Paperwork

Business Tax Paperwork Retention Period

Introduction to Business Tax Paperwork Retention

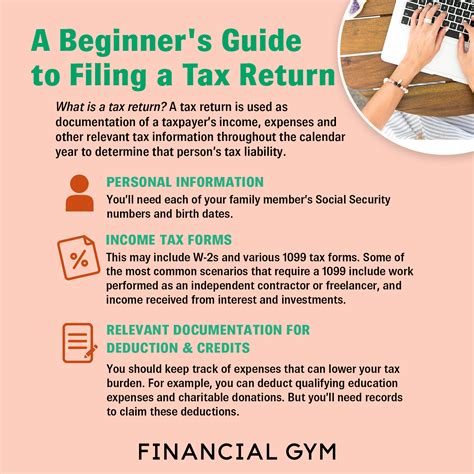

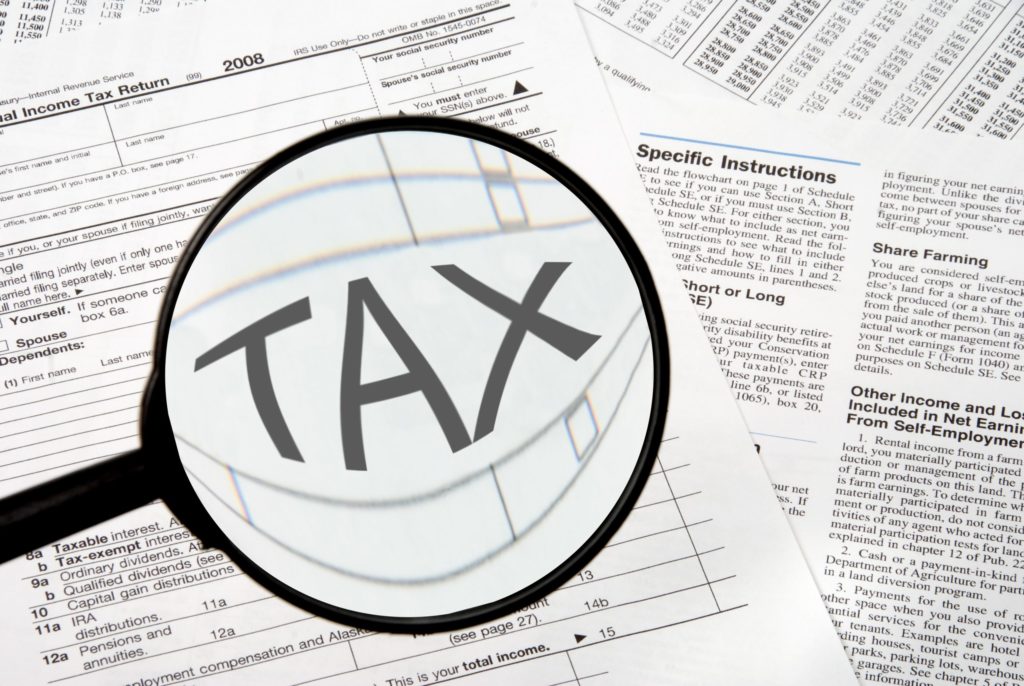

When it comes to managing a business, one of the most critical aspects is handling tax paperwork. Businesses are required to maintain accurate and detailed records of their financial transactions, including tax-related documents, for a specified period. The retention period for business tax paperwork varies depending on the type of document and the tax authority’s requirements. In this article, we will delve into the world of business tax paperwork retention, exploring the importance of maintaining these records, the different types of documents that need to be retained, and the recommended retention periods.

Importance of Retaining Business Tax Paperwork

Retaining business tax paperwork is crucial for several reasons. Firstly, it helps businesses to ensure compliance with tax laws and regulations. In the event of an audit or investigation, having accurate and complete records can help to resolve any disputes or issues that may arise. Secondly, retained documents can provide valuable information for financial reporting and analysis, enabling businesses to make informed decisions about their operations. Finally, maintaining tax paperwork can help to prevent fines and penalties that may be imposed for non-compliance or incorrect filing.

Types of Business Tax Paperwork

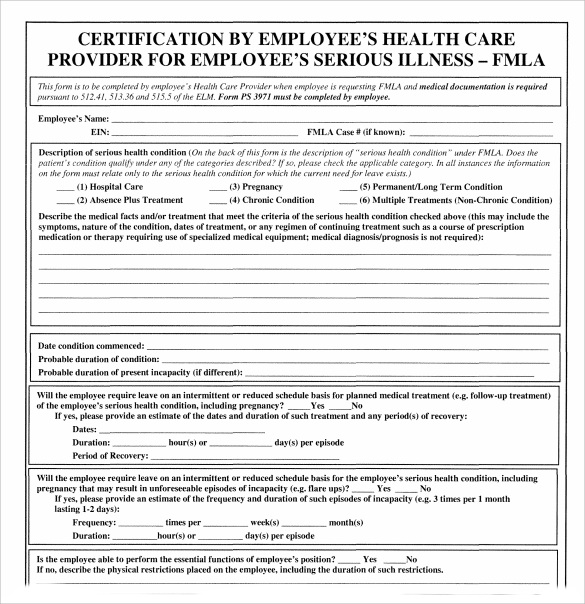

There are various types of business tax paperwork that need to be retained, including: * Income tax returns: These include federal, state, and local tax returns, as well as any amended returns or supplementary documentation. * Employment tax records: This includes records of employee wages, tax withholdings, and payroll tax returns. * Sales tax records: Businesses that are required to collect sales tax must retain records of sales tax collected, as well as any exemption certificates or other relevant documentation. * Business expense records: This includes receipts, invoices, and bank statements that support business expense deductions. * Audit and examination records: In the event of an audit or examination, businesses must retain records of the audit, including any correspondence, agreements, or settlements.

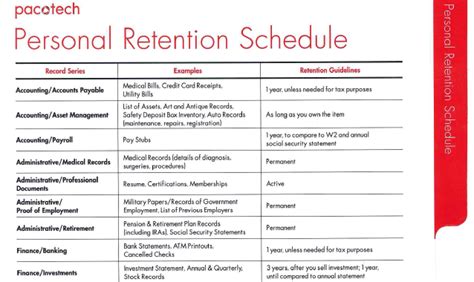

Recommended Retention Periods

The retention period for business tax paperwork varies depending on the type of document and the tax authority’s requirements. Here are some general guidelines: * Income tax returns: 3-7 years * Employment tax records: 4-7 years * Sales tax records: 3-7 years * Business expense records: 3-7 years * Audit and examination records: permanently

| Document Type | Retention Period |

|---|---|

| Income Tax Returns | 3-7 years |

| Employment Tax Records | 4-7 years |

| Sales Tax Records | 3-7 years |

| Business Expense Records | 3-7 years |

| Audit and Examination Records | Permanently |

📝 Note: The retention periods listed above are general guidelines and may vary depending on the specific requirements of the tax authority or other regulatory bodies.

Best Practices for Retaining Business Tax Paperwork

To ensure compliance and maintain accurate records, businesses should follow these best practices: * Store documents securely: Use a secure and fireproof storage system to protect sensitive documents. * Use a document management system: Implement a document management system to track and manage tax paperwork. * Regularly review and update records: Regularly review and update tax paperwork to ensure accuracy and completeness. * Consider digital storage: Consider using digital storage solutions to reduce physical storage space and improve accessibility.

Conclusion and Final Thoughts

In conclusion, retaining business tax paperwork is a critical aspect of managing a business. By understanding the importance of retaining these records, the different types of documents that need to be retained, and the recommended retention periods, businesses can ensure compliance with tax laws and regulations. By following best practices and using secure storage solutions, businesses can maintain accurate and complete records, reducing the risk of fines and penalties. Ultimately, effective management of business tax paperwork is essential for making informed decisions, ensuring compliance, and achieving long-term success.

What is the recommended retention period for income tax returns?

+

The recommended retention period for income tax returns is 3-7 years.

What types of business tax paperwork need to be retained?

+

Businesses need to retain income tax returns, employment tax records, sales tax records, business expense records, and audit and examination records.

What are the consequences of not retaining business tax paperwork?

+

The consequences of not retaining business tax paperwork can include fines, penalties, and even audits or examinations.