Paperwork

Keep Deceased Parents Paperwork

Introduction to Managing Deceased Parents’ Paperwork

When a parent passes away, it can be a challenging and emotional time for the family. Along with the grief and bereavement, there are numerous practical tasks that need to be addressed, including managing the deceased parent’s paperwork and estate. This process involves several steps, from notifying relevant parties to organizing and distributing assets according to the parent’s will or the laws of intestacy. The goal of this guide is to provide a comprehensive overview of how to navigate this complex situation with sensitivity and efficiency.

Understanding the Initial Steps

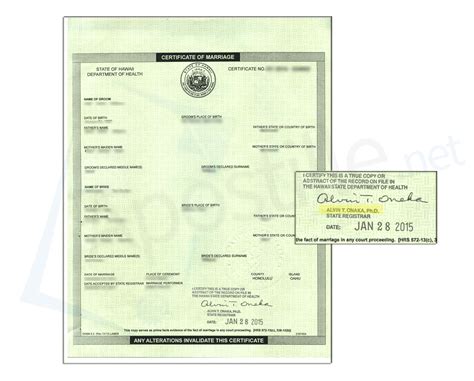

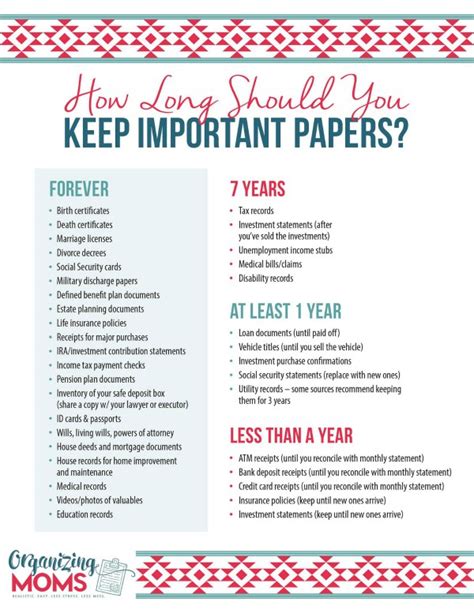

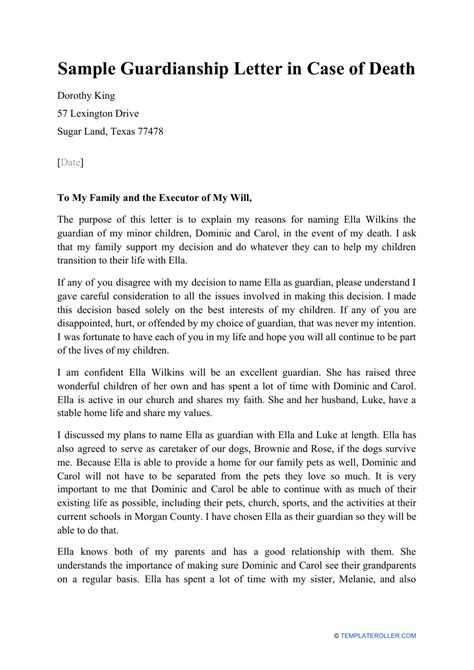

The first steps in managing a deceased parent’s paperwork are crucial and set the stage for the rest of the process. These include: - Obtaining a Death Certificate: This is a vital document that serves as proof of death and is required for various legal and administrative tasks, such as notifying banks, insurance companies, and government agencies. - Locating the Will: If the parent had a will, it’s essential to find it as soon as possible. The will outlines how the parent wanted their assets to be distributed and can name an executor who is responsible for carrying out these wishes. - Identifying Assets and Debts: Making a list of the parent’s assets (such as property, investments, and personal belongings) and debts (like loans, credit card debt, and outstanding bills) is crucial for understanding the estate’s overall financial situation.

Notifying Relevant Parties

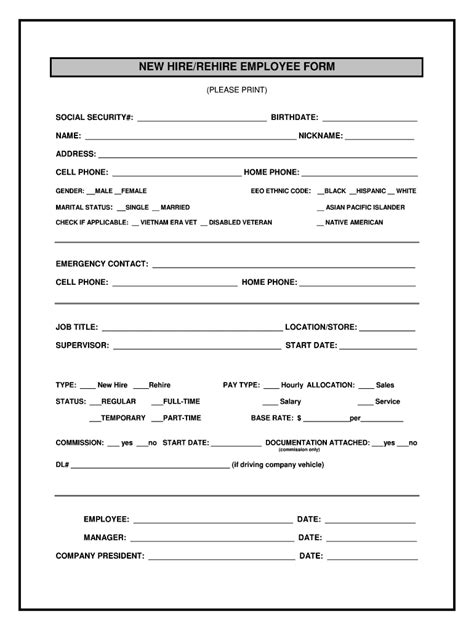

Notifying relevant parties is a critical step that involves a series of communications to various entities. This includes: - Government Agencies: The Social Security Administration, the Department of Veterans Affairs (if applicable), and other relevant government agencies need to be informed. - Banks and Financial Institutions: Banks, credit unions, and investment firms where the parent had accounts or holdings must be notified to freeze accounts and begin the process of distributing assets according to the will or laws of intestacy. - Credit Card Companies and Loan Providers: Credit card companies and loan providers need to be informed to prevent further transactions and to settle debts. - Insurance Companies: Life insurance companies, health insurance providers, and any other insurance entities should be contacted to file claims and make necessary adjustments.

Organizing and Managing the Estate

Organizing the estate involves several key tasks: - Appointing an Executor or Administrator: If there is a will, the named executor is responsible for managing the estate. If there is no will, the court will appoint an administrator. - Inventorying Assets: A detailed inventory of the parent’s assets is necessary for tax purposes, to settle debts, and to distribute assets to beneficiaries. - Paying Taxes and Debts: The estate must pay any outstanding taxes and debts before assets can be distributed to beneficiaries. - Distributing Assets: Finally, assets are distributed according to the will or, if there is no will, according to the state’s laws of intestacy.

Important Considerations

There are several important considerations to keep in mind when managing a deceased parent’s paperwork: - Seeking Professional Advice: The process can be complex, and seeking advice from attorneys, accountants, and financial advisors can be invaluable. - Preserving Family Heirlooms: Beyond financial assets, personal and sentimental items, such as family heirlooms, should be preserved and distributed thoughtfully. - Handling Conflicts: Unfortunately, conflicts can arise among family members. Open communication and seeking mediation if necessary can help navigate these challenges.

| Task | Description |

|---|---|

| Obtain Death Certificate | Proof of death for legal and administrative tasks |

| Locate the Will | Outlines distribution of assets and names executor |

| Identify Assets and Debts | Understand the estate's financial situation |

| Notify Relevant Parties | Inform government agencies, banks, credit companies, etc. |

| Manage the Estate | Includes paying taxes and debts, distributing assets |

💡 Note: Keeping detailed records of all communications, transactions, and decisions made during this process is essential for transparency and accountability.

In the end, managing a deceased parent’s paperwork and estate requires patience, diligence, and often professional guidance. By understanding the steps involved and approaching the task with care and sensitivity, family members can navigate this challenging time with greater ease and ensure that their parent’s wishes are respected and carried out. The process, though complex, is a final act of love and respect, ensuring that the parent’s legacy is honored and their estate is managed according to their intentions.