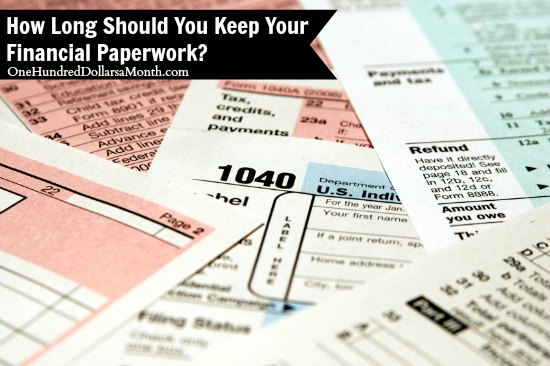

Keep Tax Paperwork

Understanding the Importance of Keeping Tax Paperwork

Keeping tax paperwork is a crucial aspect of personal and business financial management. It involves maintaining accurate and detailed records of all financial transactions, including income, expenses, deductions, and credits. These records are essential for filing tax returns, audits, and other financial purposes. In this article, we will discuss the importance of keeping tax paperwork, the types of documents that should be kept, and tips for organizing and maintaining these records.

Why Keep Tax Paperwork?

There are several reasons why keeping tax paperwork is important. Some of the key reasons include: * Audit Protection: In the event of an audit, having accurate and detailed records can help prove your income, expenses, and deductions, reducing the risk of penalties and fines. * Tax Savings: Keeping track of expenses and deductions can help you claim more deductions and credits, resulting in a lower tax liability. * Financial Planning: Tax paperwork can provide valuable insights into your financial situation, helping you make informed decisions about investments, savings, and budgeting. * Compliance: Keeping tax paperwork is a legal requirement, and failure to do so can result in penalties and fines.

Types of Tax Paperwork to Keep

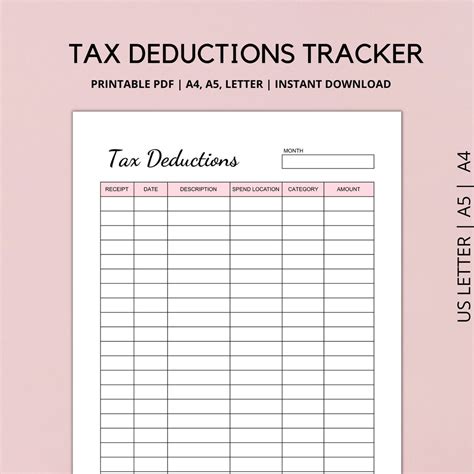

The types of tax paperwork to keep vary depending on your individual or business situation. Some common types of documents that should be kept include: * Income statements (W-2s, 1099s) * Expense receipts (medical, charitable, business) * Deduction records (mortgage interest, property taxes) * Credit records (earned income tax credit, child tax credit) * Business records (income statements, balance sheets, payroll records) * Investment records (stock purchases, dividend income)

Organizing and Maintaining Tax Paperwork

Organizing and maintaining tax paperwork can be a daunting task, but there are several tips that can help: * Create a Filing System: Develop a filing system that includes separate folders for each type of document, such as income, expenses, and deductions. * Use a Tax Organizer: Consider using a tax organizer or software to help track and organize your tax paperwork. * Scan and Digitalize: Scan and digitalize your tax paperwork to reduce clutter and make it easier to access and share documents. * Set Reminders: Set reminders to review and update your tax paperwork regularly, such as quarterly or annually.

| Document Type | Retention Period |

|---|---|

| Income statements (W-2s, 1099s) | 3-7 years |

| Expense receipts (medical, charitable, business) | 3-7 years |

| Deduction records (mortgage interest, property taxes) | 3-7 years |

| Credit records (earned income tax credit, child tax credit) | 3-7 years |

📝 Note: The retention period for tax paperwork varies depending on the type of document and individual circumstances. It's essential to consult with a tax professional or financial advisor to determine the specific retention period for your tax paperwork.

As we can see, keeping tax paperwork is a critical aspect of personal and business financial management. By understanding the importance of keeping tax paperwork, the types of documents that should be kept, and tips for organizing and maintaining these records, individuals and businesses can ensure compliance, reduce the risk of penalties and fines, and make informed financial decisions.

In the end, keeping tax paperwork is not just a legal requirement, but also a vital part of maintaining good financial health. By staying organized, keeping accurate records, and seeking professional advice when needed, individuals and businesses can navigate the complex world of taxation with confidence and clarity.

What is the importance of keeping tax paperwork?

+

Keeping tax paperwork is essential for filing tax returns, audits, and other financial purposes. It helps prove income, expenses, and deductions, reducing the risk of penalties and fines, and provides valuable insights into financial situations.

What types of tax paperwork should be kept?

+

The types of tax paperwork to keep vary depending on individual or business situations, but common types of documents include income statements, expense receipts, deduction records, credit records, and business records.

How long should tax paperwork be kept?

+

The retention period for tax paperwork varies depending on the type of document and individual circumstances, but generally ranges from 3-7 years. It’s essential to consult with a tax professional or financial advisor to determine the specific retention period for your tax paperwork.