5 Tips Cobra Paperwork

Understanding Cobra Paperwork: A Comprehensive Guide

When it comes to dealing with COBRA (Consolidated Omnibus Budget Reconciliation Act) paperwork, it’s essential to have a clear understanding of the process and the requirements involved. COBRA is a federal law that allows certain former employees, retirees, spouses, and dependent children to temporarily continue their health coverage at group rates. In this article, we’ll delve into the world of COBRA paperwork, providing you with 5 tips to navigate the process with ease.

Tip 1: Familiarize Yourself with COBRA Eligibility

To begin with, it’s crucial to understand who is eligible for COBRA coverage. This typically includes employees who have lost their job, retirees, spouses, and dependent children who were covered under the group health plan. Key events that may trigger COBRA eligibility include: * Voluntary or involuntary termination of employment * Reduction in work hours * Death of the covered employee * Divorce or legal separation * Dependent children losing their dependent status

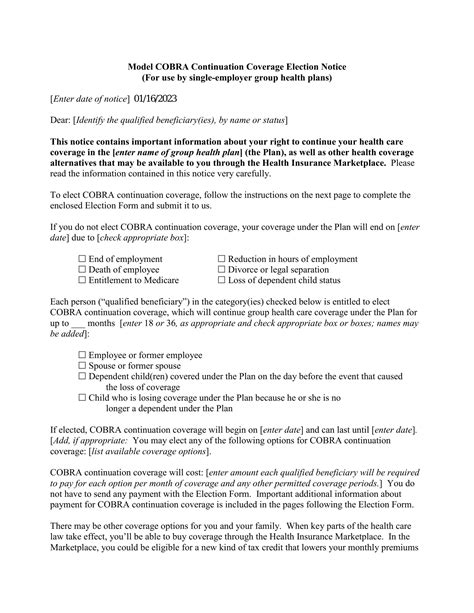

Tip 2: Understanding the COBRA Notice Requirements

The COBRA notice is a critical component of the COBRA paperwork process. The employer or plan administrator must provide a COBRA election notice to the qualified beneficiary within a specified timeframe, usually 44 days after the qualifying event. This notice must include essential information, such as: * A description of the COBRA coverage available * The cost of the coverage * The duration of the coverage * Instructions for electing COBRA coverage

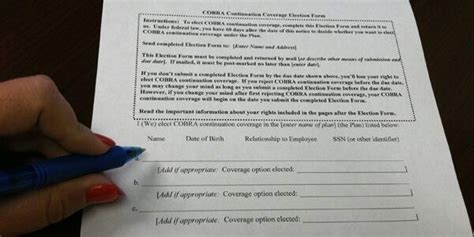

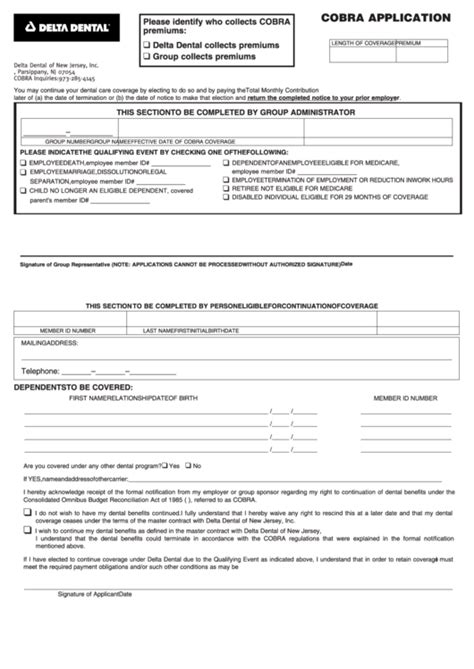

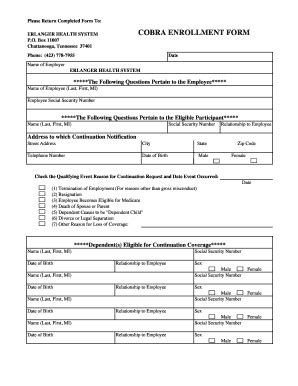

Tip 3: Completing the COBRA Election Form

Once the qualified beneficiary receives the COBRA election notice, they must complete and return the COBRA election form within 60 days. This form typically requires the following information: * The name and address of the qualified beneficiary * The type of coverage being elected (e.g., single, family) * The payment method for the COBRA premiums * Any other relevant information required by the plan administrator

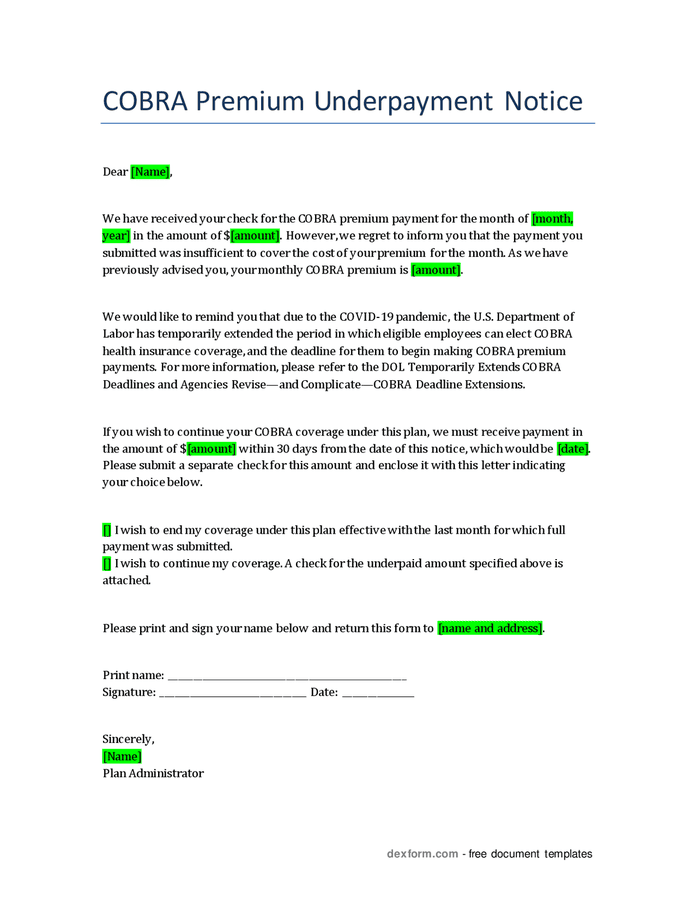

Tip 4: Managing COBRA Premium Payments

COBRA premium payments can be a significant burden for qualified beneficiaries. It’s essential to understand the payment requirements, including: * The amount of the premium payment * The due date for the payment * The consequences of late or missed payments * The options for payment, such as online payments or check payments

Tip 5: Maintaining COBRA Coverage

After electing COBRA coverage, it’s crucial to maintain the coverage by: * Making timely premium payments * Notifying the plan administrator of any changes in address or dependents * Understanding the duration of the COBRA coverage, which typically ranges from 18 to 36 months * Exploring alternative coverage options, such as individual health plans or Medicare, before the COBRA coverage expires

| COBRA Event | Notice Requirement | Election Period |

|---|---|---|

| Termination of employment | 44 days | 60 days |

| Reduction in work hours | 44 days | 60 days |

| Death of the covered employee | 44 days | 60 days |

💡 Note: It's essential to review and understand the specific COBRA requirements and regulations, as they may vary depending on the employer, plan administrator, or state laws.

In summary, navigating COBRA paperwork requires a thorough understanding of the eligibility requirements, notice obligations, election process, premium payments, and maintenance of coverage. By following these 5 tips, you’ll be better equipped to manage the COBRA paperwork process and ensure a smooth transition for qualified beneficiaries.

What is COBRA coverage, and how does it work?

+

COBRA coverage is a federal law that allows certain former employees, retirees, spouses, and dependent children to temporarily continue their health coverage at group rates. It works by providing a temporary extension of the group health plan coverage, usually for 18 to 36 months, after a qualifying event.

Who is eligible for COBRA coverage?

+

COBRA eligibility typically includes employees who have lost their job, retirees, spouses, and dependent children who were covered under the group health plan. Key events that may trigger COBRA eligibility include voluntary or involuntary termination of employment, reduction in work hours, death of the covered employee, divorce or legal separation, and dependent children losing their dependent status.

How long do I have to elect COBRA coverage?

+

Qualified beneficiaries have 60 days to elect COBRA coverage after receiving the COBRA election notice. It’s essential to complete and return the COBRA election form within this timeframe to ensure continuation of the group health plan coverage.