Keep Tax Paperwork

Understanding the Importance of Keeping Tax Paperwork

When it comes to managing your finances, one of the most crucial aspects is keeping track of your tax paperwork. This includes receipts, invoices, bank statements, and any other documents related to your income and expenses. Proper record-keeping is essential for ensuring that you are in compliance with tax laws and regulations, and it can also help you to avoid any potential penalties or fines. In this article, we will explore the importance of keeping tax paperwork and provide tips on how to stay organized.

Why Keep Tax Paperwork?

There are several reasons why keeping tax paperwork is important. Some of the key reasons include: * Audit protection: In the event of an audit, having accurate and detailed records can help to protect you from potential penalties and fines. * Tax deductions: Keeping track of your expenses and receipts can help you to identify eligible tax deductions, which can reduce your taxable income and lower your tax bill. * Financial planning: Accurate financial records can help you to make informed decisions about your financial future, such as planning for retirement or making investments. * Business expenses: If you are self-employed or own a business, keeping track of your expenses and receipts is crucial for accurately reporting your income and expenses on your tax return.

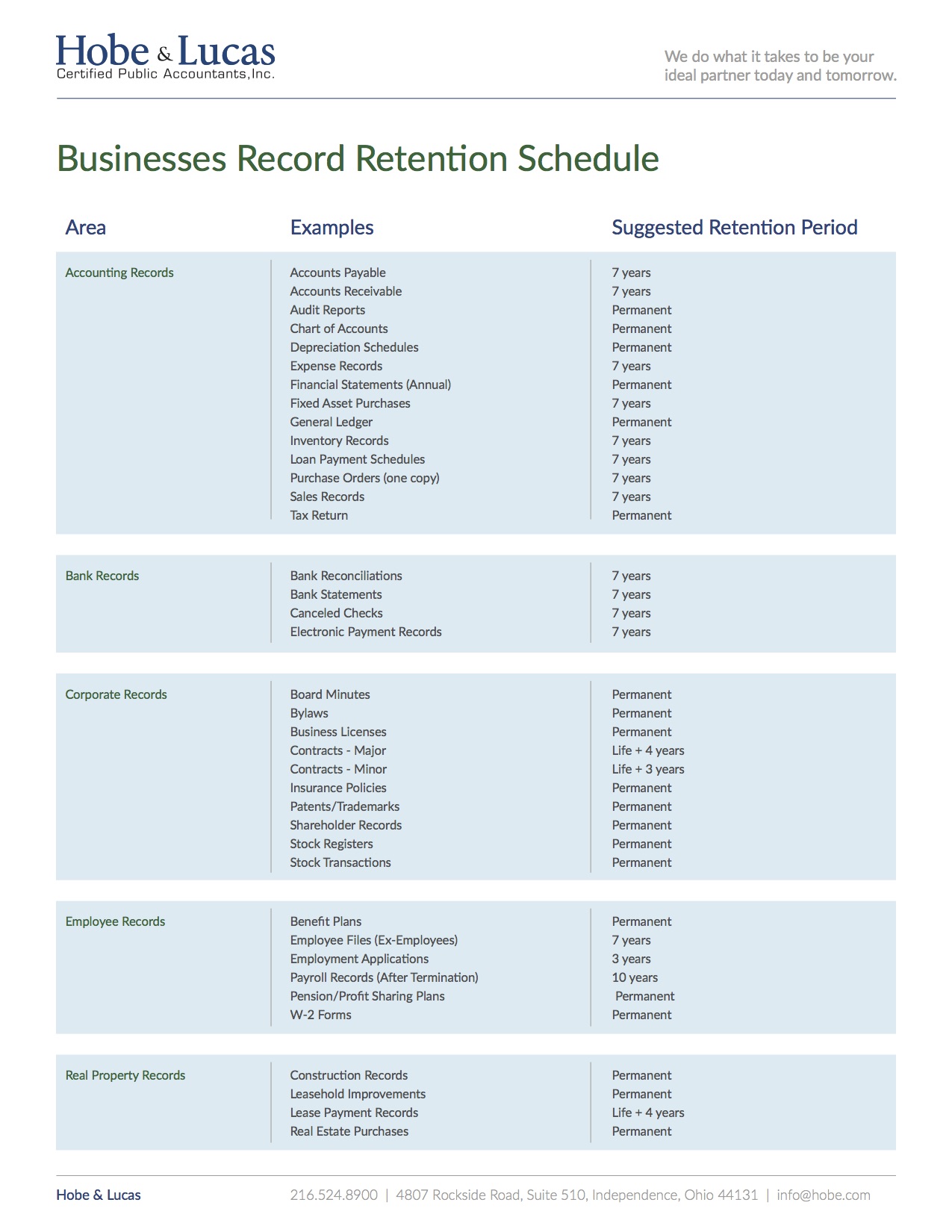

What Tax Paperwork to Keep

So, what tax paperwork should you keep? Some of the key documents include: * Receipts: Keep receipts for all business-related expenses, including meals, travel, and equipment purchases. * Invoices: Keep copies of all invoices related to your business, including invoices for services provided and invoices for goods sold. * Bank statements: Keep copies of your bank statements, including statements for your business and personal accounts. * W-2 forms: Keep copies of your W-2 forms, which show your income and taxes withheld. * 1099 forms: Keep copies of your 1099 forms, which show your income from self-employment or freelance work.

| Document | Description |

|---|---|

| Receipts | Business-related expenses, including meals, travel, and equipment purchases |

| Invoices | Business-related invoices, including invoices for services provided and invoices for goods sold |

| Bank statements | Business and personal bank account statements |

| W-2 forms | Income and taxes withheld |

| 1099 forms | Income from self-employment or freelance work |

How to Keep Tax Paperwork

So, how can you keep your tax paperwork organized? Some tips include: * Use a filing system: Set up a filing system that includes separate folders for different types of documents, such as receipts, invoices, and bank statements. * Scan documents: Consider scanning your documents and saving them to a digital file, such as a cloud storage service or an external hard drive. * Use accounting software: Consider using accounting software, such as QuickBooks or Xero, to help you keep track of your expenses and income. * Set reminders: Set reminders to review and update your tax paperwork on a regular basis, such as quarterly or annually.

💡 Note: It's also a good idea to keep a backup of your tax paperwork in a secure location, such as a safe or a fireproof box, in case of an emergency or natural disaster.

Best Practices for Keeping Tax Paperwork

Some best practices for keeping tax paperwork include: * Keep accurate records: Make sure to keep accurate and detailed records of your income and expenses. * Keep records up to date: Make sure to review and update your tax paperwork on a regular basis. * Keep records secure: Make sure to keep your tax paperwork secure, such as by using a password-protected digital file or a locked filing cabinet. * Seek professional help: Consider seeking the help of a tax professional or accountant if you are unsure about how to keep your tax paperwork organized.

As you can see, keeping tax paperwork is an important part of managing your finances and ensuring that you are in compliance with tax laws and regulations. By following the tips and best practices outlined in this article, you can help to ensure that your tax paperwork is accurate, up to date, and secure.

In final thoughts, keeping tax paperwork is a crucial aspect of managing your finances and ensuring that you are in compliance with tax laws and regulations. By understanding the importance of keeping tax paperwork, what tax paperwork to keep, and how to keep it organized, you can help to ensure that your financial records are accurate, up to date, and secure. This can help to reduce the risk of penalties and fines, and can also help you to make informed decisions about your financial future.

What is the importance of keeping tax paperwork?

+

Keeping tax paperwork is important for ensuring that you are in compliance with tax laws and regulations, and it can also help you to avoid any potential penalties or fines. It can also help you to identify eligible tax deductions, which can reduce your taxable income and lower your tax bill.

What tax paperwork should I keep?

+

Some of the key tax paperwork to keep includes receipts, invoices, bank statements, W-2 forms, and 1099 forms. You should also keep any other documents related to your income and expenses, such as cancelled checks and credit card statements.

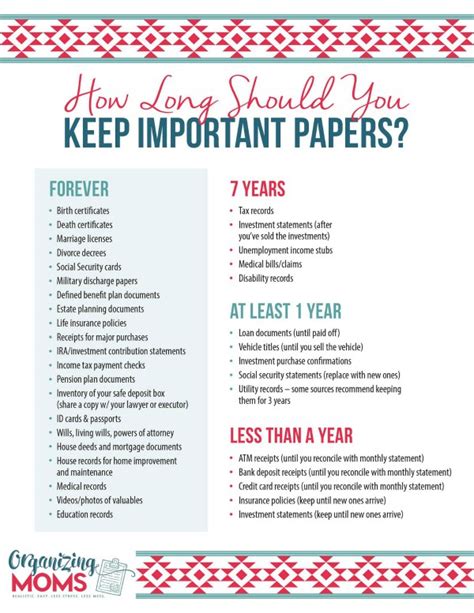

How long should I keep my tax paperwork?

+

The length of time you should keep your tax paperwork will depend on the type of document and your individual circumstances. Generally, it’s a good idea to keep tax paperwork for at least three to five years, in case of an audit or other issue.