Keep Refinance Paperwork

Understanding the Importance of Keeping Refinance Paperwork

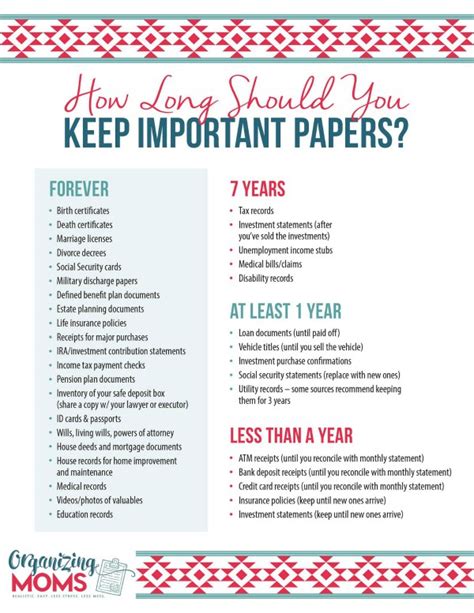

When refinancing a home, it’s essential to keep track of all the paperwork involved in the process. This includes documents related to the original loan, the refinancing application, and the new loan terms. Organizing and maintaining these records can help homeowners avoid potential issues and ensure a smooth transition to the new loan. In this article, we’ll explore the key documents to keep and why they’re crucial for a successful refinance.

Documents to Keep

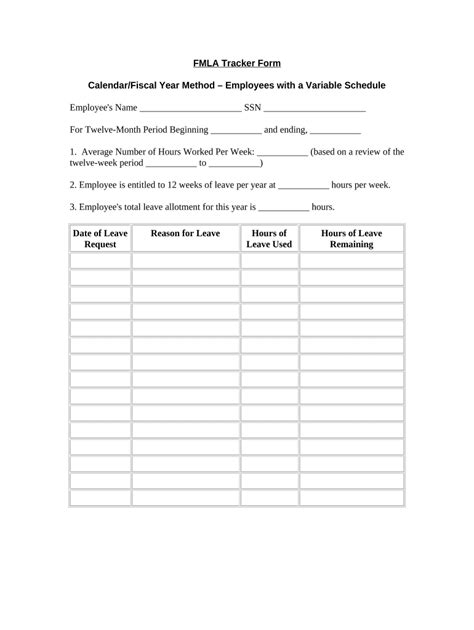

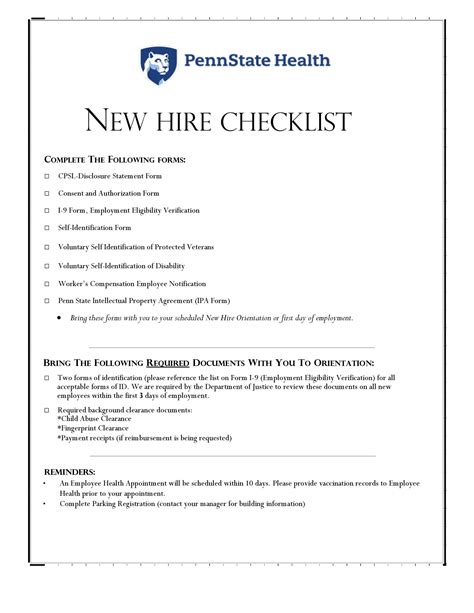

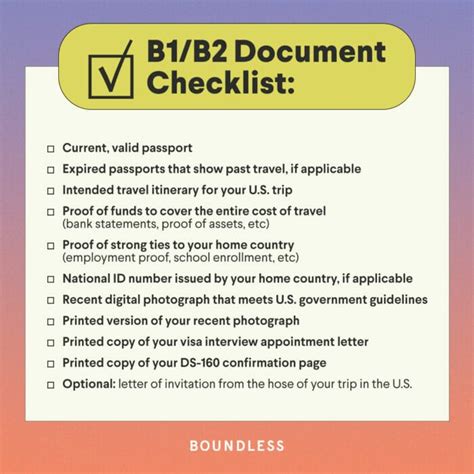

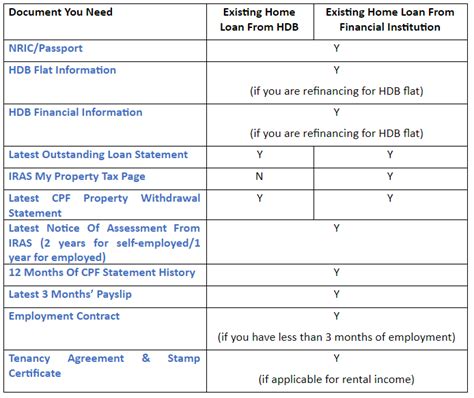

Homeowners should keep the following documents related to their refinance: * The original loan documents, including the note and mortgage * The refinancing application and approval documents * The new loan documents, including the note and mortgage * Any correspondence with the lender, including emails and letters * Records of payments made on the original loan and the new loan * Appraisals and inspections conducted during the refinancing process * Credit reports and credit scores used to determine loan eligibility

Why Keep Refinance Paperwork?

Keeping refinance paperwork is essential for several reasons: * Tax purposes: Homeowners may need to provide documentation to support tax deductions related to their mortgage interest and property taxes. * Loan disputes: In the event of a dispute with the lender, having accurate records can help resolve issues and protect the homeowner’s interests. * Future refinancing: When refinancing again in the future, having the previous refinance documents can help streamline the process and ensure accuracy. * Audit and compliance: In the event of an audit or regulatory compliance review, having complete and accurate records can help demonstrate compliance with lending regulations.

Best Practices for Organizing Refinance Paperwork

To keep refinance paperwork organized, homeowners can follow these best practices: * Create a dedicated file: Designate a specific file or folder for refinance documents to keep them separate from other financial records. * Use a cloud storage service: Consider scanning and storing documents in a secure cloud storage service, such as Google Drive or Dropbox, to ensure accessibility and backup. * Keep electronic and physical copies: Maintain both electronic and physical copies of important documents to ensure redundancy and ease of access. * Review and update regularly: Periodically review refinance paperwork to ensure accuracy and update records as necessary.

Common Mistakes to Avoid

When keeping refinance paperwork, homeowners should avoid the following common mistakes: * Losing or misplacing documents: Failing to keep track of important documents can lead to delays and issues during the refinance process. * Failing to update records: Neglecting to update records can result in inaccurate or incomplete information, which can cause problems in the future. * Not maintaining electronic and physical copies: Relying solely on electronic or physical copies can leave homeowners vulnerable to data loss or document damage.

| Document | Importance |

|---|---|

| Original loan documents | Supports loan history and terms |

| Refinancing application and approval documents | Confirms loan eligibility and terms |

| New loan documents | Outlines loan terms and conditions |

📝 Note: Homeowners should keep refinance paperwork for at least three years after the refinance is complete, as this is the typical statute of limitations for mortgage-related disputes.

In summary, keeping refinance paperwork is crucial for homeowners to ensure a smooth transition to a new loan, avoid potential issues, and maintain accurate records. By understanding the importance of keeping refinance paperwork, following best practices for organization, and avoiding common mistakes, homeowners can protect their interests and make the most of their refinancing experience. The key takeaways from this article include the importance of maintaining accurate records, keeping electronic and physical copies, and reviewing and updating records regularly. By following these guidelines, homeowners can ensure a successful refinance and a secure financial future.

What documents should I keep after refinancing my home?

+

You should keep the original loan documents, refinancing application and approval documents, new loan documents, and any correspondence with the lender.

Why is it important to keep refinance paperwork?

+

Keeping refinance paperwork is essential for tax purposes, loan disputes, future refinancing, and audit and compliance.

How long should I keep refinance paperwork?

+

You should keep refinance paperwork for at least three years after the refinance is complete.