Paperwork

Probate Paperwork Timeline

Introduction to Probate Paperwork Timeline

When a loved one passes away, it can be a challenging and emotional time for the family and friends left behind. One of the many tasks that need to be taken care of is the probate process, which involves managing the deceased person’s estate and distributing their assets according to their will or the laws of the state. The probate process can be complex and time-consuming, involving a significant amount of paperwork and legal procedures. In this article, we will provide an overview of the probate paperwork timeline and the various steps involved in the process.

Understanding the Probate Process

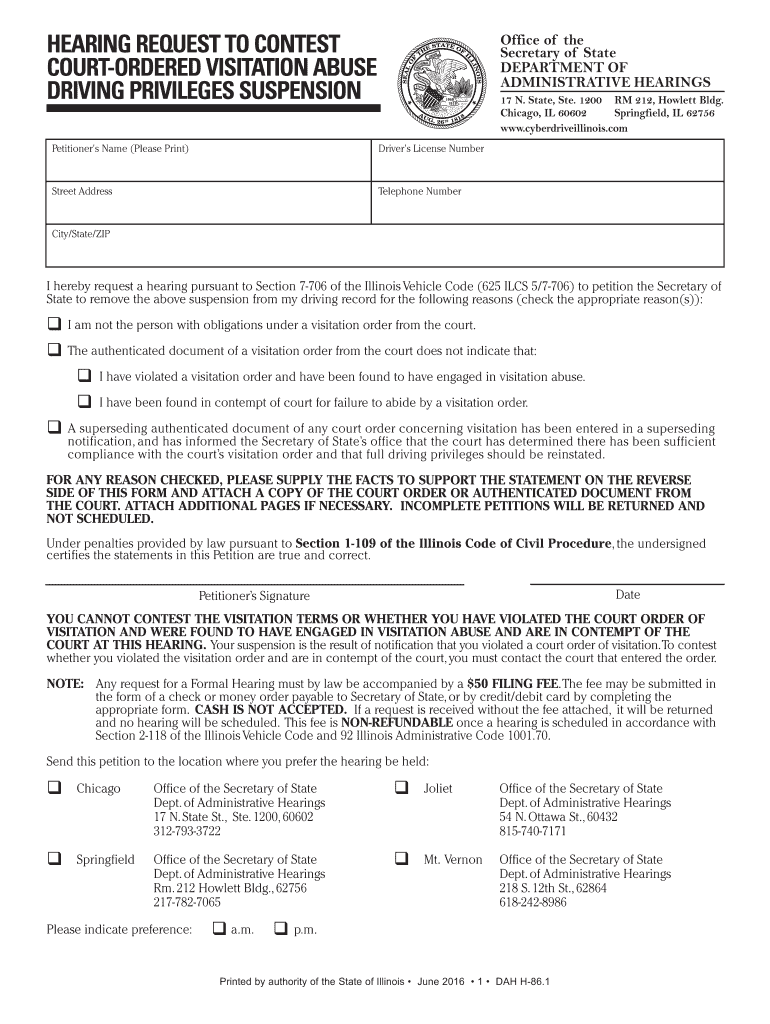

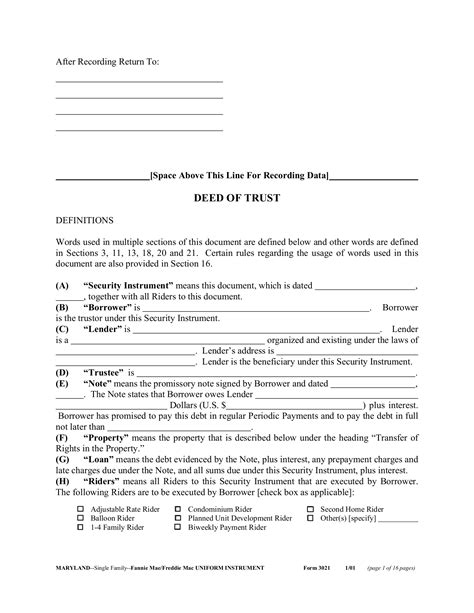

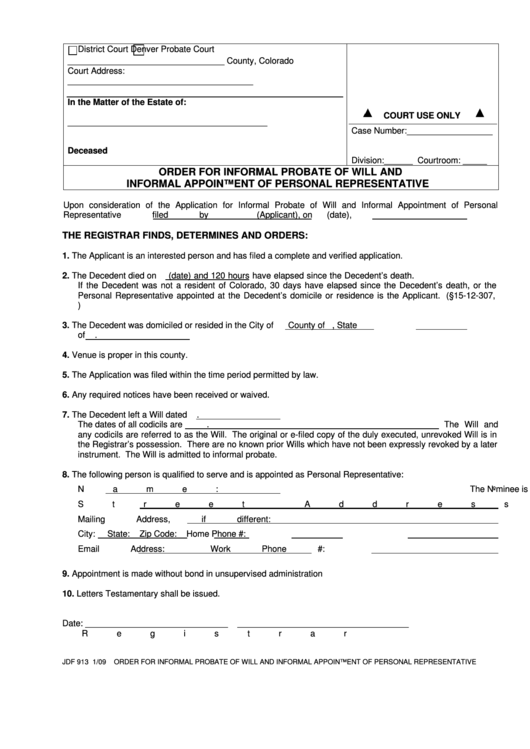

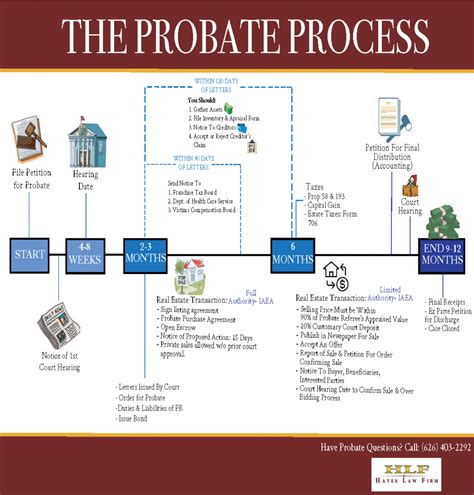

The probate process typically begins when the deceased person’s will is filed with the court, or when a petition is filed to open the estate if there is no will. The court will then appoint a personal representative, also known as an executor or administrator, to manage the estate and oversee the probate process. The personal representative is responsible for gathering the deceased person’s assets, paying off debts and taxes, and distributing the remaining assets to the beneficiaries.

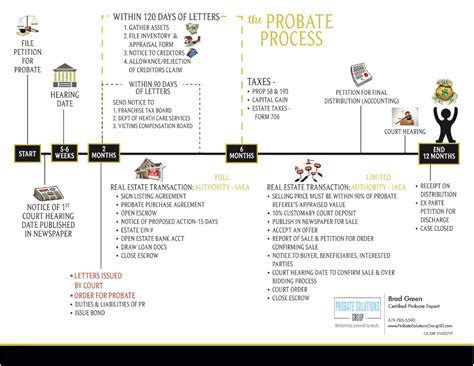

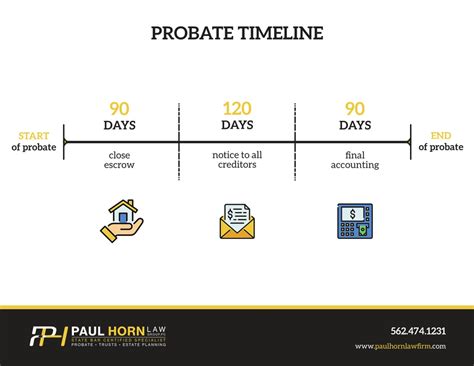

Probate Paperwork Timeline

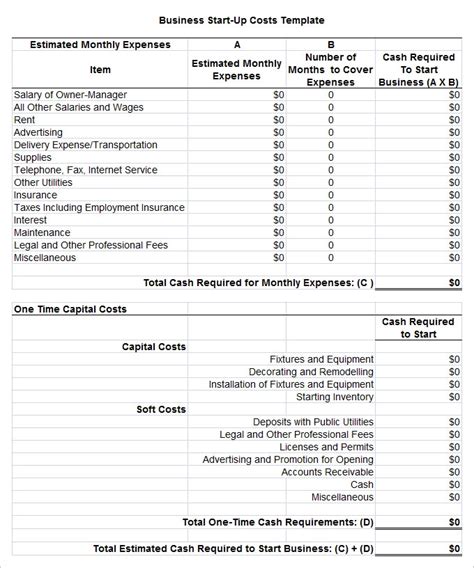

The probate paperwork timeline can vary depending on the complexity of the estate and the laws of the state. However, here is a general outline of the steps involved in the probate process and the typical timeline for each step: * Filing the will and petition to open the estate: 1-3 weeks * Appointment of personal representative: 1-4 weeks * Gathering assets and paying debts: 2-6 months * Filing tax returns and paying taxes: 3-9 months * Distributing assets to beneficiaries: 6-12 months * Closing the estate: 9-18 months

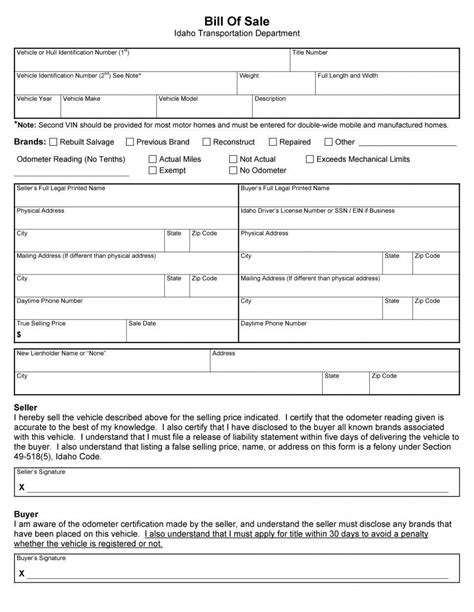

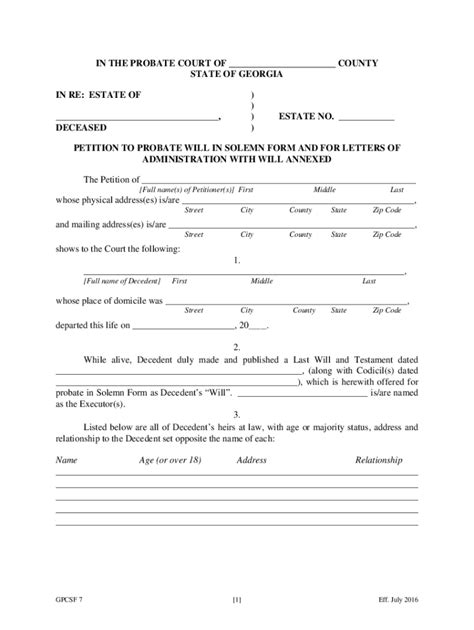

Key Documents Required for Probate

The following are some of the key documents required for the probate process: * Will: The deceased person’s will, which outlines their wishes for the distribution of their assets. * Death certificate: A certified copy of the deceased person’s death certificate. * Petition to open the estate: A document filed with the court to open the estate and appoint a personal representative. * Inventory of assets: A list of the deceased person’s assets, including real estate, bank accounts, investments, and personal property. * Appraisal of assets: An appraisal of the deceased person’s assets to determine their value. * Tax returns: The deceased person’s tax returns, including income tax and estate tax returns.

| Document | Description | Timeline |

|---|---|---|

| Will | The deceased person's will | Filed with the court within 1-3 weeks |

| Death certificate | Certified copy of the deceased person's death certificate | Obtained within 1-2 weeks |

| Petition to open the estate | Document filed with the court to open the estate | Filed within 1-3 weeks |

| Inventory of assets | List of the deceased person's assets | Completed within 2-3 months |

| Appraisal of assets | Appraisal of the deceased person's assets | Completed within 2-3 months |

| Tax returns | The deceased person's tax returns | Filed within 3-9 months |

Challenges and Delays in the Probate Process

The probate process can be complex and time-consuming, and there are several challenges and delays that can arise. Some of the common challenges and delays include: * Contested wills: If the will is contested, the probate process can be delayed for several months or even years. * Missing or unclear documents: If the deceased person’s documents are missing or unclear, it can be difficult to determine their wishes and assets. * Disputes among beneficiaries: If the beneficiaries disagree on the distribution of assets, it can lead to delays and disputes. * Tax issues: If there are tax issues or disputes, it can delay the probate process.

💡 Note: It's essential to work with an experienced attorney or probate professional to navigate the probate process and avoid delays and challenges.

Conclusion and Final Thoughts

In conclusion, the probate paperwork timeline can be complex and time-consuming, involving a significant amount of paperwork and legal procedures. Understanding the probate process and the various steps involved can help individuals and families navigate the process more efficiently. It’s essential to work with an experienced attorney or probate professional to ensure that the probate process is handled correctly and that the deceased person’s wishes are carried out.

What is the purpose of the probate process?

+

The purpose of the probate process is to manage the deceased person’s estate, pay off debts and taxes, and distribute the remaining assets to the beneficiaries according to the deceased person’s will or the laws of the state.

How long does the probate process typically take?

+

The probate process can take anywhere from 6 to 18 months, depending on the complexity of the estate and the laws of the state.

What are the key documents required for the probate process?

+

The key documents required for the probate process include the will, death certificate, petition to open the estate, inventory of assets, appraisal of assets, and tax returns.