5 Insurance Paper Tips

Understanding Insurance Papers: A Comprehensive Guide

When it comes to insurance, having the right paperwork in order is crucial. Whether you’re dealing with health, auto, home, or life insurance, understanding your policy documents is essential for making informed decisions and ensuring you’re adequately covered. In this article, we’ll delve into the world of insurance papers, providing you with five valuable tips to help you navigate this complex terrain.

Tip 1: Read Your Policy Carefully

The first and most important tip is to thoroughly read your insurance policy. This might seem obvious, but many people skim over the details or overlook crucial sections. Your policy is a legal contract between you and the insurance provider, outlining what is covered, what is not, and under what circumstances claims can be made. Take your time to understand the terminology, coverage limits, deductibles, and any exclusions. Don’t hesitate to ask your insurance agent or broker for clarification on any points you’re unsure about.

Tip 2: Keep Your Documents Organized

Staying organized is key when it comes to insurance documents. This includes not only your policy documents but also any correspondence with your insurer, claims forms, and receipts for payments. Consider digitizing your documents for safekeeping and easy access. Make sure you have a secure backup, such as an external hard drive or a cloud storage service, to protect your files against loss or damage.

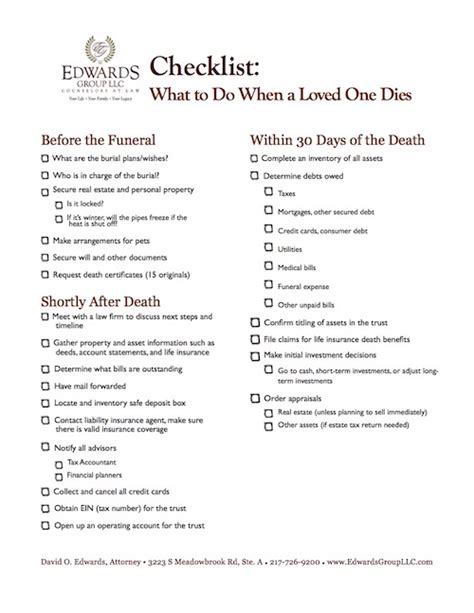

Tip 3: Review and Update Your Policy Regularly

Insurance needs can change over time due to various factors such as moving to a new home, getting married, having children, or starting a business. It’s essential to review your policy annually or whenever you experience a significant life event. This ensures that your coverage remains relevant and adequate. For instance, if you’ve recently purchased a valuable item, you may need to adjust your home insurance to include it.

Tip 4: Understand Your Rights and Responsibilities

As a policyholder, you have certain rights and responsibilities. It’s crucial to understand what these are to avoid any misunderstandings or disputes with your insurer. Your rights typically include the ability to cancel your policy, make claims, and access certain information about your policy. Your responsibilities might include paying premiums on time, disclosing relevant information when applying for or renewing a policy, and complying with policy conditions. Be aware of these to maintain a healthy relationship with your insurer and to ensure your claims are processed smoothly.

Tip 5: Seek Professional Advice When Needed

Lastly, don’t hesitate to seek professional advice if you’re unsure about any aspect of your insurance policy. This could be from your insurance provider, an independent insurance broker, or a financial advisor. They can offer valuable insights and help you make informed decisions about your insurance coverage. Whether you’re considering purchasing a new policy, switching providers, or dealing with a claim, professional advice can be invaluable.

📝 Note: Always keep a record of your communications with your insurance provider, including dates, times, and details of conversations. This can be helpful in case of any disputes or for tracking the progress of your claims.

In essence, managing your insurance papers effectively is about being informed, organized, and proactive. By following these tips, you can ensure that you’re well-covered and prepared for any eventuality. Remember, your insurance policy is there to provide you with peace of mind and financial protection, so it’s worth taking the time to understand and manage it properly.

As you reflect on the importance of insurance papers, consider how these documents play a critical role in your financial planning and risk management strategy. By being diligent and informed, you can navigate the complex world of insurance with confidence, knowing that you’re protected against life’s uncertainties.

What should I do if I lose my insurance documents?

+

If you lose your insurance documents, contact your insurance provider immediately. They can guide you through the process of obtaining replacement documents or accessing your policy information online.

How often should I review my insurance policy?

+

It’s recommended to review your insurance policy at least once a year or whenever you experience a significant life change, such as moving to a new home, getting married, or having children.

What information should I keep track of regarding my insurance policy?

+

Keep track of your policy number, coverage details, premiums, payment due dates, and any claims you’ve made. Also, maintain a record of communications with your insurer, including emails, letters, and phone calls.