Keep Home Refinance Paperwork

Introduction to Keeping Home Refinance Paperwork

When refinancing a home, it’s essential to keep track of all the paperwork involved in the process. This includes documents related to the original mortgage, the refinance application, and the closing process. Organizing these documents can help homeowners ensure a smooth and efficient refinance process, and also provide a record of the transaction for future reference. In this article, we will discuss the importance of keeping home refinance paperwork, the types of documents involved, and tips for organizing and storing these documents.

Types of Documents Involved in Home Refinance

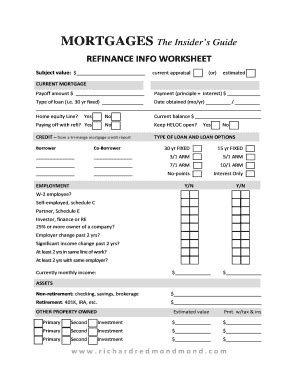

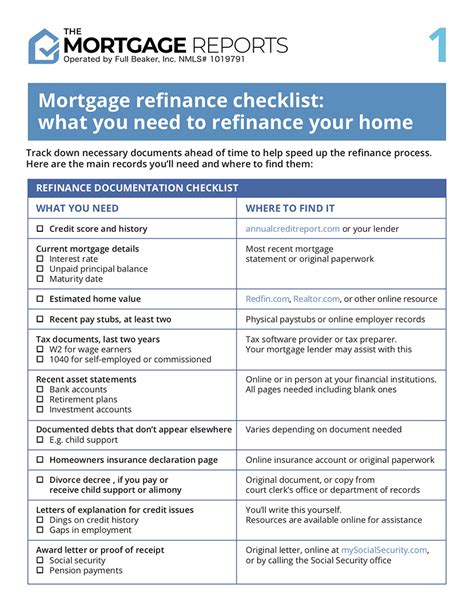

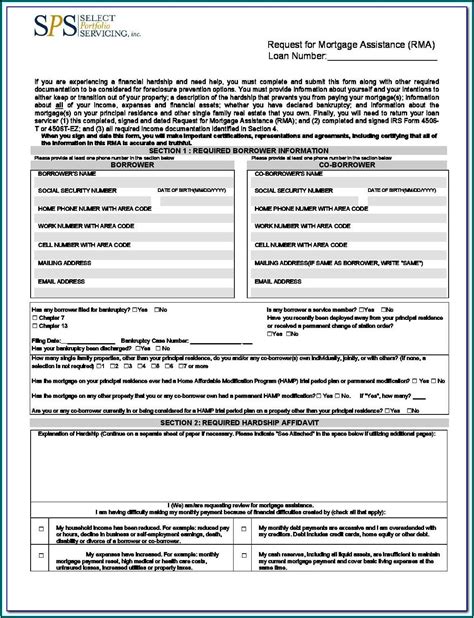

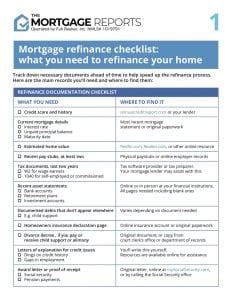

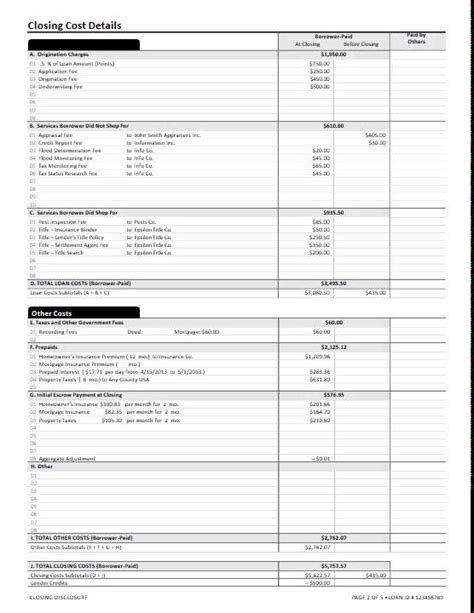

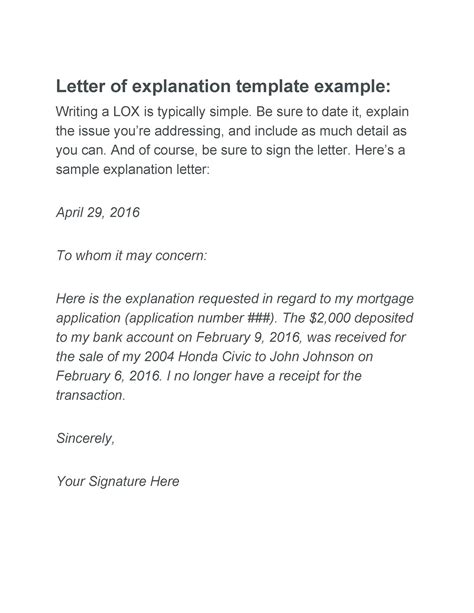

The home refinance process involves a variety of documents, including: * Original mortgage documents: This includes the original loan application, mortgage note, and deed of trust. * Refinance application: This includes the new loan application, credit reports, and income verification documents. * Appraisal reports: An appraisal report is required to determine the current value of the property. * Inspection reports: Inspection reports may be required to identify any potential issues with the property. * Closing documents: This includes the new mortgage note, deed of trust, and closing disclosure. * Title insurance and escrow documents: These documents ensure that the title to the property is clear and that the transaction is properly recorded.

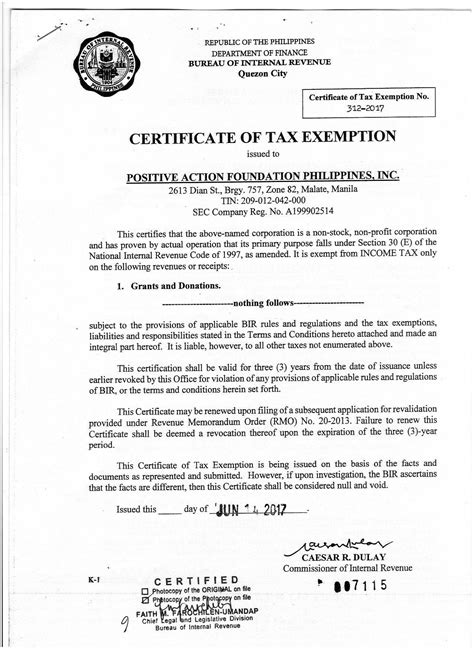

Importance of Keeping Home Refinance Paperwork

Keeping home refinance paperwork is crucial for several reasons: * Record of the transaction: The documents provide a record of the refinance transaction, including the terms of the new loan and the fees paid. * Tax purposes: The documents may be required for tax purposes, such as claiming mortgage interest deductions. * Future reference: The documents can be used as a reference for future transactions, such as a second refinance or a sale of the property. * Dispute resolution: In the event of a dispute, the documents can be used to resolve any issues related to the refinance transaction.

Tips for Organizing and Storing Home Refinance Paperwork

Here are some tips for organizing and storing home refinance paperwork: * Create a file folder: Create a file folder specifically for the refinance documents, and keep all the documents in one place. * Scan and digitize documents: Scan and digitize the documents to create electronic copies, and store them on a secure external hard drive or cloud storage service. * Use a document management system: Consider using a document management system, such as a digital filing cabinet, to organize and store the documents. * Keep documents in a safe place: Keep the physical documents in a safe place, such as a fireproof safe or a safe deposit box.

📝 Note: It's essential to keep the documents in a secure location, such as a fireproof safe or a safe deposit box, to protect them from damage or loss.

Best Practices for Maintaining Home Refinance Paperwork

Here are some best practices for maintaining home refinance paperwork: * Review and update documents regularly: Review and update the documents regularly to ensure that they are accurate and up-to-date. * Keep documents organized: Keep the documents organized and easy to access, using a file folder or document management system. * Store documents securely: Store the documents securely, using a fireproof safe or a safe deposit box. * Make copies of documents: Make copies of the documents, and store them in a separate location, such as a cloud storage service.

| Document Type | Description |

|---|---|

| Original mortgage documents | Original loan application, mortgage note, and deed of trust |

| Refinance application | New loan application, credit reports, and income verification documents |

| Appraisal reports | Report determining the current value of the property |

| Inspection reports | Report identifying any potential issues with the property |

| Closing documents | New mortgage note, deed of trust, and closing disclosure |

| Title insurance and escrow documents | Documents ensuring that the title to the property is clear and that the transaction is properly recorded |

In summary, keeping home refinance paperwork is essential for ensuring a smooth and efficient refinance process, and for providing a record of the transaction for future reference. By organizing and storing the documents securely, homeowners can protect their investment and ensure that they have access to the documents when needed. It is crucial to maintain the documents accurately and securely to avoid any potential issues or disputes in the future. By following the tips and best practices outlined in this article, homeowners can ensure that their home refinance paperwork is kept safe and organized.

What documents are required for a home refinance?

+

The documents required for a home refinance include the original mortgage documents, refinance application, appraisal reports, inspection reports, closing documents, and title insurance and escrow documents.

Why is it important to keep home refinance paperwork?

+

Keeping home refinance paperwork is important because it provides a record of the transaction, can be used for tax purposes, and can be used as a reference for future transactions.

How should I store my home refinance paperwork?

+

You should store your home refinance paperwork in a secure location, such as a fireproof safe or a safe deposit box, and consider scanning and digitizing the documents to create electronic copies.