Paperwork

Keep Paperwork for Audit Purposes Years

Understanding the Importance of Record Keeping

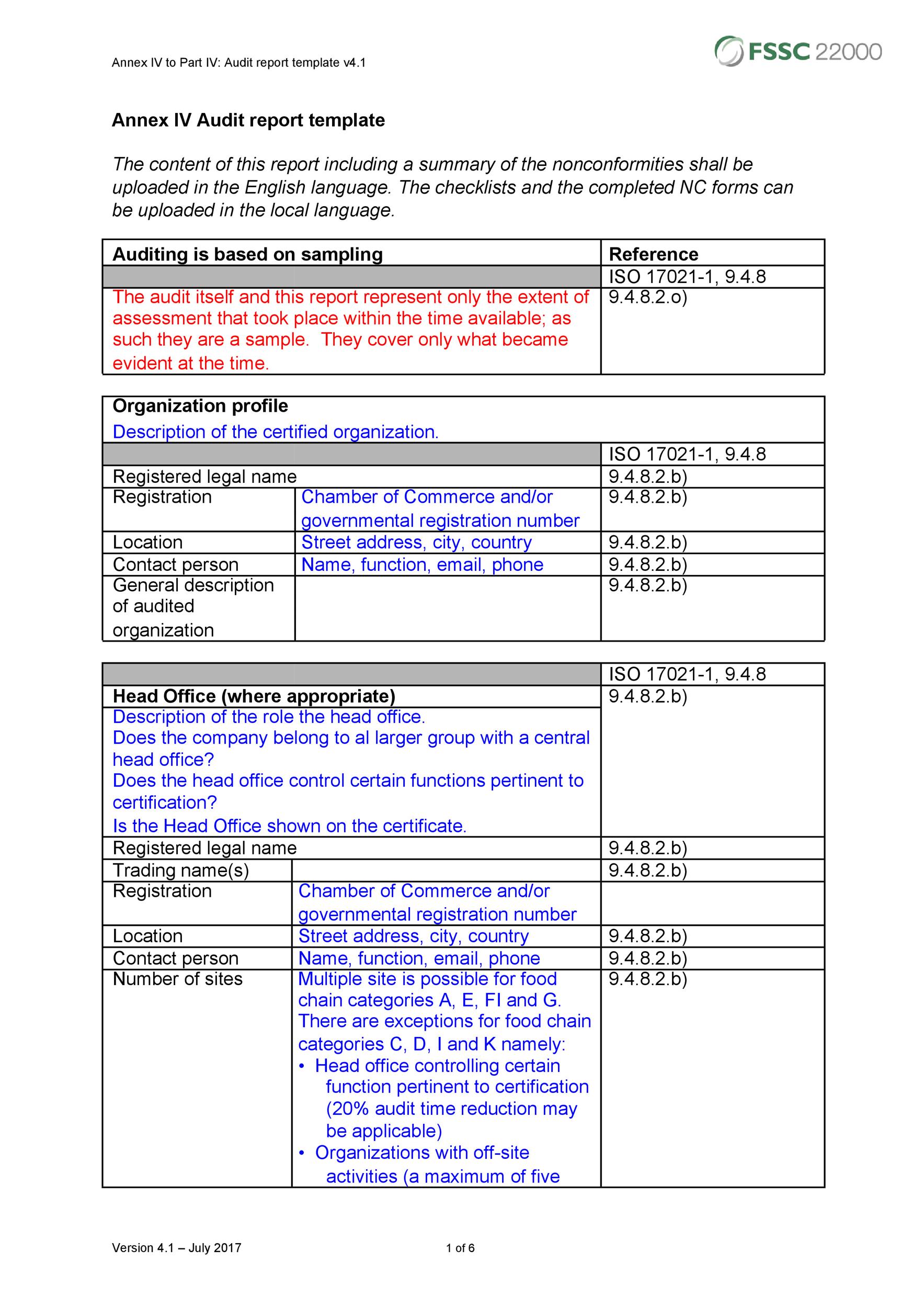

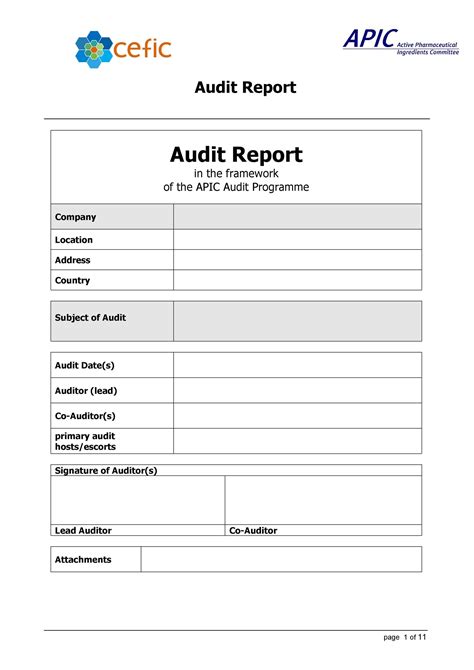

When it comes to managing a business or personal finances, keeping accurate and detailed records is crucial for several reasons. One of the primary purposes of maintaining thorough paperwork is for audit purposes. Audits can be conducted by government agencies, internal auditors, or external accounting firms to ensure compliance with laws and regulations, as well as to verify the accuracy of financial statements. In this context, having well-organized paperwork can significantly facilitate the audit process and help avoid potential penalties or legal issues.

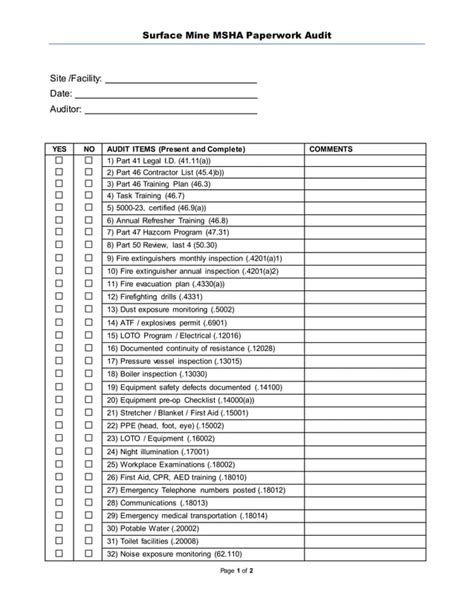

Types of Records to Keep

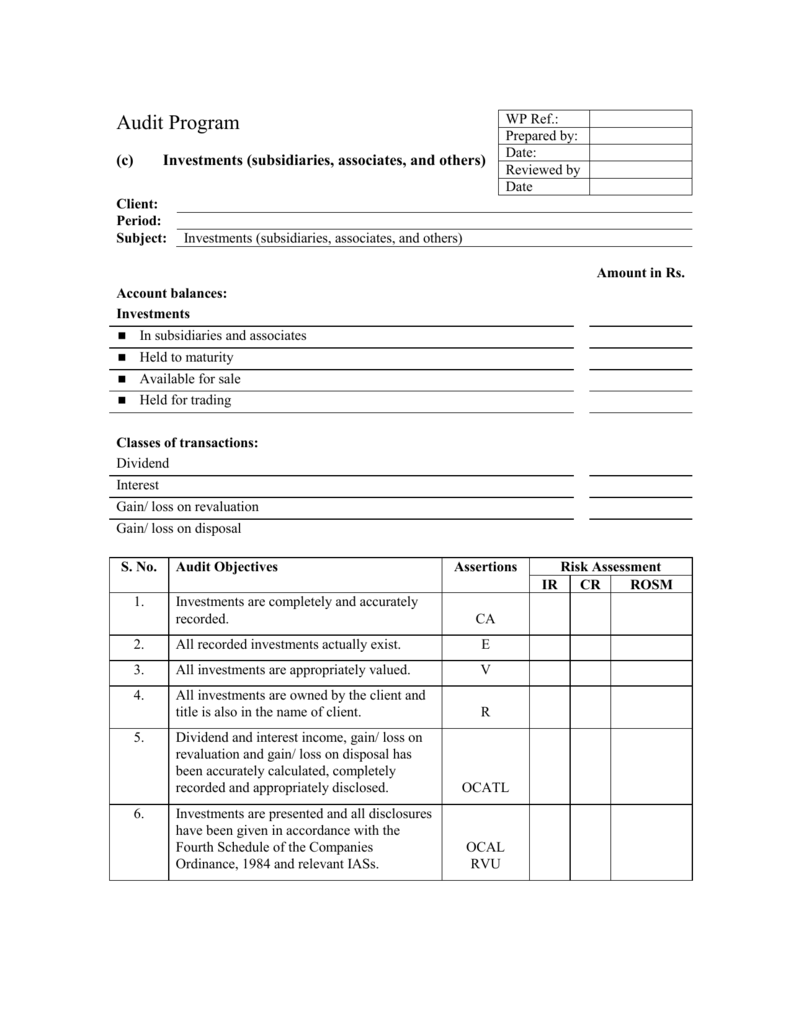

There are various types of records that individuals and businesses should keep for audit purposes. These include:

- Financial Statements: Balance sheets, income statements, and cash flow statements provide a comprehensive overview of an entity’s financial position and performance.

- Tax Returns: Copies of tax returns, including supporting documentation such as W-2s, 1099s, and receipts for deductions, are essential for verifying tax compliance.

- Bank Statements: Detailed bank statements can help track financial transactions, including income, expenses, and transfers.

- Inventory Records: For businesses, maintaining accurate inventory records is vital for accounting and tax purposes, as well as for managing stock levels and supply chains.

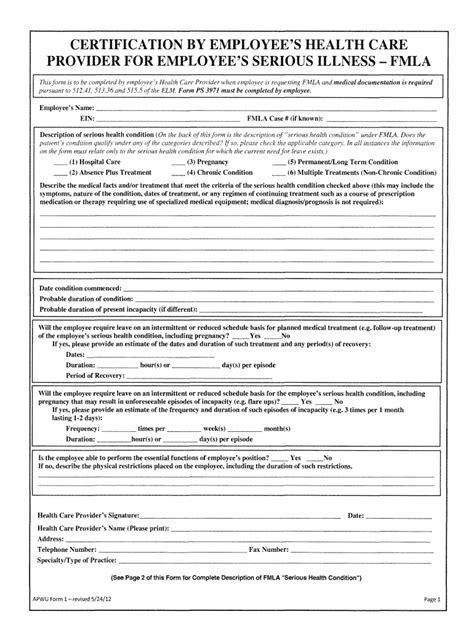

- Employee Records: Employment contracts, payroll records, and benefits information are crucial for human resource management and compliance with labor laws.

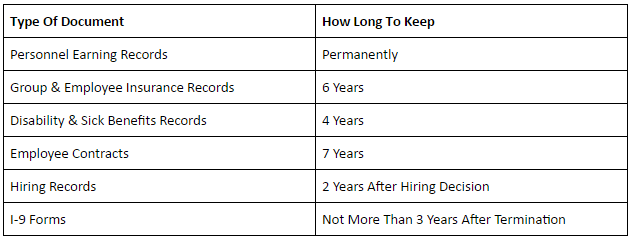

How Long to Keep Records

The length of time to keep records varies depending on the type of document and the purpose it serves. Generally, it’s recommended to keep:

- Financial Records: 3 to 7 years, depending on the jurisdiction and the specific financial regulations applicable.

- Tax Records: At least 3 years from the date the tax return was filed, but it’s often advised to keep them for 7 years in case of audits or if filing a claim for a refund.

- Employment Records: 4 to 7 years, considering various labor laws and regulations that may require longer retention periods for certain documents.

- Business Records: The lifespan of a business plus 7 years, especially for documents related to the formation, operation, and dissolution of the business.

📝 Note: The specific retention period can vary significantly based on local laws, industry regulations, and the nature of the business or individual's financial activities. It's essential to consult with a legal or financial advisor to determine the appropriate record-keeping period.

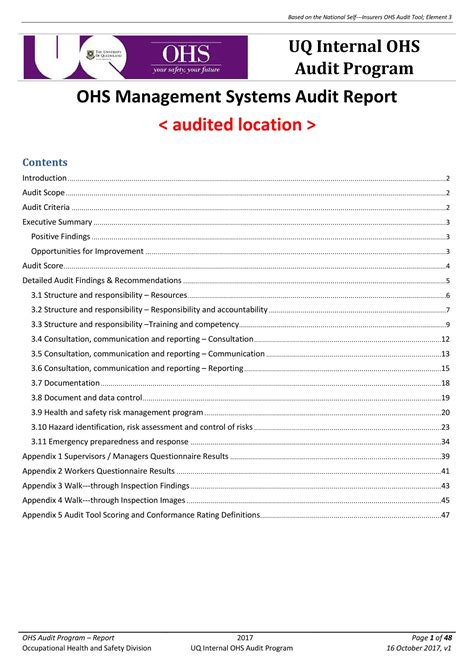

Best Practices for Record Keeping

Maintaining organized and accessible records is key to efficient audit preparation and compliance. Some best practices include:

- Digital Storage: Consider scanning paper documents and storing them digitally in a secure, cloud-based storage system. This approach can help reduce physical storage needs and improve accessibility.

- Regular Backups: Ensure that digital records are backed up regularly to prevent data loss in case of technical failures or cyberattacks.

- Secure Access: Implement strong access controls, including encryption and secure login credentials, to protect sensitive information from unauthorized access.

- Standardized Filing System: Develop a consistent and logical filing system that makes it easy to locate specific documents when needed.

| Type of Record | Retention Period | Purpose |

|---|---|---|

| Financial Statements | 7 years | Audit and financial analysis |

| Tax Returns | 7 years | Tax compliance and potential audits |

| Employee Records | 4 to 7 years | Compliance with labor laws and regulations |

Conclusion and Future Directions

In summary, keeping thorough and well-organized records is essential for both personal and business financial management, particularly for audit purposes. Understanding what types of records to keep, how long to retain them, and implementing best practices for record keeping can significantly reduce the complexity and stress associated with audits. As technology continues to evolve, adopting digital solutions for record keeping can enhance security, accessibility, and efficiency. Ultimately, a well-managed record-keeping system is a critical component of responsible financial stewardship and compliance with regulatory requirements.

What is the primary purpose of keeping records for audit purposes?

+

The primary purpose is to ensure compliance with laws and regulations, and to verify the accuracy of financial statements.

How long should financial records be kept?

+

Generally, financial records should be kept for 3 to 7 years, depending on the jurisdiction and specific financial regulations.

What are some best practices for digital record keeping?

+

Best practices include using secure, cloud-based storage, implementing strong access controls, and backing up data regularly.