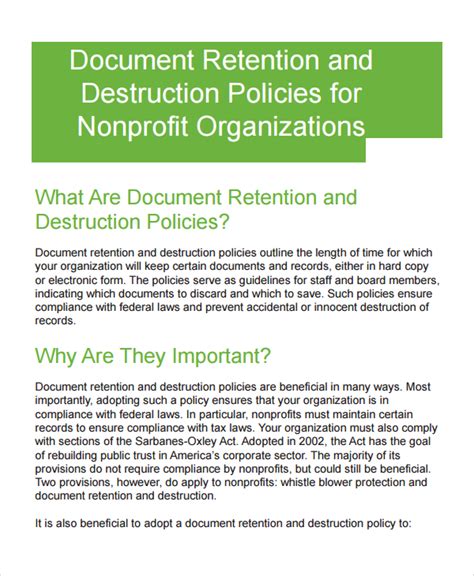

UK Tax PaperworkRetention Period

Understanding UK Tax Paperwork Retention Period

When it comes to managing finances and ensuring compliance with tax regulations, individuals and businesses in the UK must be aware of the importance of retaining tax-related paperwork. The UK tax authorities, such as HM Revenue & Customs (HMRC), require taxpayers to keep certain documents for a specified period. This is crucial for audits, investigations, and other purposes. In this blog post, we will delve into the world of UK tax paperwork retention periods, exploring what documents need to be kept, for how long, and why.

Why Retain Tax Paperwork?

Retaining tax paperwork is essential for several reasons. Firstly, it helps taxpayers to support their tax returns and claims in case of an inquiry or audit by HMRC. Having the necessary documents readily available can simplify the process and reduce the risk of penalties or fines. Secondly, retained paperwork can serve as proof of income, expenses, and other financial transactions, which can be vital for future reference or in the event of a tax dispute. Lastly, keeping accurate and comprehensive records demonstrates good financial management and compliance with tax laws.

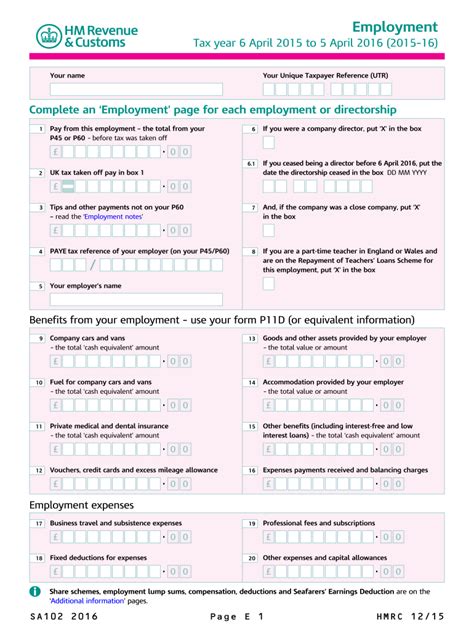

Documents That Need to Be Retained

The type of documents that need to be retained varies depending on the individual’s or business’s specific circumstances. However, some common examples include: * Income tax returns and supporting documents, such as P60s, P45s, and dividend vouchers * Business records, including invoices, receipts, bank statements, and payroll records * Expense receipts and records of business use of personal assets, such as cars or homes * Capital gains tax records, including documents related to the purchase and sale of assets * VAT records, such as VAT returns, invoices, and receipts

Retention Periods for Different Types of Documents

The retention period for tax paperwork in the UK varies depending on the type of document and the individual’s or business’s circumstances. The following are some general guidelines: * Income tax and capital gains tax records: 1 year from the 31 January following the tax year, or if the taxpayer is subject to an inquiry, until the inquiry is completed * Business records: 6 years from the end of the accounting period, or if the business is subject to an inquiry, until the inquiry is completed * VAT records: 6 years from the end of the accounting period, or if the business is subject to an inquiry, until the inquiry is completed * Payroll records: 3 years from the end of the tax year, or if the business is subject to an inquiry, until the inquiry is completed

| Document Type | Retention Period |

|---|---|

| Income tax and capital gains tax records | 1 year from the 31 January following the tax year |

| Business records | 6 years from the end of the accounting period |

| VAT records | 6 years from the end of the accounting period |

| Payroll records | 3 years from the end of the tax year |

Best Practices for Retaining Tax Paperwork

To ensure compliance with UK tax regulations and to make the most of retained paperwork, individuals and businesses should follow these best practices: * Keep documents in a secure and organized manner, either physically or digitally * Ensure that all documents are accurate, complete, and up-to-date * Regularly review and update records to reflect changes in circumstances * Consider scanning paper documents to create digital copies, but ensure that the originals are retained * Keep records in a format that is easily accessible and readable

📝 Note: It is essential to check with HMRC or a tax professional for specific guidance on retaining tax paperwork, as individual circumstances may affect the required retention periods.

In summary, retaining tax paperwork is a critical aspect of managing finances and ensuring compliance with UK tax regulations. By understanding what documents need to be retained, for how long, and why, individuals and businesses can simplify their tax affairs and reduce the risk of penalties or fines. By following best practices and seeking professional advice when necessary, taxpayers can ensure that they are meeting their tax obligations and making the most of their retained paperwork.

What happens if I fail to retain the necessary tax paperwork?

+

Failing to retain the necessary tax paperwork can result in penalties, fines, or even a tax investigation. It is essential to keep accurate and comprehensive records to support tax returns and claims.

Can I store my tax paperwork digitally?

+

Yes, you can store your tax paperwork digitally, but it is essential to ensure that the digital copies are accurate, complete, and easily accessible. You should also retain the original documents, as digital copies may not be accepted by HMRC in all cases.

How long do I need to retain payroll records?

+

You need to retain payroll records for 3 years from the end of the tax year, or if the business is subject to an inquiry, until the inquiry is completed.