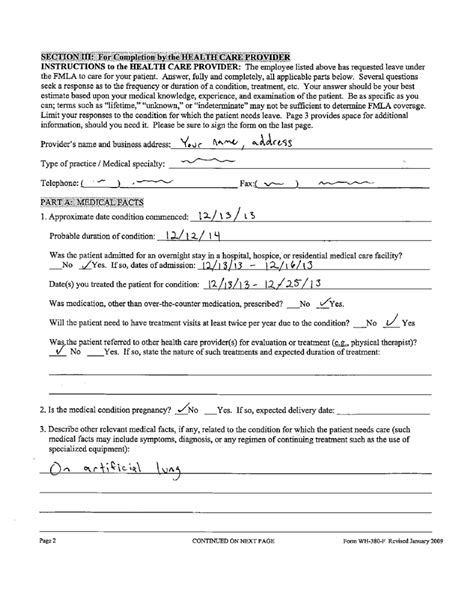

Documents can be broadly categorized into personal, financial, and business records. Each category has its own set of rules and guidelines for retention. - Personal records include identification documents, birth and marriage certificates, divorce and death certificates, wills, and trusts. These documents are crucial for proving identity, inheritance, and other legal matters. - Financial records encompass bank statements, investment accounts, tax returns, receipts, and invoices. These documents are essential for tracking financial transactions, preparing tax returns, and auditing purposes. - Business records include contracts, employee records, customer information, and business licenses. These documents are vital for running a business, complying with regulations, and resolving disputes.

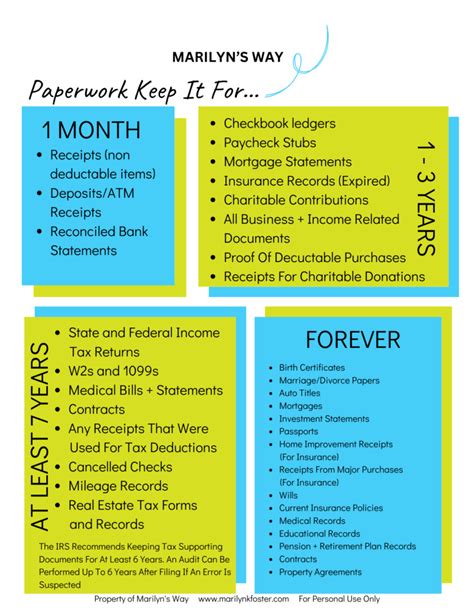

Retention Periods for Documents

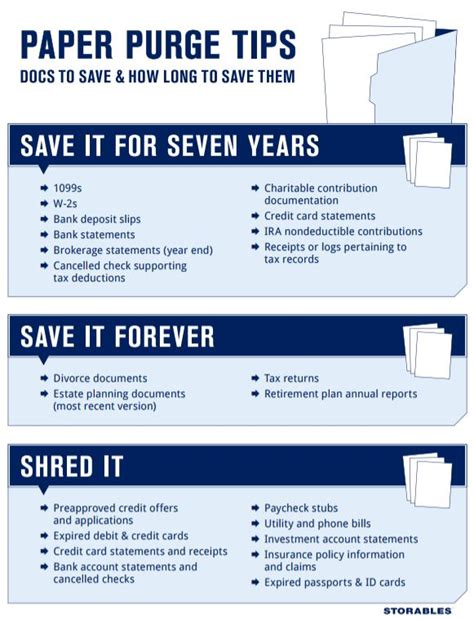

The retention period for documents varies significantly. Here are some general guidelines: - Personal records: These should be kept indefinitely, as they are crucial for legal and identification purposes. - Financial records: The retention period for financial records depends on their type. For example: - Tax returns and supporting documents: Keep for at least three to seven years in case of an audit. - Bank statements and investment accounts: Keep for one to three years for general financial tracking. - Receipts and invoices: Keep for one year for warranty and return purposes, unless they are related to tax deductions, in which case they should be kept for three to seven years. - Business records: The retention period for business records also varies: - Contracts and agreements: Keep for the duration of the contract plus a few years after its termination. - Employee records: Keep for three to seven years after an employee leaves the company. - Business licenses and permits: Keep for as long as the business is operational.

Digitizing Records

In today’s digital age, digitizing records is becoming increasingly popular. It offers the benefits of reduced storage space, enhanced security, and easier access to documents. However, it’s essential to ensure that digital records are stored securely, using password protection and backup systems to prevent data loss.

Destroying Documents

When documents are no longer needed, it’s crucial to destroy them securely to prevent identity theft and data breaches. Shredding or burning documents are effective methods of destruction. For digital records, permanent deletion and wiping of hard drives can ensure data is irretrievable.

📝 Note: Always check with local laws and regulations regarding document retention and destruction, as these can vary significantly.

Conclusion and Final Thoughts

In conclusion, the length of time paperwork should be kept varies widely depending on the document type and its purpose. Understanding these guidelines can help individuals and businesses manage their records effectively, ensuring compliance with laws and regulations, and maintaining organized and secure document storage systems. By applying these principles, one can navigate the complex world of record keeping with confidence, making informed decisions about what to keep, for how long, and how to store it securely.

What is the general rule for keeping tax returns?

+

It is recommended to keep tax returns and supporting documents for at least three to seven years in case of an audit.

How long should I keep bank statements?

+

Bank statements should be kept for one to three years for general financial tracking, unless they are related to tax deductions or other significant financial transactions.

What is the best way to store digital records securely?

+

Digital records should be stored using secure methods such as password protection and backup systems to prevent data loss and unauthorized access.