Paperwork

UK Death Paperwork Retention Period

Introduction to UK Death Paperwork Retention Period

When a loved one passes away, it can be a challenging and emotional time. In addition to dealing with the emotional aspects of grief, there are also various administrative tasks that need to be completed. One of these tasks is managing the paperwork associated with the deceased person’s estate. This includes understanding the UK death paperwork retention period, which is the length of time that certain documents must be kept after a person’s death. In this article, we will explore the different types of paperwork that must be retained, the retention periods for each, and provide guidance on how to manage these documents effectively.

Types of Paperwork Associated with Death

There are several types of paperwork associated with death, including: * Death certificate: This is an official document that confirms the person’s death and provides details such as the cause of death and the location where the person died. * Will: If the deceased person had a will, this document outlines how their estate should be distributed after their death. * Probate documents: If the deceased person’s estate is subject to probate, these documents will include the grant of probate, which confirms the authority of the executor or administrator to manage the estate. * Inheritance tax documents: If the deceased person’s estate is subject to inheritance tax, these documents will include the tax return and any supporting documentation. * Pension and benefit documents: If the deceased person was in receipt of a pension or benefits, these documents will include details of the payments made and any outstanding balance.

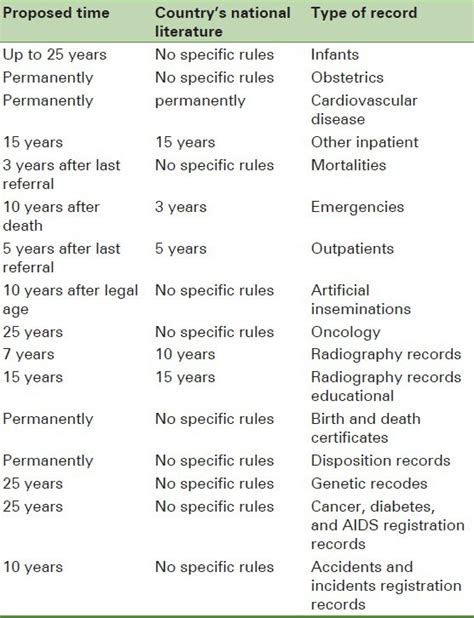

Retention Periods for Death Paperwork

The retention period for death paperwork varies depending on the type of document and the relevant regulations. Here are some general guidelines: * Death certificate: This document should be kept indefinitely, as it may be required for future reference. * Will: The original will should be kept indefinitely, but copies can be retained for a minimum of 6 years. * Probate documents: These documents should be kept for a minimum of 12 years from the date of the grant of probate. * Inheritance tax documents: These documents should be kept for a minimum of 6 years from the date of the tax return. * Pension and benefit documents: These documents should be kept for a minimum of 3 years from the date of the last payment.

| Document Type | Retention Period |

|---|---|

| Death certificate | Indefinitely |

| Will | 6 years (copies), indefinitely (original) |

| Probate documents | 12 years |

| Inheritance tax documents | 6 years |

| Pension and benefit documents | 3 years |

Managing Death Paperwork Effectively

To manage death paperwork effectively, it is essential to have a system in place for storing and retrieving documents. Here are some tips: * Keep documents in a safe place: Consider using a fireproof safe or a secure online storage service to keep documents safe. * Use a filing system: Use a filing system to keep documents organized and easy to find. * Make copies: Make copies of important documents, such as the will and death certificate, and store them in a separate location. * Scan documents: Consider scanning documents and storing them electronically, but make sure to keep the original documents as well.

💡 Note: It is essential to keep the original documents, as they may be required for future reference or to resolve any disputes that may arise.

Conclusion and Final Thoughts

In conclusion, managing death paperwork effectively is crucial to ensure that the estate is administered correctly and that all necessary documents are retained for the required period. By understanding the different types of paperwork associated with death, the retention periods for each, and using a system to manage documents effectively, individuals can ensure that they are complying with the relevant regulations and minimizing the risk of any disputes or issues arising. It is also essential to seek professional advice if unsure about any aspect of managing death paperwork.

What is the retention period for a death certificate?

+

The retention period for a death certificate is indefinitely, as it may be required for future reference.

How long should I keep probate documents?

+

Probate documents should be kept for a minimum of 12 years from the date of the grant of probate.

Can I scan death paperwork and store it electronically?

+

Yes, you can scan death paperwork and store it electronically, but make sure to keep the original documents as well.