5 Tips Jefferies Paperwork

Introduction to Jefferies Paperwork

When dealing with financial transactions, especially those involving significant investments or mergers and acquisitions, paperwork is an inevitable part of the process. Jefferies, a well-established global investment banking firm, handles a wide range of financial services, including advising on mergers and acquisitions, raising capital, and managing assets. Given the complexity and the sensitive nature of these transactions, the paperwork involved is not only extensive but also highly detailed and regulated. Here, we will delve into 5 tips for navigating Jefferies paperwork efficiently, ensuring compliance with regulatory requirements, and understanding the intricacies of the documentation process.

Understanding the Basics of Jefferies Paperwork

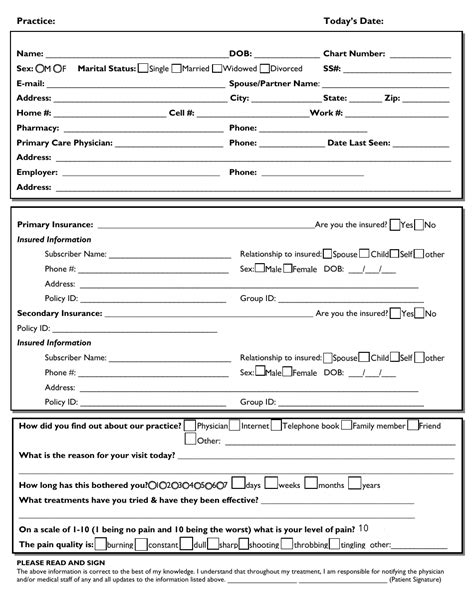

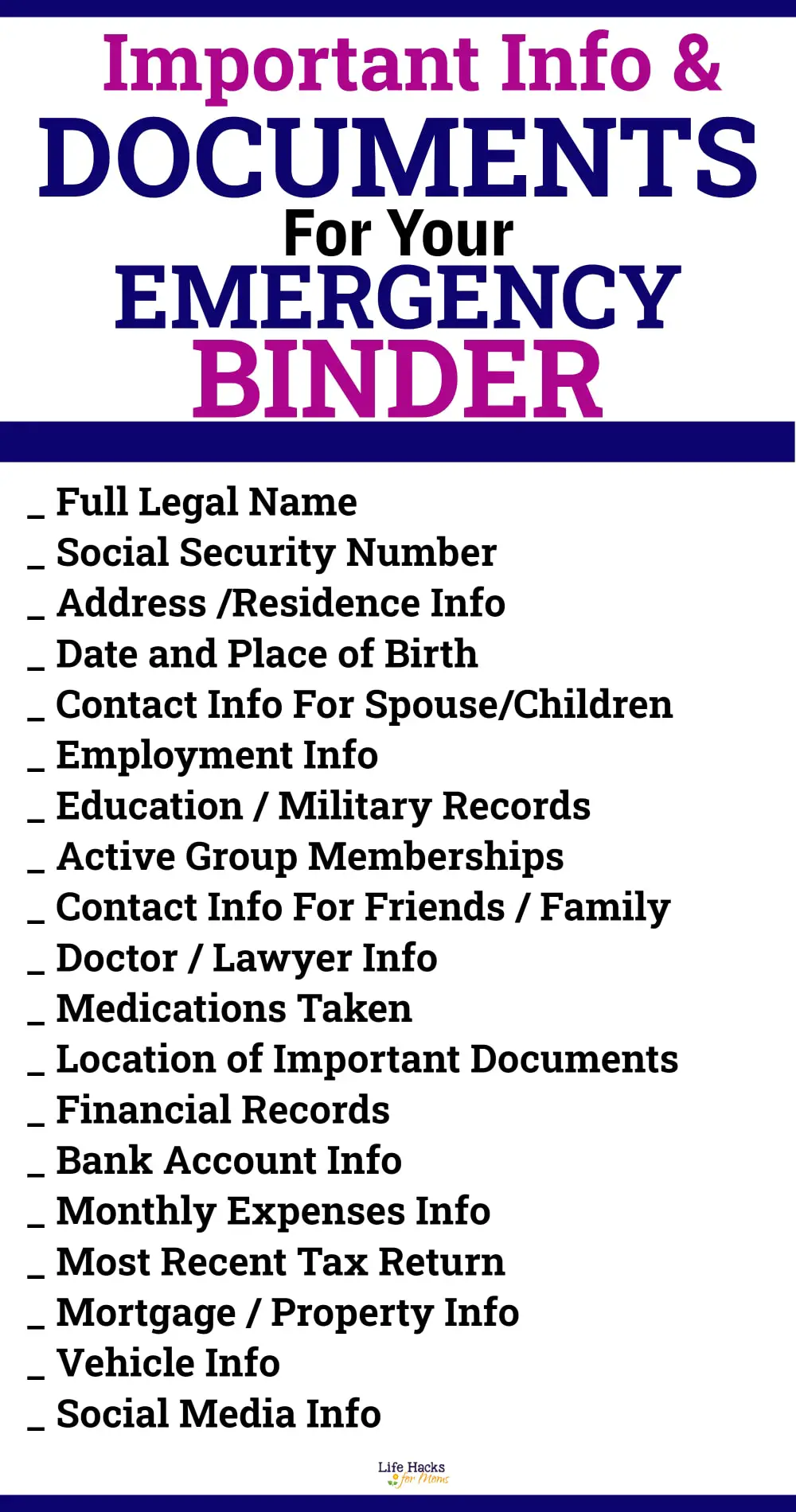

Before diving into the tips, it’s essential to understand the basics of what Jefferies paperwork entails. This includes non-disclosure agreements, engagement letters, due diligence documents, and transaction agreements. Each of these documents plays a crucial role in the transaction process, from the initial stages of negotiation to the final closing of a deal. Familiarizing oneself with these documents and their purposes is the first step in efficiently managing Jefferies paperwork.

Tips for Efficient Navigation

The following are 5 key tips to help in the efficient navigation of Jefferies paperwork:

- Tip 1: Ensure Compliance with Regulatory Requirements. It’s critical to ensure that all paperwork complies with the relevant financial regulations. This includes understanding the Securities and Exchange Commission (SEC) requirements, Financial Industry Regulatory Authority (FINRA) rules, and any other applicable laws. Compliance is not only a legal necessity but also a way to avoid potential legal and financial repercussions.

- Tip 2: Maintain Detailed Records. Keeping detailed and organized records of all paperwork and communications is vital. This includes digital and physical copies of documents, emails, meeting notes, and any other form of communication related to the transaction. A well-maintained record system can help in tracking the progress of transactions and providing evidence in case of disputes.

- Tip 3: Utilize Technology for Efficiency. Leveraging technology can significantly streamline the paperwork process. Digital platforms and software designed for document management, electronic signatures, and secure data storage can reduce the time spent on paperwork, minimize errors, and enhance security.

- Tip 4: Engage Legal and Financial Experts. Given the complexity of financial transactions and the associated paperwork, it’s advisable to engage legal and financial experts. These professionals can provide guidance on the preparation and review of documents, ensuring that all aspects are covered and that the documentation complies with legal and regulatory standards.

- Tip 5: Review and Understand Each Document Thoroughly. Before signing any document, it’s crucial to review and understand its contents thoroughly. This includes understanding the terms and conditions, obligations, and any potential liabilities. A thorough review can help in avoiding misunderstandings and ensuring that all parties are aware of their responsibilities and commitments.

Benefits of Efficient Paperwork Management

Efficient management of Jefferies paperwork offers several benefits, including reduced transaction times, enhanced compliance, improved risk management, and increased transparency. By streamlining the paperwork process, transactions can be completed more quickly, reducing the time and resources spent on administrative tasks. Moreover, efficient paperwork management can help in identifying and mitigating risks associated with financial transactions, thereby protecting the interests of all parties involved.

📝 Note: Efficient paperwork management is not just about completing transactions quickly but also about ensuring that all legal and regulatory requirements are met, thereby minimizing the risk of legal and financial repercussions.

Conclusion and Future Directions

In conclusion, navigating Jefferies paperwork requires a thorough understanding of the documentation process, adherence to regulatory requirements, and the efficient management of records. By following the 5 tips outlined above and leveraging technology and professional expertise, individuals and organizations can streamline their paperwork processes, reduce risks, and ensure compliance. As the financial sector continues to evolve, with advancements in technology and changes in regulatory environments, the importance of efficient and compliant paperwork management will only continue to grow.

What is the importance of compliance in Jefferies paperwork?

+

Compliance is crucial in Jefferies paperwork as it ensures that all transactions adhere to relevant financial regulations, reducing the risk of legal and financial repercussions.

How can technology enhance the efficiency of paperwork management?

+

Technology can enhance efficiency by providing digital platforms for document management, facilitating electronic signatures, and offering secure data storage solutions, thereby reducing time spent on paperwork and minimizing errors.

Why is it advisable to engage legal and financial experts in paperwork management?

+

Engaging legal and financial experts is advisable because they can provide guidance on the preparation and review of documents, ensuring compliance with legal and regulatory standards and helping to identify and mitigate potential risks.