7 Tips Keep Claims

Introduction to Insurance Claims

When it comes to insurance, one of the most critical aspects is the claims process. Filing an insurance claim can be a daunting task, especially for those who are not familiar with the process. However, with the right knowledge and preparation, you can ensure that your claims are handled efficiently and that you receive the compensation you deserve. In this article, we will discuss 7 tips to keep in mind when dealing with insurance claims.

Understanding Your Policy

Before filing a claim, it is essential to understand your insurance policy. Read your policy carefully and make sure you understand what is covered and what is not. This will help you avoid any surprises during the claims process. Take note of the following: * What is the coverage amount? * What are the deductibles? * What are the limitations and exclusions? * What is the process for filing a claim?

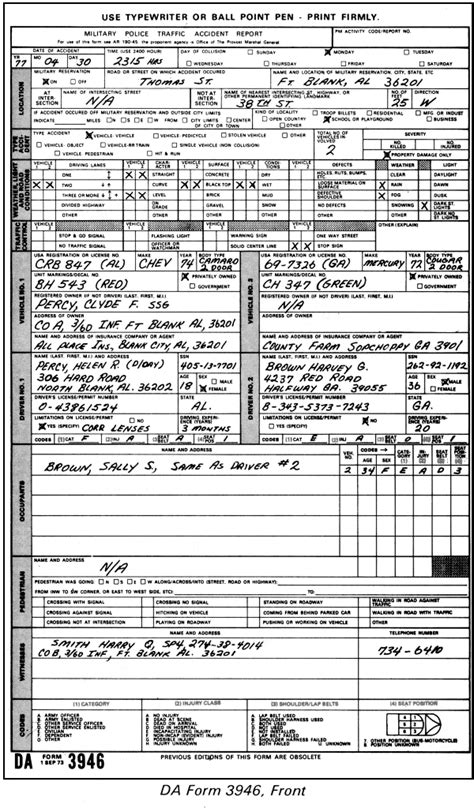

Gathering Evidence

When filing a claim, it is crucial to gather as much evidence as possible to support your claim. This can include: * Police reports * Medical records * Witness statements * Photographs * Videos * Any other relevant documentation

Reporting the Incident

It is essential to report the incident to your insurance company as soon as possible. Delaying the report can lead to delays in the claims process and may even result in your claim being denied. Make sure to provide as much detail as possible when reporting the incident.

Keeping Records

Keeping accurate records of all correspondence with your insurance company is vital. This includes: * Dates and times of phone calls * Emails and letters * Meetings and discussions * Any agreements or disagreements

Being Honest and Transparent

It is crucial to be honest and transparent when filing a claim. Providing false information can lead to your claim being denied and may even result in legal action. Make sure to disclose all relevant information and avoid exaggerating or misrepresenting the facts.

Seeking Professional Help

If you are not sure about the claims process or need help navigating the system, consider seeking professional help. This can include: * Hiring a public adjuster * Consulting with a lawyer * Seeking advice from a financial advisor

Staying Patient and Persistent

Finally, it is essential to stay patient and persistent when dealing with insurance claims. The process can be lengthy and frustrating at times, but staying calm and composed can help ensure that your claim is handled efficiently. Make sure to follow up regularly with your insurance company and keep track of the progress.

📝 Note: Keep all your documents and records in a safe and secure place, and make sure to keep a backup of all your files.

In summary, dealing with insurance claims requires patience, persistence, and attention to detail. By understanding your policy, gathering evidence, reporting the incident, keeping records, being honest and transparent, seeking professional help, and staying patient and persistent, you can ensure that your claims are handled efficiently and that you receive the compensation you deserve.

What is the first step in filing an insurance claim?

+

The first step in filing an insurance claim is to report the incident to your insurance company as soon as possible.

What is the importance of keeping records when filing a claim?

+

Keeping accurate records of all correspondence with your insurance company is vital to ensure that your claim is handled efficiently and that you receive the compensation you deserve.

Can I seek professional help when filing a claim?

+

Yes, you can seek professional help when filing a claim. This can include hiring a public adjuster, consulting with a lawyer, or seeking advice from a financial advisor.