Keep IRS Paperwork How Long

Understanding the Importance of Keeping IRS Paperwork

The Internal Revenue Service (IRS) requires taxpayers to keep accurate and detailed records of their income, expenses, and tax-related documents. These records are essential for preparing tax returns, responding to audits, and resolving any tax-related issues that may arise. One of the most common questions taxpayers have is how long they should keep their IRS paperwork. The answer to this question depends on the type of document and the circumstances surrounding it.

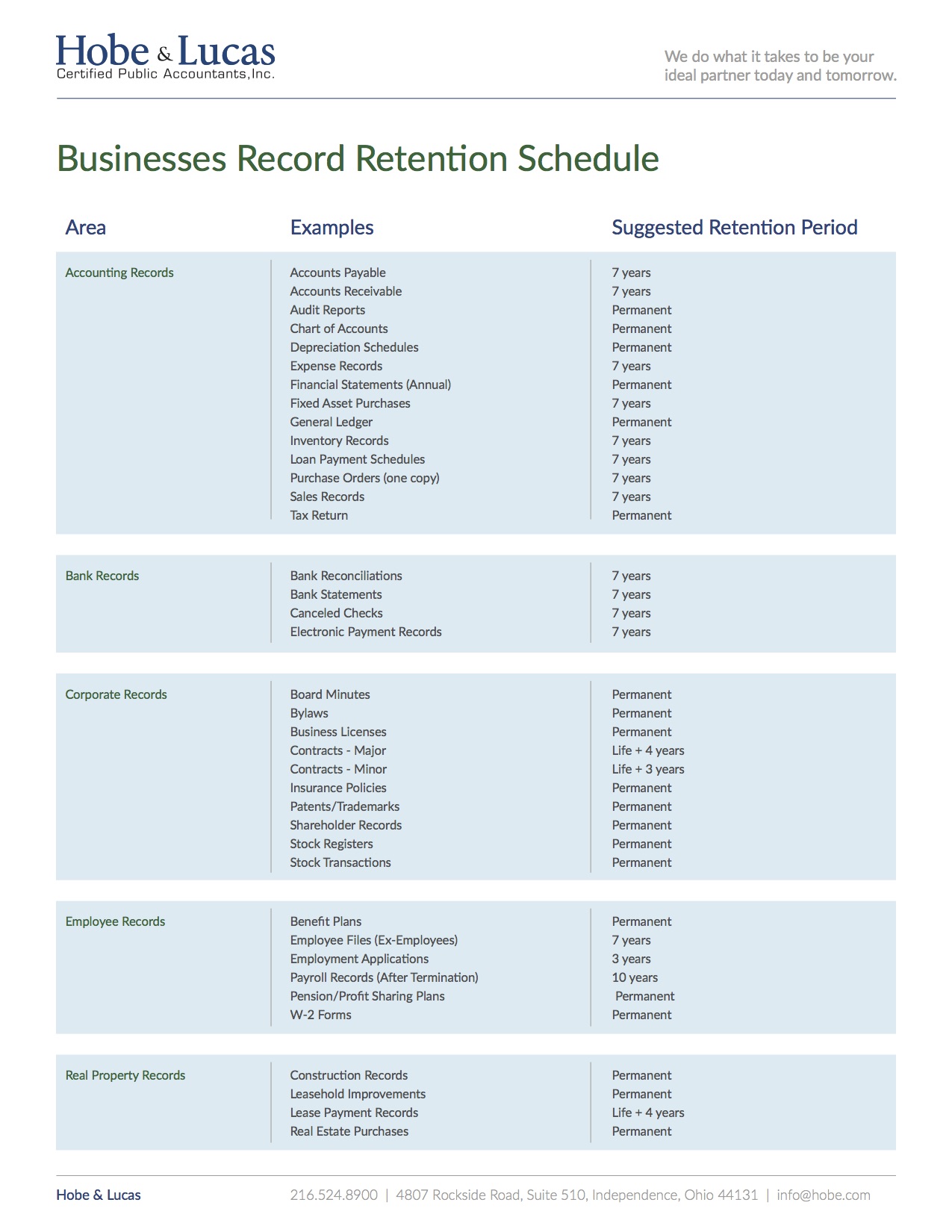

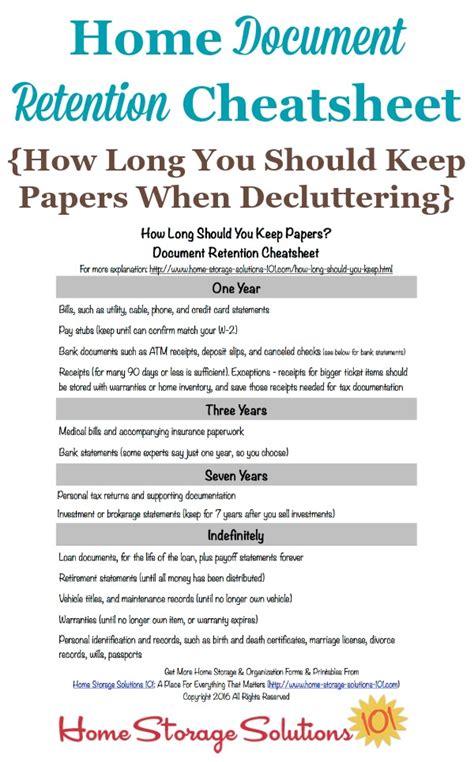

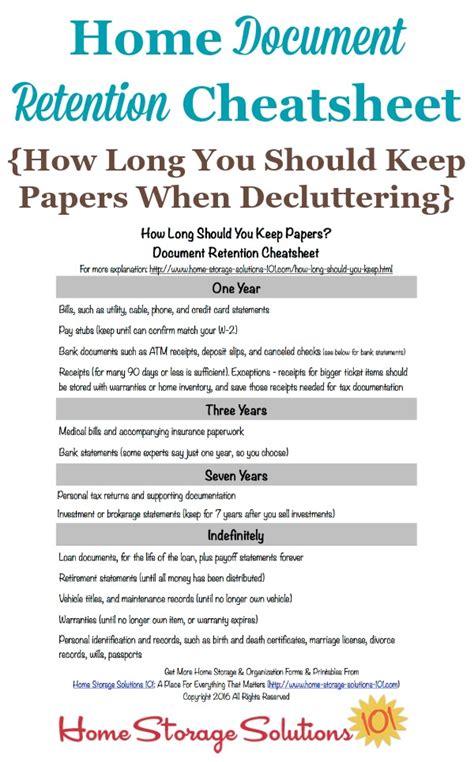

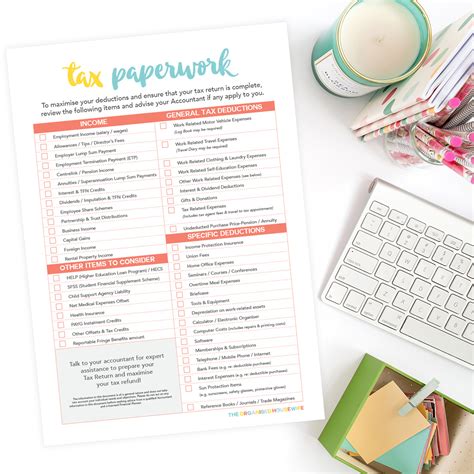

Type of Documents and Retention Period

The IRS recommends that taxpayers keep different types of documents for varying lengths of time. Here are some general guidelines: * Tax returns and supporting documents: Keep for at least three years from the date the return was filed or two years from the date the tax was paid, whichever is later. This includes W-2 forms, 1099 forms, and receipts for deductions. * Records of income: Keep for at least one year from the date the return was filed. This includes pay stubs, bank statements, and investment records. * Records of expenses: Keep for at least three years from the date the return was filed. This includes receipts, invoices, and canceled checks. * Records of assets: Keep for at least six years from the date the return was filed. This includes records of property purchases, sales, and improvements. * Records of business expenses: Keep for at least three years from the date the return was filed. This includes receipts, invoices, and bank statements.

Special Circumstances

There are certain situations where taxpayers may need to keep their IRS paperwork for a longer period. These include: * Audit or examination: If the IRS is auditing or examining a taxpayer’s return, they should keep all relevant documents until the audit or examination is complete. * Amended return: If a taxpayer files an amended return, they should keep all relevant documents for at least three years from the date the amended return was filed. * Tax court case: If a taxpayer is involved in a tax court case, they should keep all relevant documents until the case is resolved. * Bankruptcy or insolvency: If a taxpayer is bankrupt or insolvent, they should keep all relevant documents for at least six years from the date the return was filed.

📝 Note: Taxpayers should keep their IRS paperwork in a safe and secure location, such as a fireproof safe or a secure online storage service.

Organizing and Storing IRS Paperwork

To make it easier to keep track of IRS paperwork, taxpayers can use a variety of organizational tools and storage methods. These include: * Filing cabinets: Use a filing cabinet to store physical documents, such as tax returns and supporting documents. * Digital storage: Use a digital storage service, such as a cloud-based storage service, to store electronic documents, such as PDFs and spreadsheets. * Binders and folders: Use binders and folders to organize and store physical documents, such as receipts and invoices. * Scanning and digitizing: Consider scanning and digitizing physical documents to make them easier to store and access.

Disposing of IRS Paperwork

When disposing of IRS paperwork, taxpayers should take steps to protect their personal and financial information. These include: * Shredding: Use a shredder to destroy physical documents, such as tax returns and supporting documents. * Secure disposal: Use a secure disposal service, such as a document destruction service, to dispose of sensitive documents. * Electronic disposal: Use a secure electronic disposal method, such as a secure delete program, to dispose of electronic documents.

| Type of Document | Retention Period |

|---|---|

| Tax returns and supporting documents | At least 3 years from the date the return was filed or 2 years from the date the tax was paid, whichever is later |

| Records of income | At least 1 year from the date the return was filed |

| Records of expenses | At least 3 years from the date the return was filed |

| Records of assets | At least 6 years from the date the return was filed |

| Records of business expenses | At least 3 years from the date the return was filed |

In summary, keeping IRS paperwork for the appropriate amount of time is crucial for taxpayers to ensure they can respond to audits, resolve tax-related issues, and prepare accurate tax returns. By understanding the type of documents and retention periods, taxpayers can organize and store their IRS paperwork effectively and dispose of it securely when it is no longer needed.

What is the minimum amount of time I should keep my tax returns and supporting documents?

+

You should keep your tax returns and supporting documents for at least 3 years from the date the return was filed or 2 years from the date the tax was paid, whichever is later.

Can I dispose of my IRS paperwork after 1 year?

+

No, you should keep your IRS paperwork for the recommended retention period, which varies depending on the type of document. Disposing of paperwork too soon can lead to difficulties in responding to audits or resolving tax-related issues.

How should I store my IRS paperwork?

+

You can store your IRS paperwork in a safe and secure location, such as a fireproof safe or a secure online storage service. Consider using organizational tools, such as filing cabinets, binders, and folders, to keep your paperwork organized and easily accessible.