7 Years Business Paperwork

Introduction to Business Paperwork

Starting and running a business can be a daunting task, especially when it comes to handling the paperwork. Over the course of 7 years, a business will accumulate a significant amount of paperwork, from initial registration documents to ongoing compliance and tax filings. In this article, we will explore the various types of paperwork that a business may encounter over a 7-year period, and provide tips on how to manage and organize these documents.

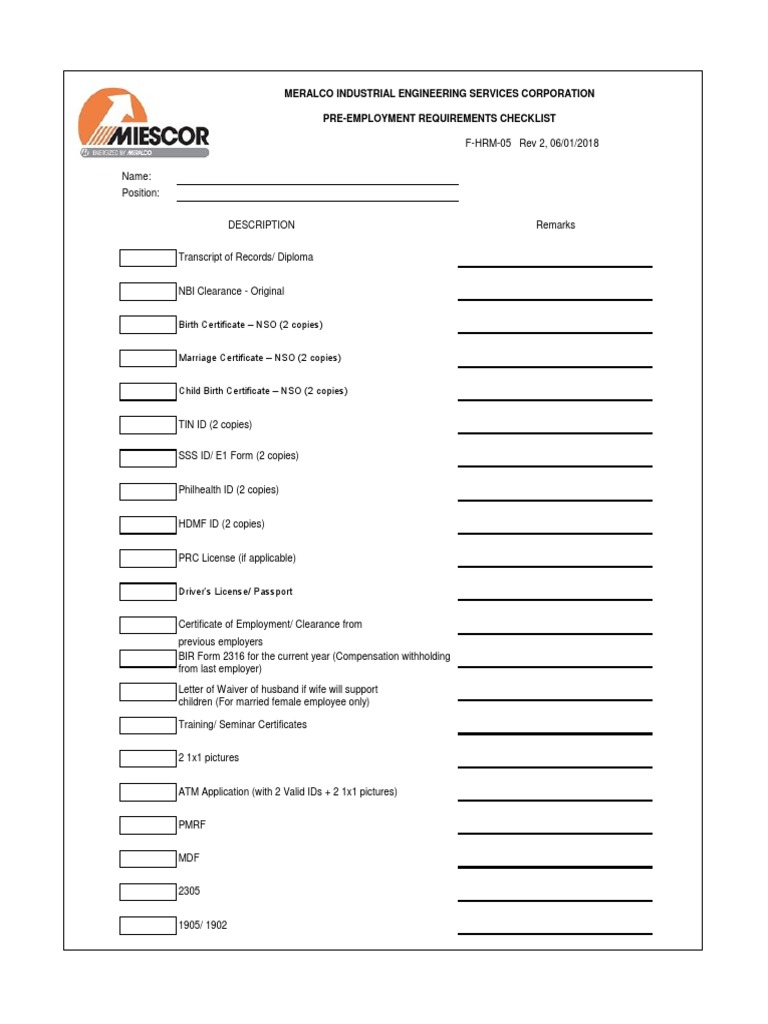

Initial Registration Documents

When a business is first established, there are several initial registration documents that must be filed. These may include: * Articles of Incorporation or Articles of Organization, which outline the basic structure and purpose of the business * Business License, which grants the business permission to operate in a particular jurisdiction * Employer Identification Number (EIN), which is used to identify the business for tax purposes * Registering for State and Local Taxes, which may include sales tax, income tax, and other local taxes

📝 Note: It is essential to keep accurate and detailed records of all initial registration documents, as they will be required for future filings and compliance.

Ongoing Compliance Filings

In addition to initial registration documents, businesses must also file ongoing compliance documents on a regular basis. These may include: * Annual Reports, which provide an update on the business’s activities and financial condition * Quarterly Tax Filings, which report on the business’s tax liability and payments * Employment Tax Filings, which report on the business’s employment tax obligations and payments * Compliance Filings with State and Local Governments, which may include reports on business activities, taxes, and other compliance matters

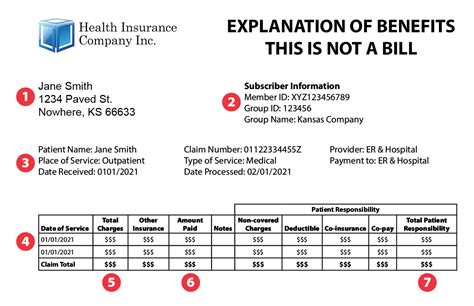

Tax Filings

Tax filings are a critical component of business paperwork, and must be filed accurately and on time to avoid penalties and fines. These may include: * Income Tax Returns, which report on the business’s income and tax liability * Employment Tax Returns, which report on the business’s employment tax obligations and payments * Sales Tax Returns, which report on the business’s sales tax liability and payments * Other Tax Filings, which may include reports on business use of home, travel expenses, and other tax-related matters

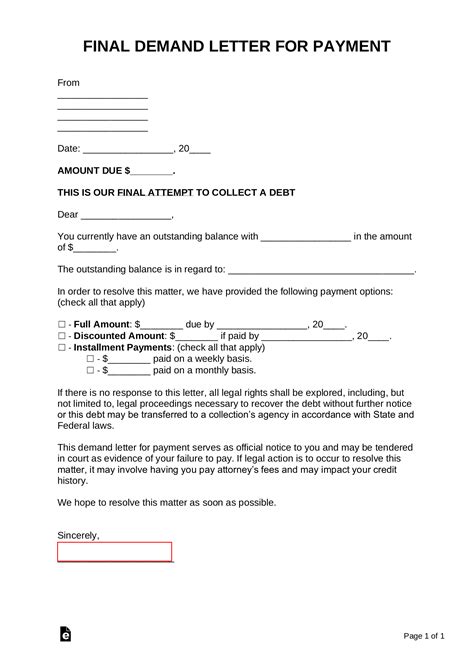

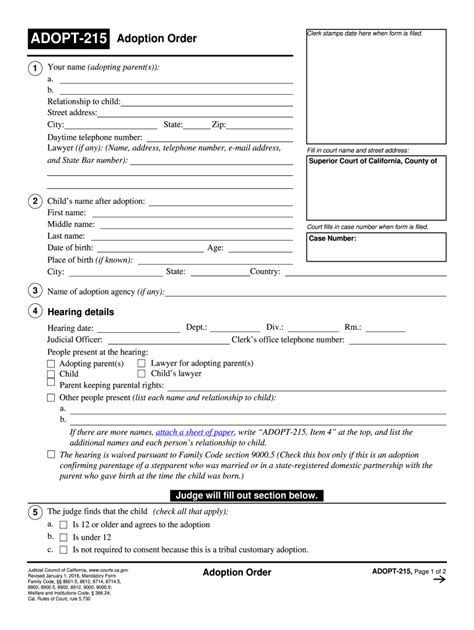

Other Business Paperwork

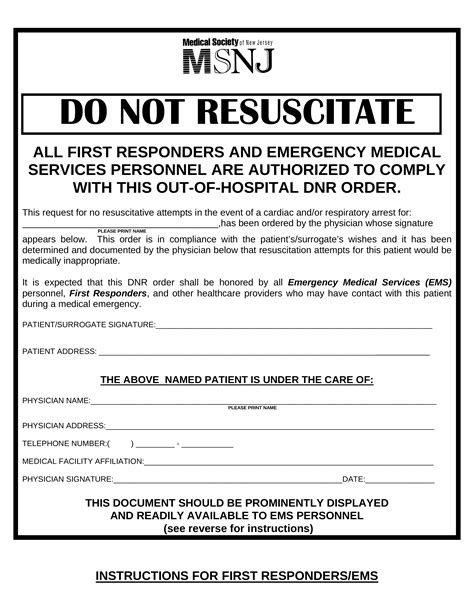

In addition to registration documents, compliance filings, and tax filings, businesses may also need to maintain other types of paperwork, such as: * Contract Agreements, which outline the terms and conditions of business relationships * Lease Agreements, which outline the terms and conditions of business leases * Insurance Policies, which provide protection against business risks and liabilities * Employee Records, which document employee information, benefits, and performance

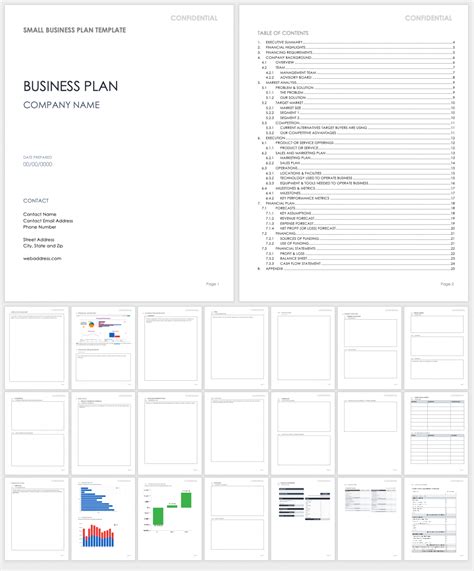

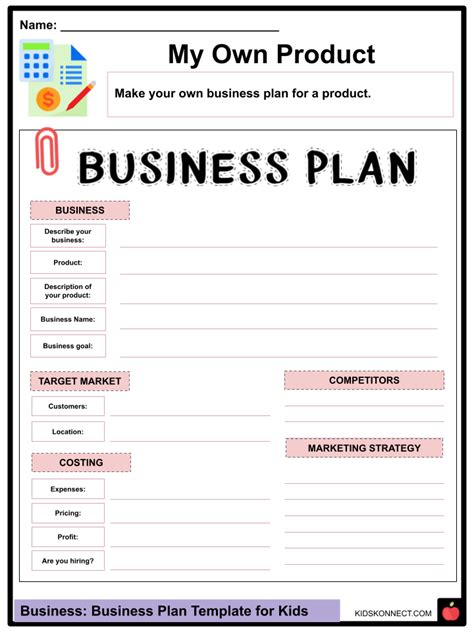

Managing and Organizing Business Paperwork

With so many different types of paperwork to manage, it can be challenging for businesses to keep everything organized and up-to-date. Here are some tips for managing and organizing business paperwork: * Use a Filing System, which can help to keep paperwork organized and easy to find * Designate a Paperwork Manager, who can be responsible for ensuring that all paperwork is completed and filed on time * Use Technology, such as digital filing systems and online tax preparation software, to streamline paperwork and reduce errors * Review and Update Paperwork Regularly, to ensure that all information is accurate and up-to-date

| Type of Paperwork | Frequency of Filing | Deadline for Filing |

|---|---|---|

| Annual Reports | Annually | January 31st |

| Quarterly Tax Filings | Quarterly | April 15th, July 15th, October 15th, January 15th |

| Employment Tax Filings | Quarterly | April 15th, July 15th, October 15th, January 15th |

Conclusion and Final Thoughts

In conclusion, managing business paperwork is an essential task that requires attention to detail, organization, and timely filing. By understanding the different types of paperwork that a business may encounter over a 7-year period, and by implementing strategies for managing and organizing this paperwork, businesses can reduce errors, avoid penalties, and ensure compliance with all relevant laws and regulations. By following these tips and best practices, businesses can streamline their paperwork processes and focus on what matters most - growing and succeeding in their industry.

What is the purpose of business paperwork?

+

The purpose of business paperwork is to provide a record of a business’s activities, financial condition, and compliance with laws and regulations. It helps to establish the business’s identity, provides a framework for decision-making, and ensures accountability.

What are the consequences of not filing business paperwork on time?

+

The consequences of not filing business paperwork on time can include penalties, fines, and even loss of business license. It can also lead to delays in receiving tax refunds, and can impact the business’s credit score and reputation.

How can businesses ensure that their paperwork is accurate and up-to-date?

+

Businesses can ensure that their paperwork is accurate and up-to-date by implementing a filing system, designating a paperwork manager, using technology, and reviewing and updating paperwork regularly. It is also essential to seek professional advice from accountants, lawyers, and other experts to ensure compliance with all relevant laws and regulations.