Tax Return Processing Time After Sending

Introduction to Tax Return Processing Time

When it comes to filing tax returns, one of the most common concerns for individuals and businesses alike is the time it takes for the tax authorities to process the return. The tax return processing time can vary depending on several factors, including the method of filing, the complexity of the return, and the workload of the tax authority. In this article, we will delve into the details of tax return processing time, exploring the factors that influence it and providing guidance on what to expect after sending in your tax return.

Factors Influencing Tax Return Processing Time

Several factors can impact the time it takes for the tax authority to process a tax return. These include: * Method of Filing: Tax returns that are filed electronically are generally processed faster than those filed by mail. Electronic filing allows for automated processing, reducing the time it takes for the tax authority to review and process the return. * Complexity of the Return: Tax returns with complex income structures, such as those involving multiple sources of income, investments, or self-employment income, may take longer to process. This is because these returns require more detailed review and verification. * Workload of the Tax Authority: The workload of the tax authority can significantly impact processing times. During peak tax season, the tax authority may receive a high volume of returns, leading to longer processing times. * Accuracy and Completeness of the Return: Returns that are incomplete or contain errors may be delayed, as the tax authority will need to request additional information or corrections.

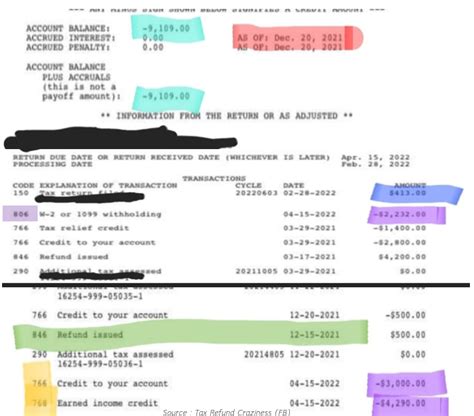

What to Expect After Sending in Your Tax Return

After sending in your tax return, you can expect the following steps to occur: * Receipt of Return: The tax authority will acknowledge receipt of your return, either through an electronic confirmation or a mailed acknowledgement. * Review and Verification: The tax authority will review your return to ensure it is complete and accurate. This may involve verifying income, deductions, and credits. * Processing and Refund Issuance: Once your return is verified, the tax authority will process it and issue any refund due to you. * Notification of Outcome: You will be notified of the outcome of your return, either through mail or electronic notification.

Estimated Tax Return Processing Times

The estimated tax return processing time can vary depending on the factors mentioned earlier. However, here are some general guidelines: * E-Filed Returns: 1-3 weeks * Paper-Filed Returns: 6-8 weeks * Complex Returns: 2-6 months

📝 Note: These are general estimates, and actual processing times may vary depending on the specific circumstances of your return.

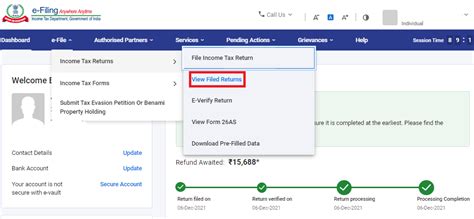

Tracking the Status of Your Tax Return

To track the status of your tax return, you can: * Check the Tax Authority’s Website: Most tax authorities provide online tools to track the status of your return. * Call the Tax Authority: You can contact the tax authority directly to inquire about the status of your return. * Use a Tax Professional: If you used a tax professional to prepare your return, they may be able to provide you with updates on the status of your return.

Common Issues That May Delay Tax Return Processing

Some common issues that may delay tax return processing include: * Incomplete or Inaccurate Information: Failing to provide complete or accurate information can delay processing. * Missing Documentation: Failing to provide required documentation, such as W-2s or 1099s, can delay processing. * Math Errors: Math errors or discrepancies can delay processing.

| Issue | Description | Resolution |

|---|---|---|

| Incomplete or Inaccurate Information | Failing to provide complete or accurate information | Provide complete and accurate information |

| Missing Documentation | Failing to provide required documentation | Provide required documentation |

| Math Errors | Math errors or discrepancies | Correct math errors or discrepancies |

As the tax return processing time can vary, it’s essential to stay informed and patient. By understanding the factors that influence processing time and tracking the status of your return, you can better manage your expectations and ensure a smooth tax filing experience.

In the end, the key to a successful tax filing experience is to be prepared, accurate, and patient. By following the guidelines outlined in this article, you can ensure that your tax return is processed efficiently and effectively, minimizing delays and potential issues. The tax return processing time may seem like a daunting aspect of tax filing, but with the right knowledge and approach, you can navigate it with ease and confidence.