7 Years Paperwork

Introduction to 7 Years Paperwork

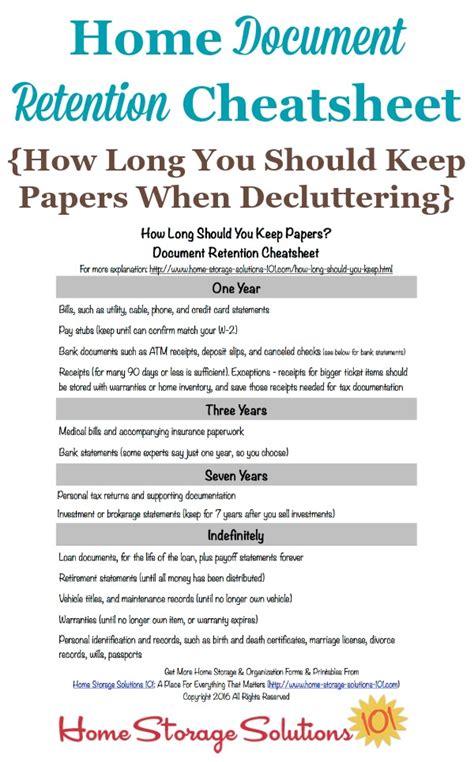

The concept of maintaining 7 years of paperwork is a crucial aspect of financial and legal management for individuals and businesses alike. This practice involves keeping detailed records of all financial transactions, contracts, and other significant documents for a period of seven years. The primary reason behind this duration is to ensure compliance with tax laws and regulations, as well as to provide a safeguard against potential audits or legal disputes.

Why Keep 7 Years of Paperwork?

There are several reasons why maintaining 7 years of paperwork is essential:

- Tax Audit Protection: In the event of a tax audit, having detailed records can help individuals and businesses prove their income and expenses, reducing the risk of penalties and fines.

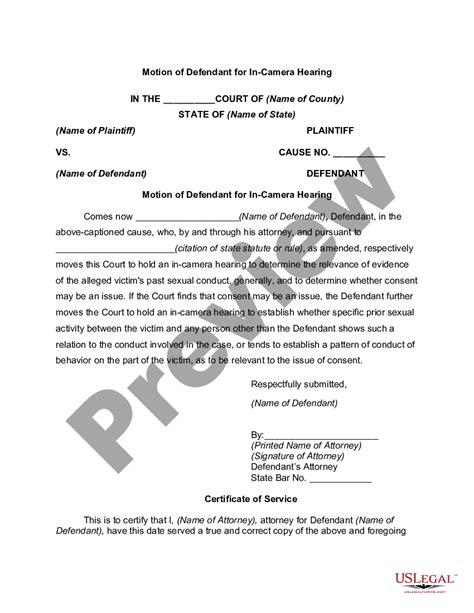

- Legal Dispute Resolution: Accurate and comprehensive paperwork can serve as valuable evidence in legal disputes, helping to resolve issues efficiently and effectively.

- Financial Planning and Analysis: Maintaining detailed financial records enables individuals and businesses to track their financial progress, identify areas for improvement, and make informed decisions about future investments and expenditures.

Types of Documents to Keep

It is essential to keep a wide range of documents for 7 years, including:

- Financial Statements: Balance sheets, income statements, and cash flow statements provide a comprehensive overview of an individual’s or business’s financial situation.

- Tax Returns: Keeping copies of tax returns, including supporting documentation such as W-2s and 1099s, can help in the event of an audit.

- Contracts and Agreements: Maintaining records of contracts, leases, and other agreements can help resolve disputes and ensure compliance with terms and conditions.

- Receipts and Invoices: Keeping detailed records of receipts and invoices can help track expenses and provide evidence of business-related expenditures.

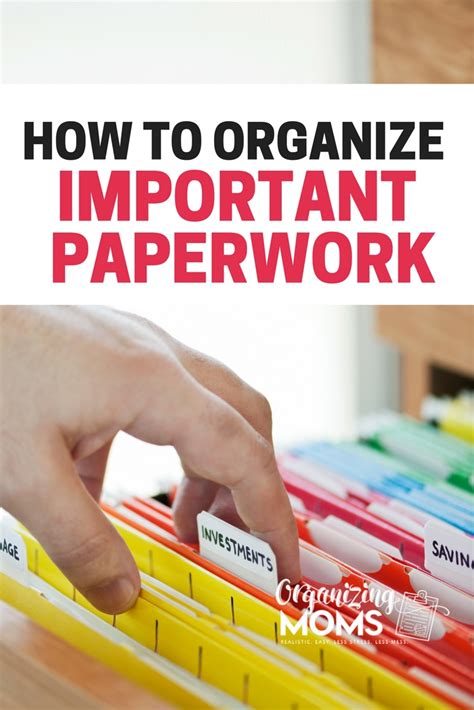

Best Practices for Maintaining 7 Years of Paperwork

To ensure that 7 years of paperwork is maintained efficiently and effectively, consider the following best practices:

- Implement a Filing System: Develop a comprehensive filing system, both physical and digital, to store and organize documents.

- Use Cloud Storage: Utilize cloud storage services to store electronic copies of documents, ensuring accessibility and security.

- Set Reminders: Establish reminders to review and update documents regularly, ensuring that all records are accurate and up-to-date.

- Train Employees: Educate employees on the importance of maintaining accurate records and provide training on document management and retention policies.

Tools and Resources for Managing 7 Years of Paperwork

Several tools and resources can help individuals and businesses manage their 7 years of paperwork, including:

| Tool/Resource | Description |

|---|---|

| Cloud Storage Services | Google Drive, Dropbox, and Microsoft OneDrive provide secure and accessible storage for electronic documents. |

| Document Management Software | Programs like Evernote and Shoeboxed help organize and categorize documents, making it easier to locate specific records. |

| Scanning and Digitization Services | Companies like ScanMyPhotos and DigMyPics offer scanning and digitization services for physical documents, making it easier to store and manage electronic records. |

💡 Note: It is essential to research and evaluates the security and reliability of any tool or resource before using it to manage sensitive documents.

Challenges and Solutions

Maintaining 7 years of paperwork can be challenging, especially for small businesses or individuals with limited resources. Some common challenges include:

- Space and Storage: Physical documents can take up significant space, making it difficult to store and manage records.

- Security and Confidentiality: Ensuring the security and confidentiality of sensitive documents can be a concern, especially when storing electronic records.

- Compliance and Regulations: Staying up-to-date with changing regulations and compliance requirements can be overwhelming, especially for small businesses or individuals without extensive knowledge of tax laws and financial regulations.

- Outsourcing Document Management: Hiring a professional document management service can help alleviate storage and security concerns.

- Investing in Document Management Software: Utilizing document management software can help streamline record-keeping and ensure compliance with regulations.

- Seeking Professional Advice: Consulting with a tax professional or financial advisor can help individuals and businesses navigate complex regulations and ensure compliance.

In the end, maintaining 7 years of paperwork is a critical aspect of financial and legal management. By understanding the importance of keeping detailed records, implementing effective document management systems, and utilizing tools and resources, individuals and businesses can ensure compliance with regulations, reduce the risk of audits and legal disputes, and make informed financial decisions. By following best practices and staying organized, anyone can effectively manage their paperwork and achieve long-term financial stability.

What types of documents should I keep for 7 years?

+

You should keep financial statements, tax returns, contracts, receipts, and invoices for 7 years. These documents provide a comprehensive overview of your financial situation and can help in the event of an audit or legal dispute.

How can I ensure the security and confidentiality of my documents?

+

To ensure the security and confidentiality of your documents, consider using cloud storage services, document management software, and outsourcing document management to a professional service. Additionally, make sure to implement robust password protection and access controls.

What are the consequences of not maintaining 7 years of paperwork?

+

Failing to maintain 7 years of paperwork can result in penalties, fines, and legal disputes. In the event of an audit, you may be unable to provide supporting documentation, leading to additional taxes, interest, and penalties. Furthermore, lack of documentation can make it difficult to resolve legal disputes, potentially leading to financial losses.