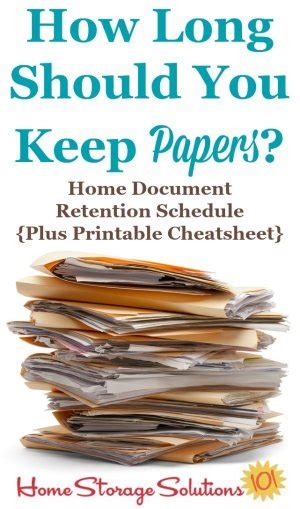

7 Years Keep Papers

Introduction to Document Retention

Keeping papers for 7 years is a common guideline for individuals and businesses to follow for tax purposes and other financial records. This period allows for the retention of essential documents that may be required for audits, tax returns, and other financial obligations. In this blog post, we will delve into the importance of document retention, the types of documents that should be kept, and the best practices for maintaining these records.

Why Keep Documents for 7 Years?

The primary reason for keeping documents for 7 years is to ensure compliance with tax laws and regulations. The Internal Revenue Service (IRS) can audit tax returns from the past 7 years, and having the necessary documents can help individuals and businesses navigate these audits more efficiently. Additionally, keeping accurate and detailed records can help in case of any disputes or discrepancies.

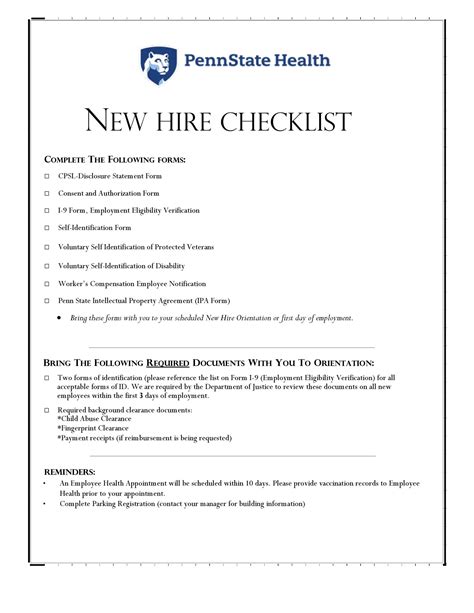

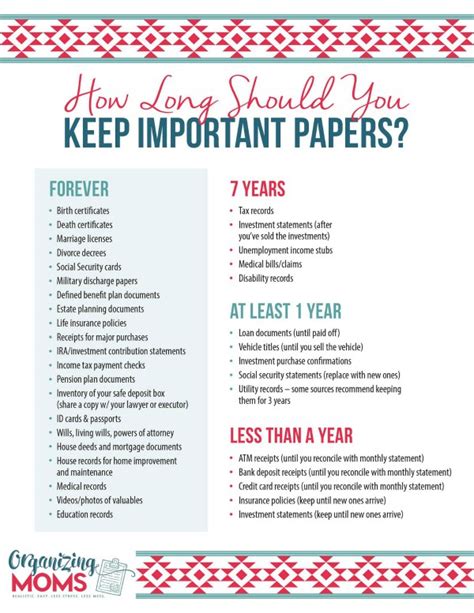

Types of Documents to Keep

There are various types of documents that individuals and businesses should keep for at least 7 years. These include: * Tax returns and supporting documents, such as W-2s and 1099s * Financial statements, including balance sheets and income statements * Bank statements and cancelled checks * Investment records, such as stock certificates and dividend statements * Business expense records, including receipts and invoices * Employment records, including payroll records and employee personnel files

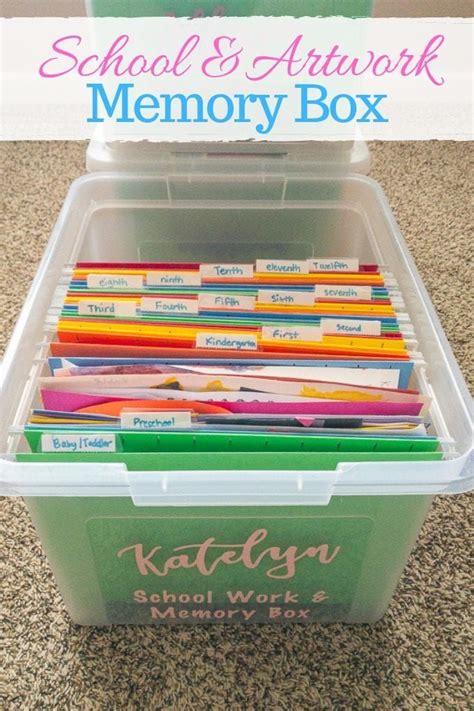

Best Practices for Document Retention

To ensure that documents are kept safely and efficiently, individuals and businesses should follow these best practices: * Organize documents in a logical and accessible manner * Store documents in a secure and fireproof location, such as a safe or a secure online storage service * Scan documents to create digital copies, which can be easily stored and retrieved * Shred unnecessary documents to prevent identity theft and maintain confidentiality * Review and update documents regularly to ensure accuracy and completeness

| Document Type | Retention Period |

|---|---|

| Tax returns | 7 years |

| Financial statements | 7 years |

| Bank statements | 7 years |

| Investment records | 7 years |

| Business expense records | 7 years |

Importance of Digital Document Storage

In today’s digital age, it’s essential to consider digital document storage as a means of keeping records safe and secure. Digital storage services, such as cloud storage, can provide an additional layer of protection against physical damage or loss. When choosing a digital storage service, individuals and businesses should consider the following factors: * Security: Look for services that offer robust security measures, such as encryption and two-factor authentication * Accessibility: Choose services that allow easy access to documents from anywhere, at any time * Compliance: Ensure that the service complies with relevant regulations, such as GDPR and HIPAA

💡 Note: When storing documents digitally, it's essential to ensure that the service provider is reputable and trustworthy.

In summary, keeping papers for 7 years is a crucial aspect of financial record-keeping, and individuals and businesses should prioritize document retention to ensure compliance with tax laws and regulations. By following best practices and considering digital document storage, individuals and businesses can maintain accurate and detailed records, navigate audits and disputes more efficiently, and protect themselves against potential risks.

What types of documents should I keep for 7 years?

+

You should keep tax returns, financial statements, bank statements, investment records, business expense records, and employment records for at least 7 years.

Why is it important to keep documents for 7 years?

+

Keeping documents for 7 years ensures compliance with tax laws and regulations, and provides a means of navigating audits and disputes more efficiently.

What are the best practices for document retention?

+

Best practices for document retention include organizing documents, storing them in a secure location, scanning documents to create digital copies, shredding unnecessary documents, and reviewing and updating documents regularly.