Keep Deceased Person's Paperwork

Introduction to Handling Deceased Person’s Paperwork

When a loved one passes away, the process of handling their estate and personal affairs can be overwhelming. One of the most critical aspects of this process is managing the deceased person’s paperwork. This can include a wide range of documents, from financial records and tax returns to personal identification and property deeds. In this article, we will explore the importance of keeping a deceased person’s paperwork, the types of documents that need to be managed, and the steps involved in organizing and maintaining these records.

Why Keep a Deceased Person’s Paperwork?

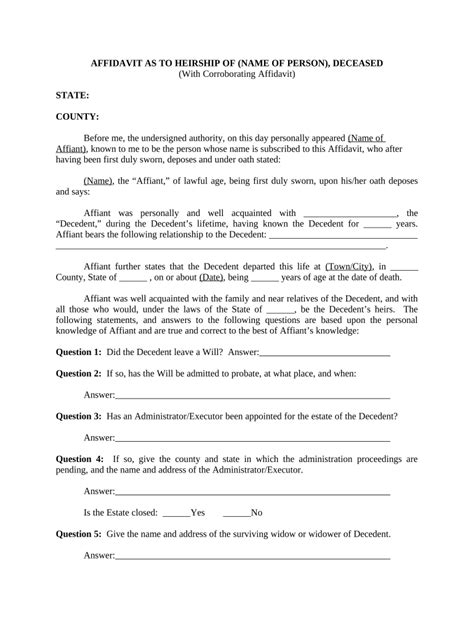

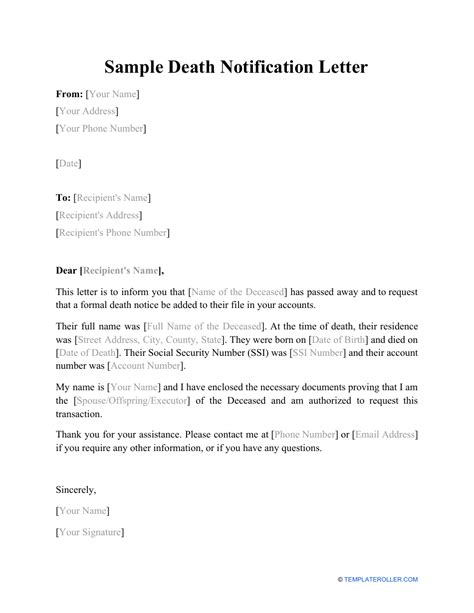

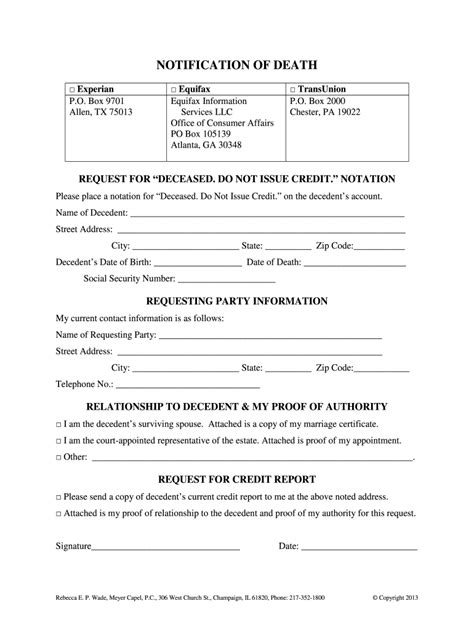

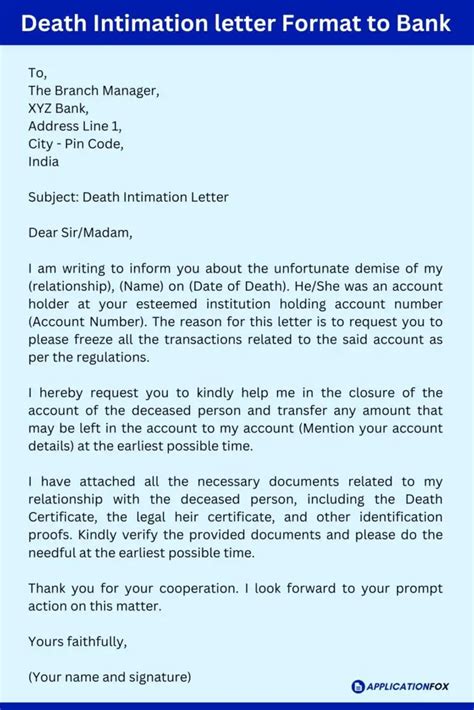

Keeping a deceased person’s paperwork is essential for several reasons. Firstly, it helps to ensure that the estate is settled efficiently and that all assets are distributed according to the deceased person’s wishes. This can include probating the will, paying off debts, and transferring ownership of property. Secondly, having access to the deceased person’s paperwork can help to prevent identity theft and other forms of fraud. Finally, keeping these records can provide a sense of closure and help family members and loved ones to move forward after a loss.

Types of Documents to Keep

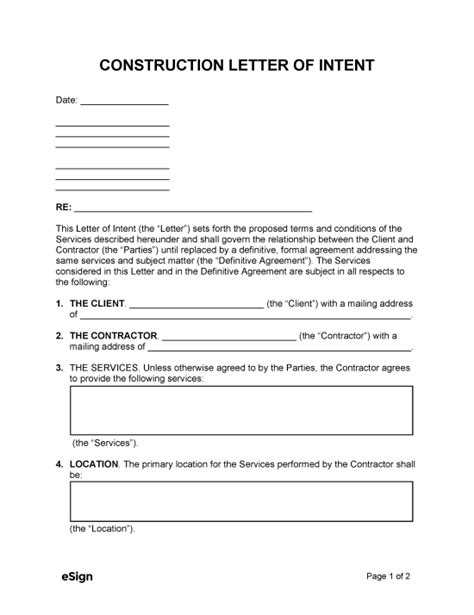

The types of documents that need to be kept can vary depending on the individual’s circumstances, but some common examples include: * Financial records: bank statements, investment accounts, tax returns, and retirement accounts * Personal identification: driver’s license, passport, social security card, and birth certificate * Property deeds: deeds to real estate, vehicles, and other valuable assets * Insurance policies: life insurance, health insurance, and other types of insurance * Wills and trusts: the deceased person’s will, trust documents, and powers of attorney * Tax records: tax returns, W-2 forms, and other tax-related documents

Organizing and Maintaining Records

Organizing and maintaining a deceased person’s paperwork can be a daunting task, but there are several steps that can be taken to make the process easier. These include: * Gathering all relevant documents: collecting all of the deceased person’s paperwork and organizing it in a central location * Creating a filing system: setting up a filing system to keep track of the different types of documents * Scanning and digitizing records: scanning and digitizing paper documents to create electronic copies * Storing records securely: storing the documents in a secure location, such as a safe or a locked file cabinet

| Document Type | Retention Period |

|---|---|

| Financial records | 3-7 years |

| Tax records | 3-7 years |

| Insurance policies | Permanently |

| Wills and trusts | Permanently |

📝 Note: The retention period for different types of documents can vary depending on the individual's circumstances and the laws of their jurisdiction.

Conclusion and Final Thoughts

In conclusion, keeping a deceased person’s paperwork is an essential part of managing their estate and personal affairs. By understanding the types of documents that need to be kept, organizing and maintaining these records, and storing them securely, family members and loved ones can ensure that the deceased person’s wishes are respected and their legacy is preserved. It is also important to note that the process of handling a deceased person’s paperwork can be complex and time-consuming, and it may be helpful to seek the advice of a professional, such as an attorney or a financial advisor, to ensure that everything is handled correctly.

What types of documents should I keep after a loved one passes away?

+

The types of documents that should be kept can vary depending on the individual’s circumstances, but some common examples include financial records, personal identification, property deeds, insurance policies, wills and trusts, and tax records.

How long should I keep a deceased person’s paperwork?

+

The retention period for different types of documents can vary depending on the individual’s circumstances and the laws of their jurisdiction. However, some documents, such as wills and trusts, should be kept permanently, while others, such as financial records and tax returns, may only need to be kept for 3-7 years.

What is the best way to organize and maintain a deceased person’s paperwork?

+

The best way to organize and maintain a deceased person’s paperwork is to gather all relevant documents, create a filing system, scan and digitize paper documents, and store the records securely. It may also be helpful to seek the advice of a professional, such as an attorney or a financial advisor, to ensure that everything is handled correctly.