Paperwork

Keep Tax Backup Paperwork

Introduction to Tax Backup Paperwork

When it comes to managing your finances, keeping track of your tax backup paperwork is essential. Accurate and detailed records can help you navigate the complex world of taxation, ensuring you take advantage of all the deductions and credits you’re eligible for. In this blog post, we’ll explore the importance of maintaining thorough tax backup paperwork and provide guidance on how to do it effectively.

Why Keep Tax Backup Paperwork?

Keeping tax backup paperwork is crucial for several reasons:

- Audit Protection: In the event of an audit, having detailed records can help you prove your income, deductions, and credits, reducing the risk of penalties and fines.

- Maximizing Refunds: Accurate records can help you identify all the deductions and credits you’re eligible for, ensuring you receive the maximum refund possible.

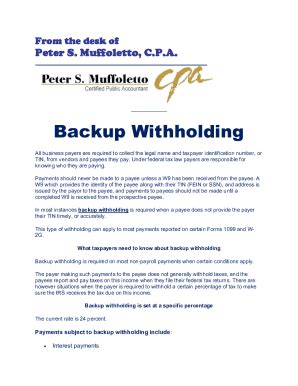

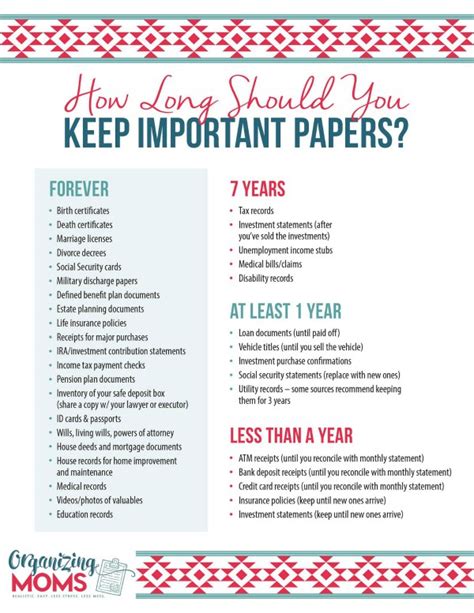

- Record-Keeping Compliance: The IRS requires taxpayers to maintain records for a certain period, typically three to seven years, depending on the type of tax return and the specific circumstances.

What to Keep

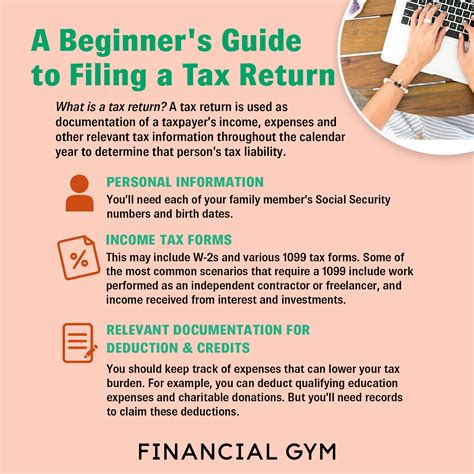

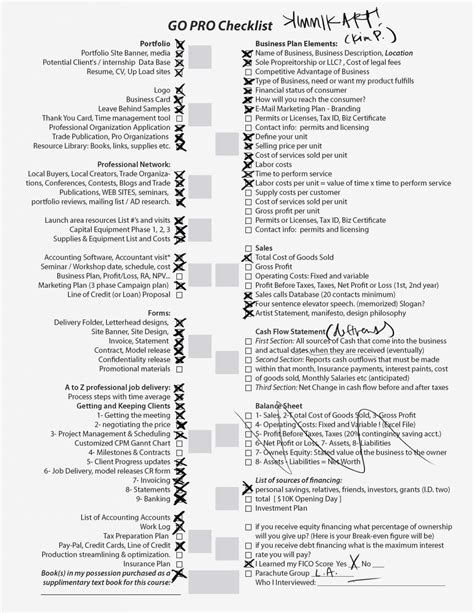

So, what type of tax backup paperwork should you keep? Here are some essential documents to include:

- Income Statements: W-2 forms, 1099 forms, and other income statements from your employer, clients, or investments.

- Receipts and Invoices: Keep receipts and invoices for business expenses, charitable donations, and medical expenses, as these can be deductible.

- Bank and Investment Statements: Statements from your bank, investment accounts, and retirement accounts can help you track your income and expenses.

- Tax-Related Documents: Keep copies of your tax returns, including any amendments or extensions, as well as correspondence with the IRS.

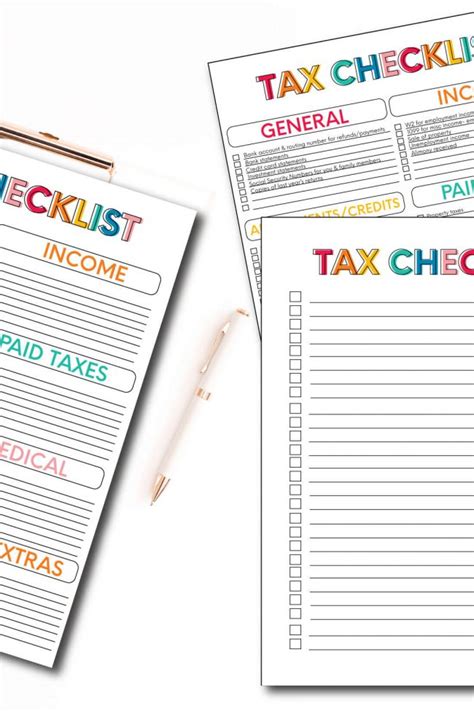

How to Organize Your Tax Backup Paperwork

Now that you know what to keep, let’s discuss how to organize your tax backup paperwork:

- Use a Filing System: Create a filing system, either physical or digital, to store your tax-related documents. Consider using folders or labels to categorize your documents.

- Scan and Digitize: Consider scanning and digitizing your documents to create a digital backup, which can be easily stored and accessed.

- Use a Secure Storage Service: If you’re concerned about the security of your digital documents, consider using a secure storage service, such as a cloud storage provider or a secure online vault.

Best Practices for Maintaining Tax Backup Paperwork

To ensure you’re maintaining accurate and detailed tax backup paperwork, follow these best practices:

- Review and Update Regularly: Regularly review your tax backup paperwork to ensure it’s accurate and up-to-date.

- Keep Records for the Right Amount of Time: Keep your tax backup paperwork for the recommended period, typically three to seven years, depending on the type of tax return and the specific circumstances.

- Seek Professional Help: If you’re unsure about what to keep or how to organize your tax backup paperwork, consider seeking the help of a tax professional or accountant.

📝 Note: It's essential to keep your tax backup paperwork organized and easily accessible, as this can help you quickly respond to any requests from the IRS or state tax authorities.

Common Mistakes to Avoid

When maintaining tax backup paperwork, there are several common mistakes to avoid:

- Not Keeping Accurate Records: Failing to keep accurate and detailed records can lead to errors and omissions on your tax return, which can result in penalties and fines.

- Not Keeping Records for the Right Amount of Time: Failing to keep your tax backup paperwork for the recommended period can make it difficult to respond to audits or requests from the IRS.

- Not Seeking Professional Help: Failing to seek professional help when needed can lead to errors and omissions on your tax return, which can result in penalties and fines.

Conclusion

In conclusion, keeping tax backup paperwork is essential for ensuring you’re taking advantage of all the deductions and credits you’re eligible for, while also protecting yourself in the event of an audit. By following the guidance outlined in this blog post, you can maintain accurate and detailed records, ensuring you’re well-prepared for tax season.

What type of tax backup paperwork should I keep?

+

You should keep income statements, receipts and invoices, bank and investment statements, and tax-related documents, such as your tax returns and correspondence with the IRS.

How long should I keep my tax backup paperwork?

+

The recommended period for keeping tax backup paperwork is typically three to seven years, depending on the type of tax return and the specific circumstances.

What are the consequences of not keeping accurate tax backup paperwork?

+

Failing to keep accurate and detailed tax backup paperwork can lead to errors and omissions on your tax return, which can result in penalties and fines. It can also make it difficult to respond to audits or requests from the IRS.