Paperwork

Estate Accounting PaperworkRetention Period

Introduction to Estate Accounting Paperwork Retention

Proper management and retention of estate accounting paperwork are crucial for ensuring the smooth administration of an estate. Estate administrators or executors have a fiduciary duty to manage the estate’s assets, pay off debts, and distribute the remaining assets according to the will or intestacy laws. To fulfill these duties, they must maintain accurate and detailed records. The retention period for estate accounting paperwork varies depending on the type of document and the applicable laws. In this article, we will delve into the world of estate accounting paperwork retention, exploring the different types of documents, their retention periods, and best practices for management.

Types of Estate Accounting Paperwork

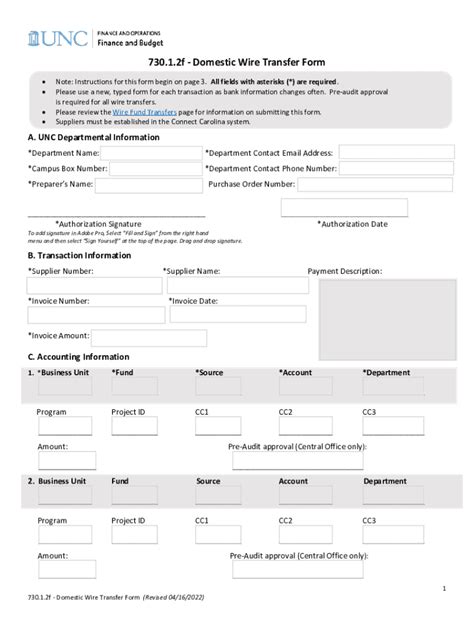

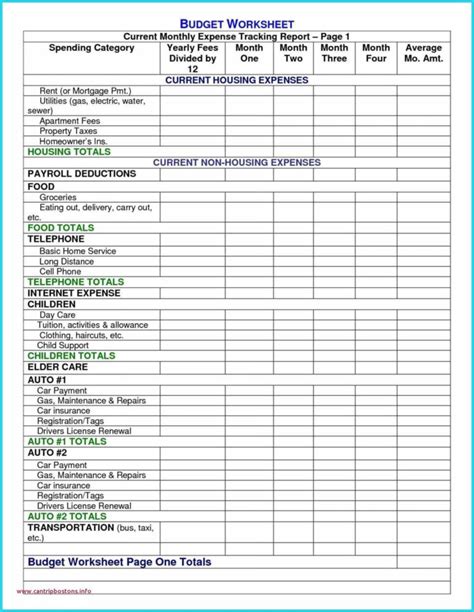

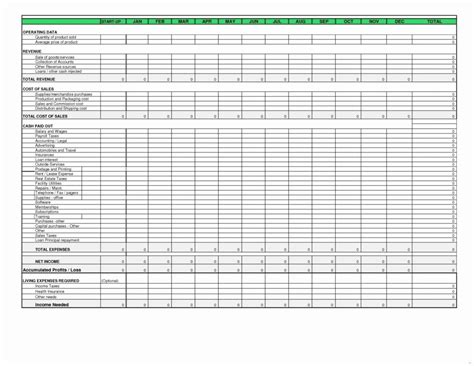

Estate accounting paperwork includes a wide range of documents, each serving a specific purpose in the administration of the estate. Some of the key documents include: * Wills and Codicils: The will and any codicils (amendments to the will) are the foundation of estate administration, outlining how the deceased wanted their assets to be distributed. * Trust Documents: If the estate includes trusts, the trust documents will outline the terms of the trust, including the beneficiaries, trustees, and the distribution of assets. * Inventory of Assets: A detailed list of the estate’s assets, including real estate, personal property, investments, and other valuables. * Debt and Expense Records: Documents related to the estate’s debts and expenses, such as funeral expenses, taxes, and creditor claims. * Tax Returns: The estate’s tax returns, including income tax returns and any necessary estate tax returns. * Distribution Records: Records of the distribution of assets to beneficiaries, including receipts and releases.

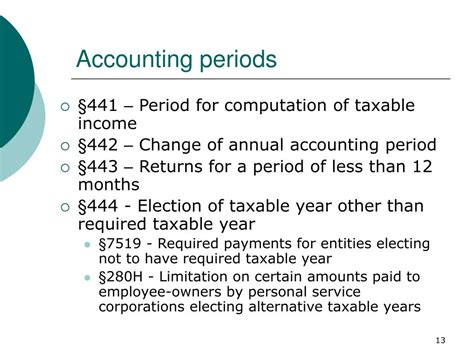

Retention Periods for Estate Accounting Paperwork

The retention period for estate accounting paperwork depends on the type of document and the applicable laws. Here are some general guidelines: * Permanent Retention: Wills, trust documents, and other foundational documents should be retained permanently. * 7-10 Years: Tax returns, including income tax returns and estate tax returns, should be retained for at least 7-10 years in case of an audit. * 5-7 Years: Debt and expense records, including receipts and invoices, should be retained for 5-7 years. * 3-5 Years: Distribution records, including receipts and releases, should be retained for 3-5 years.

| Document Type | Retention Period |

|---|---|

| Wills and Codicils | Permanent |

| Trust Documents | Permanent |

| Tax Returns | 7-10 Years |

| Debt and Expense Records | 5-7 Years |

| Distribution Records | 3-5 Years |

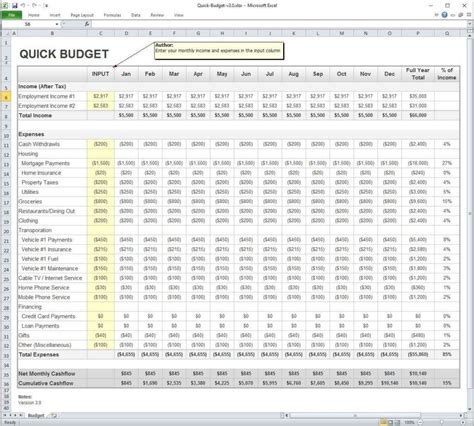

Best Practices for Managing Estate Accounting Paperwork

To ensure the efficient administration of an estate, it is essential to implement best practices for managing estate accounting paperwork. Some of these practices include: * Centralized Storage: Store all estate accounting paperwork in a centralized location, such as a file cabinet or digital storage system. * Organized Filing System: Use a logical and consistent filing system to categorize and store documents. * Digital Backups: Create digital backups of important documents to prevent loss or damage. * Regular Reviews: Regularly review estate accounting paperwork to ensure accuracy and completeness.

📝 Note: Estate administrators should consult with an attorney or tax professional to ensure compliance with applicable laws and regulations regarding estate accounting paperwork retention.

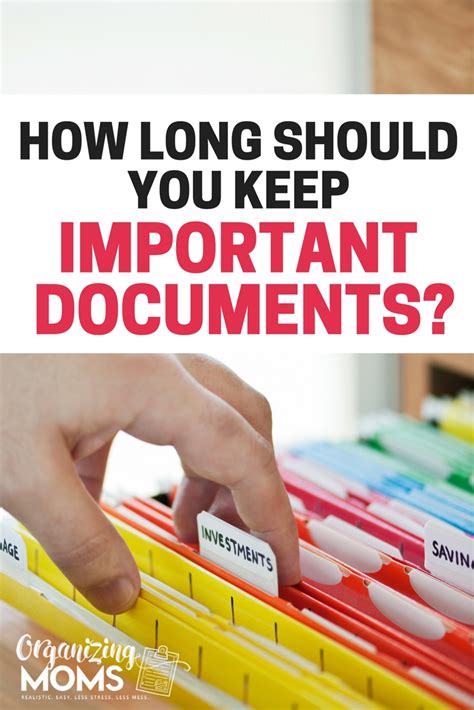

Conclusion and Final Thoughts

In conclusion, the retention of estate accounting paperwork is a critical aspect of estate administration. By understanding the different types of documents, their retention periods, and best practices for management, estate administrators can ensure the efficient and effective administration of the estate. It is essential to remember that the retention periods for estate accounting paperwork can vary depending on the type of document and applicable laws. Therefore, it is crucial to consult with an attorney or tax professional to ensure compliance with all relevant laws and regulations.

What is the purpose of retaining estate accounting paperwork?

+

The purpose of retaining estate accounting paperwork is to ensure the efficient administration of the estate, provide a clear record of the estate’s assets and liabilities, and facilitate the distribution of assets to beneficiaries.

How long should tax returns be retained?

+

Tax returns, including income tax returns and estate tax returns, should be retained for at least 7-10 years in case of an audit.

What is the best way to store estate accounting paperwork?

+

The best way to store estate accounting paperwork is in a centralized location, such as a file cabinet or digital storage system, using a logical and consistent filing system.