Keep IRS Paperwork

Understanding the Importance of Keeping IRS Paperwork

Keeping track of IRS paperwork is a crucial aspect of managing your finances, whether you are an individual or a business owner. The Internal Revenue Service (IRS) requires you to maintain accurate and detailed records of your income, expenses, and tax-related documents. These records are essential for filing your tax returns, audits, and other tax-related purposes. In this article, we will discuss the importance of keeping IRS paperwork, the types of documents you need to keep, and how to organize them effectively.

Why Keep IRS Paperwork?

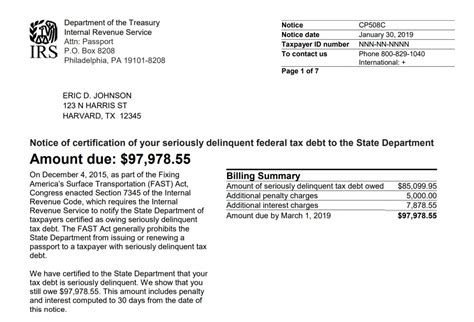

Keeping IRS paperwork is important for several reasons. Firstly, it helps you to accurately file your tax returns. When you have all the necessary documents, you can ensure that you are reporting your income and expenses correctly, which reduces the risk of errors and audits. Secondly, it helps you to support your tax deductions and credits. If you are claiming deductions or credits, you need to have documentation to support your claims. This can include receipts, invoices, and bank statements. Finally, it helps you to respond to audits and notices. If the IRS selects your return for audit or sends you a notice, you will need to provide documentation to support your tax return.

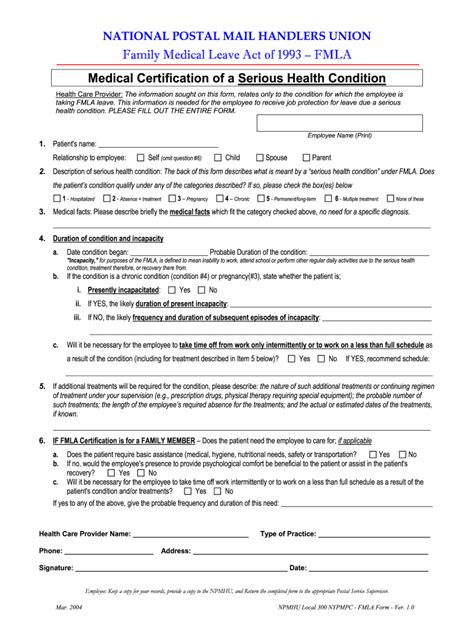

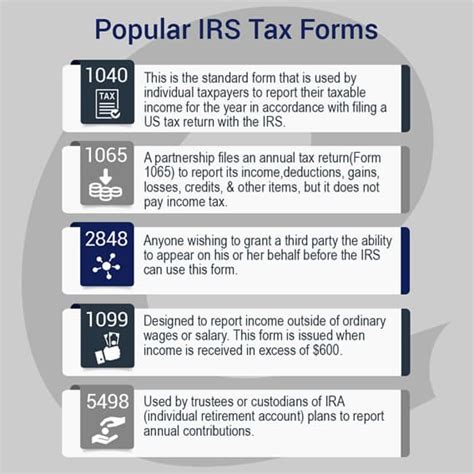

Types of IRS Paperwork to Keep

There are several types of IRS paperwork that you need to keep, including: * W-2 forms: These forms show your income and taxes withheld from your employer. * 1099 forms: These forms show your income from freelance work, investments, and other sources. * Receipts and invoices: These documents support your business expenses and deductions. * Bank statements: These documents show your income and expenses, and can be used to support your tax deductions. * Tax returns: You should keep a copy of your tax return, including all supporting documentation.

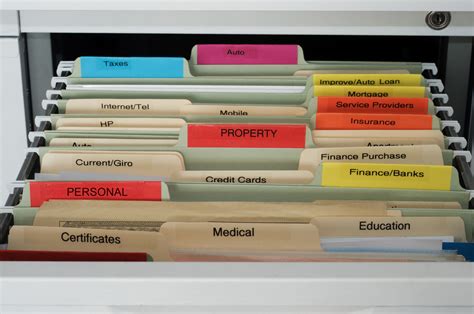

How to Organize Your IRS Paperwork

Organizing your IRS paperwork is crucial to ensuring that you can find the documents you need when you need them. Here are some tips for organizing your IRS paperwork: * Use a filing system: Create a filing system that works for you, such as a file cabinet or digital storage system. * Label your files: Label your files clearly, so you can easily find the documents you need. * Keep your files up to date: Make sure your files are up to date, and that you are keeping all the necessary documents. * Consider digital storage: Consider storing your IRS paperwork digitally, using a secure cloud storage system.

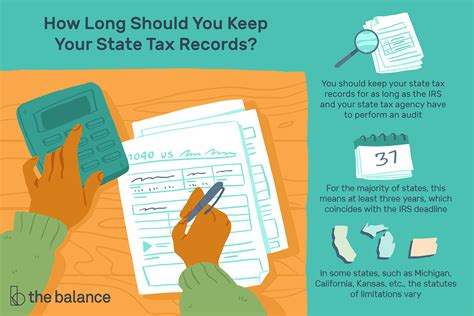

| Document | Retention Period |

|---|---|

| W-2 forms | At least 3 years |

| 1099 forms | At least 3 years |

| Receipts and invoices | At least 3 years |

| Bank statements | At least 3 years |

| Tax returns | At least 3 years |

📝 Note: The retention period for IRS paperwork can vary depending on the type of document and the circumstances. It's always best to consult with a tax professional to determine the specific retention period for your documents.

In summary, keeping IRS paperwork is crucial for managing your finances and ensuring that you are in compliance with tax laws. By understanding the importance of keeping IRS paperwork, the types of documents you need to keep, and how to organize them effectively, you can reduce the risk of errors and audits, and ensure that you are taking advantage of all the tax deductions and credits you are eligible for. As you move forward, remember to stay organized, keep your files up to date, and consult with a tax professional if you have any questions or concerns.

What types of IRS paperwork do I need to keep?

+

You should keep all IRS paperwork related to your income, expenses, and tax returns, including W-2 forms, 1099 forms, receipts, invoices, bank statements, and tax returns.

How long do I need to keep my IRS paperwork?

+

The retention period for IRS paperwork can vary depending on the type of document and the circumstances. Generally, you should keep your IRS paperwork for at least 3 years.

Can I store my IRS paperwork digitally?

+

Yes, you can store your IRS paperwork digitally, using a secure cloud storage system. However, make sure you have a backup of your files and that they are easily accessible.