Keep Chapter 7 Bankruptcy Paperwork

Understanding the Process of Chapter 7 Bankruptcy

When individuals or businesses are overwhelmed by debt and see no viable way to pay off their creditors, they may turn to bankruptcy as a last resort. Chapter 7 bankruptcy, also known as liquidation bankruptcy, is a type of bankruptcy that involves the sale of non-exempt assets to pay off creditors. The process involves a significant amount of paperwork and requires a thorough understanding of the bankruptcy laws.

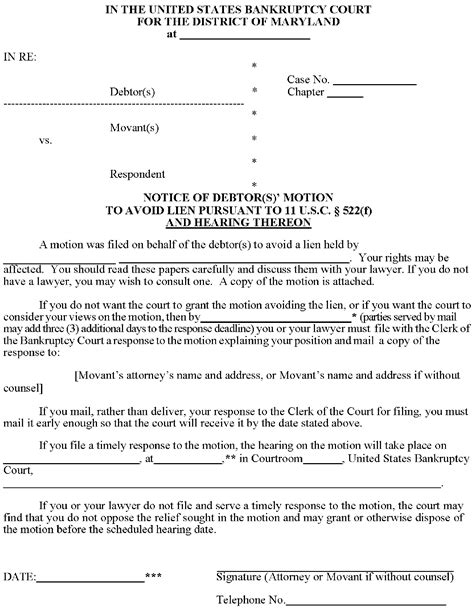

In this context, bankruptcy is a legal process that allows individuals or businesses to discharge some or all of their debts. The process begins with the filing of petition in a federal bankruptcy court. This initial step is crucial as it sets in motion the entire bankruptcy process, including the automatic stay, which temporarily halts most collection activities against the debtor.

Initial Paperwork for Chapter 7 Bankruptcy

To initiate the Chapter 7 bankruptcy process, several key documents must be filed with the bankruptcy court. These include: - Petition: The voluntary petition (Form 101) is the first document filed in a bankruptcy case. It provides basic information about the debtor, including name, address, and the chapter under which the debtor is filing. - Schedules: Schedules A/B (property), C (exemptions), D (secured creditors), E/F (unsecured creditors), G (executory contracts and unexpired leases), and H (codebtors) provide detailed information about the debtor’s assets, liabilities, income, and expenses. - Statement of Financial Affairs: This document (Form 107) requires the debtor to provide detailed information about their financial transactions, including income, expenses, and any transfers of property made before filing for bankruptcy. - Means Test: The means test (Form 122A-1) is used to determine if the debtor qualifies for Chapter 7 bankruptcy by comparing their income to the median income of their state.

The accuracy and completeness of these documents are crucial as they form the basis of the bankruptcy case. Incomplete or inaccurate filings can lead to delays or even dismissal of the case.

The Role of the Trustee

Once the bankruptcy petition is filed, a trustee is appointed to oversee the case. The trustee’s primary role is to: - Verify the Information: Review the debtor’s schedules and statement of financial affairs to ensure accuracy. - Conduct the Meeting of Creditors: Also known as the 341 meeting, this is a mandatory meeting where the debtor is questioned under oath about their financial situation. - Manage the Sale of Assets: If the debtor has non-exempt assets, the trustee will sell these assets and distribute the proceeds to the creditors. - Distribute Funds: After the sale of assets, the trustee will distribute the funds to the creditors according to the bankruptcy laws, typically following a specific order of priority.

The trustee plays a vital role in ensuring the integrity of the bankruptcy process, acting as a guardian of the estate and a representative of the creditors.

Exemptions and Non-Exempt Assets

In Chapter 7 bankruptcy, not all assets are subject to sale by the trustee. Debtors are allowed to exempt certain assets, which means these assets are protected from creditors. Exemptions vary by state and may include: - Primary residence, up to a certain value - Vehicles, up to a certain value - Personal property, such as household goods and clothing - Tools of the trade - Retirement accounts

| Asset Type | Exemption Amount |

|---|---|

| Primary Residence | Varies by State |

| Vehicles | Up to $3,775 (Federal Exemption) |

| Personal Property | Up to $12,575 (Federal Exemption) |

Understanding which assets are exempt and which are not is critical for debtors to make informed decisions about their bankruptcy case.

Discharge and Post-Bankruptcy

The ultimate goal of filing for Chapter 7 bankruptcy is to receive a discharge, which means the debtor is no longer legally obligated to pay certain debts. However, not all debts can be discharged, such as: - Student loans - Child support and alimony - Certain taxes - Debts incurred through fraud

After receiving a discharge, debtors are given a fresh start, free from most debt obligations. However, this does not mean they are free to accumulate new debt without consequences. Financial planning and budgeting are essential post-bankruptcy to avoid falling into debt again.

📝 Note: Maintaining a clean credit record post-bankruptcy requires diligence and responsible financial behavior.

In the end, navigating the complexities of Chapter 7 bankruptcy requires patience, diligence, and often the guidance of a bankruptcy attorney. By understanding the process and the paperwork involved, individuals can make informed decisions about their financial future. The journey to financial recovery is not always easy, but with the right mindset and support, it is achievable. The process of filing for bankruptcy, though daunting, offers a chance for a fresh start, allowing individuals to rebuild their financial lives and look towards a more stable future.