7 Tips Save Tax Paperwork

Introduction to Tax Paperwork Management

Effective management of tax paperwork is crucial for individuals and businesses to ensure compliance with tax laws and regulations. Proper organization and timely submission of tax documents can help avoid penalties, fines, and even audits. In this article, we will discuss 7 tips to save tax paperwork, making the process more efficient and less stressful.

Understanding Tax Paperwork Requirements

Before diving into the tips, it’s essential to understand the types of tax paperwork required for individuals and businesses. These may include: * W-2 forms for employees * 1099 forms for freelancers and independent contractors * Business expense receipts * Charitable donation receipts * Medical expense receipts * Tax returns (1040, 1065, 1120, etc.)

Tips for Saving Tax Paperwork

Here are 7 tips to help you save tax paperwork: * Go digital: Consider scanning and storing your tax documents electronically. This will help reduce physical storage space and make it easier to access and share documents. * Use a cloud-based storage service: Services like Google Drive, Dropbox, or Microsoft OneDrive can help you store and organize your tax documents securely. * Implement a filing system: Create a physical or digital filing system to categorize and store your tax documents. This can include folders, labels, and tags to help you quickly locate specific documents. * Set reminders: Set reminders for important tax deadlines, such as the deadline for submitting tax returns or making estimated tax payments. * Keep a tax calendar: Create a calendar to track important tax dates, including deadlines for submitting tax returns, making payments, and responding to IRS notices. * Outsource to a tax professional: If you’re overwhelmed with tax paperwork, consider hiring a tax professional to help with preparation and submission. * Stay organized throughout the year: Don’t wait until tax season to start organizing your tax paperwork. Instead, stay on top of your documents throughout the year to make the tax preparation process smoother.

Benefits of Saving Tax Paperwork

Saving tax paperwork can have several benefits, including: * Reduced stress: Having a organized system for managing tax paperwork can reduce stress and anxiety during tax season. * Increased efficiency: A well-organized system can help you quickly locate and access the documents you need, saving time and increasing productivity. * Improved accuracy: A organized system can help reduce errors and inaccuracies, which can lead to penalties and fines. * Better record-keeping: Saving tax paperwork can help you maintain accurate and complete records, which can be useful for future tax purposes or audits.

Common Mistakes to Avoid

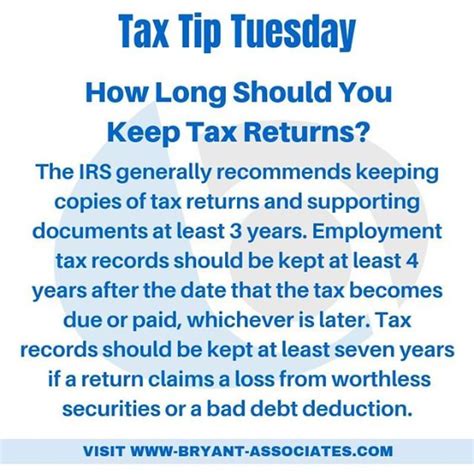

When saving tax paperwork, it’s essential to avoid common mistakes, such as: * Not keeping receipts: Failing to keep receipts for business expenses, charitable donations, or medical expenses can lead to lost deductions and increased tax liability. * Not filing documents correctly: Failing to file tax documents correctly can lead to delays, penalties, and fines. * Not keeping documents long enough: Failing to keep tax documents for the required amount of time (typically 3-7 years) can lead to lost records and increased risk of audit.

📝 Note: It's essential to keep tax documents for the required amount of time to ensure compliance with tax laws and regulations.

Best Practices for Tax Paperwork Management

To ensure effective tax paperwork management, follow these best practices: * Stay up-to-date with tax laws and regulations: Stay informed about changes to tax laws and regulations to ensure compliance. * Use tax preparation software: Consider using tax preparation software, such as TurboTax or H&R Block, to help with tax preparation and submission. * Keep accurate records: Maintain accurate and complete records of income, expenses, and tax-related documents. * Seek professional help: If you’re unsure about any aspect of tax paperwork management, consider seeking help from a tax professional.

| Type of Tax Document | Retention Period |

|---|---|

| W-2 forms | 4 years |

| 1099 forms | 4 years |

| Business expense receipts | 3 years |

| Charitable donation receipts | 3 years |

| Medical expense receipts | 3 years |

In summary, saving tax paperwork requires a combination of organization, planning, and attention to detail. By following the 7 tips outlined in this article, you can reduce stress, increase efficiency, and improve accuracy when it comes to managing your tax paperwork. Remember to stay up-to-date with tax laws and regulations, use tax preparation software, and seek professional help when needed.

What is the best way to store tax documents?

+

The best way to store tax documents is to scan and store them electronically, using a cloud-based storage service such as Google Drive or Dropbox.

How long should I keep tax documents?

+

The retention period for tax documents varies, but it’s generally recommended to keep them for 3-7 years, depending on the type of document.

Can I use tax preparation software to help with tax paperwork management?

+

Yes, tax preparation software such as TurboTax or H&R Block can help with tax preparation and submission, and can also provide tools and resources for managing tax paperwork.