7 Tips Keep Tax Returns

Understanding the Importance of Keeping Tax Returns

When it comes to managing your finances, one of the most critical aspects is handling your tax returns. Keeping your tax returns organized and easily accessible is essential for several reasons, including audits, financial planning, and even applying for loans or credit. In this article, we will delve into the importance of keeping your tax returns and provide you with 7 valuable tips on how to do it efficiently.

Why Keep Tax Returns?

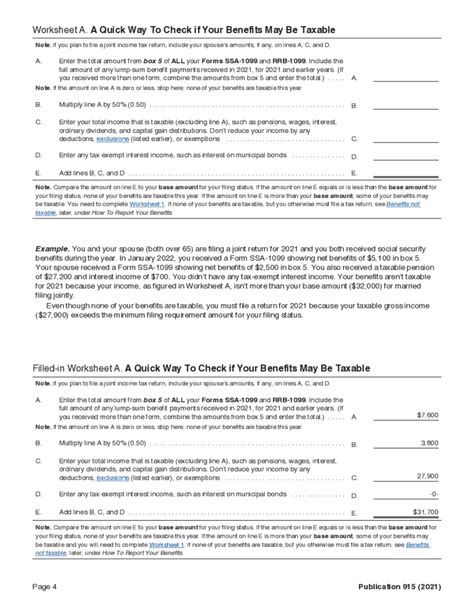

Before we dive into the tips, it’s crucial to understand why keeping your tax returns is so important. Here are a few key reasons: - Audit Purposes: The IRS can audit your tax returns for up to three years after you file. Having your returns readily available can help you respond quickly and accurately to any audit notices. - Financial Planning: Your tax returns contain valuable information about your income, deductions, and credits. This information can be indispensable for planning your financial future, including investments and retirement savings. - Loan and Credit Applications: Many lenders require copies of your tax returns as part of the loan or credit application process. Having them organized can save you time and hassle.

7 Tips for Keeping Tax Returns

Here are 7 tips to help you keep your tax returns organized and easily accessible: 1. Digital Storage: Consider scanning your paper tax returns and storing them digitally. This can help protect them from physical damage and make them easier to access. Use a secure cloud storage service to ensure your documents are safe. 2. Physical Storage: If you prefer to keep physical copies, use a fireproof safe or a secure file cabinet. Make sure the location is known to a trusted family member or friend in case of an emergency. 3. Organizational System: Develop a system to organize your tax returns. This could be as simple as labeling folders by year or using a more complex filing system. The key is to make it easy to find what you need quickly. 4. Backup: Always keep a backup of your tax returns. If you’re storing them digitally, consider having an external hard drive backup in addition to your cloud storage. 5. Secure Sharing: If you need to share your tax returns with someone (like an accountant or lender), make sure you’re doing so securely. Use encrypted email or a secure file-sharing service. 6. Retention Period: Know how long you need to keep your tax returns. Generally, it’s recommended to keep them for at least three years in case of an audit, but you may need to keep them longer for other reasons. 7. Professional Assistance: If you’re overwhelmed or unsure about how to manage your tax returns, consider hiring a professional. Accountants and tax preparers can not only help with your tax returns but also provide advice on how to keep them organized.

Additional Considerations

When keeping your tax returns, it’s also important to consider the following: - Security: Make sure your tax returns are stored in a secure location, whether physical or digital. This information is sensitive and could be used for identity theft if it falls into the wrong hands. - Accessibility: Ensure that you and any relevant parties (such as a spouse or business partner) can easily access the tax returns when needed. - Updates: Keep your storage method updated. For example, if you’re using an older version of a cloud storage service, consider upgrading to a newer, more secure version.

📝 Note: Always check with a financial advisor or tax professional for specific advice tailored to your situation, as tax laws and regulations can change frequently.

In summary, keeping your tax returns organized is a critical part of managing your finances. By following these 7 tips and considering additional factors such as security, accessibility, and updates, you can ensure that your tax returns are handled efficiently and effectively. This will not only help you in case of an audit but also provide valuable information for your financial planning and future endeavors.

How long should I keep my tax returns?

+

It’s generally recommended to keep your tax returns for at least three years in case of an audit. However, you may need to keep them longer for other reasons, such as applying for loans or credit, or for financial planning purposes.

What is the best way to store tax returns digitally?

+

Using a secure cloud storage service is one of the best ways to store your tax returns digitally. Make sure the service you choose offers strong encryption and two-factor authentication to protect your documents.

Can I throw away old tax returns?

+

Before throwing away old tax returns, make sure you no longer need them for any purpose, including audits, financial planning, or loan applications. If you’re unsure, it’s best to consult with a financial advisor or tax professional.