Keep Essential Paperwork Years

Introduction to Document Retention

When it comes to managing paperwork, one of the most critical aspects is determining how long to keep essential documents. With the increasing shift towards digital documentation, it’s easy to overlook the importance of retaining physical copies of crucial papers. However, maintaining a well-organized system for storing and preserving vital documents is essential for both personal and professional purposes. In this article, we will delve into the world of document retention, exploring the types of documents that require long-term storage, the benefits of maintaining a robust documentation system, and providing guidance on how to create an effective document management plan.

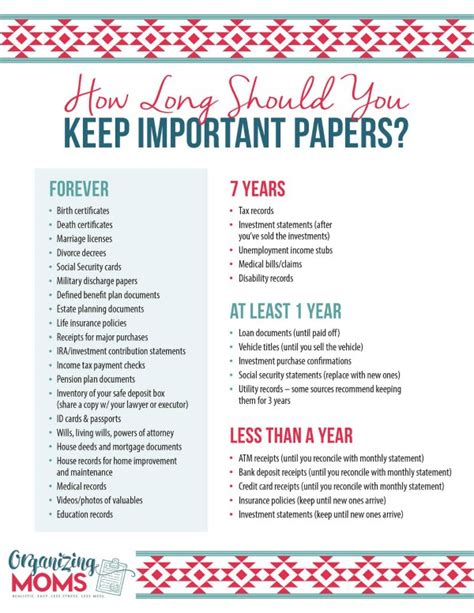

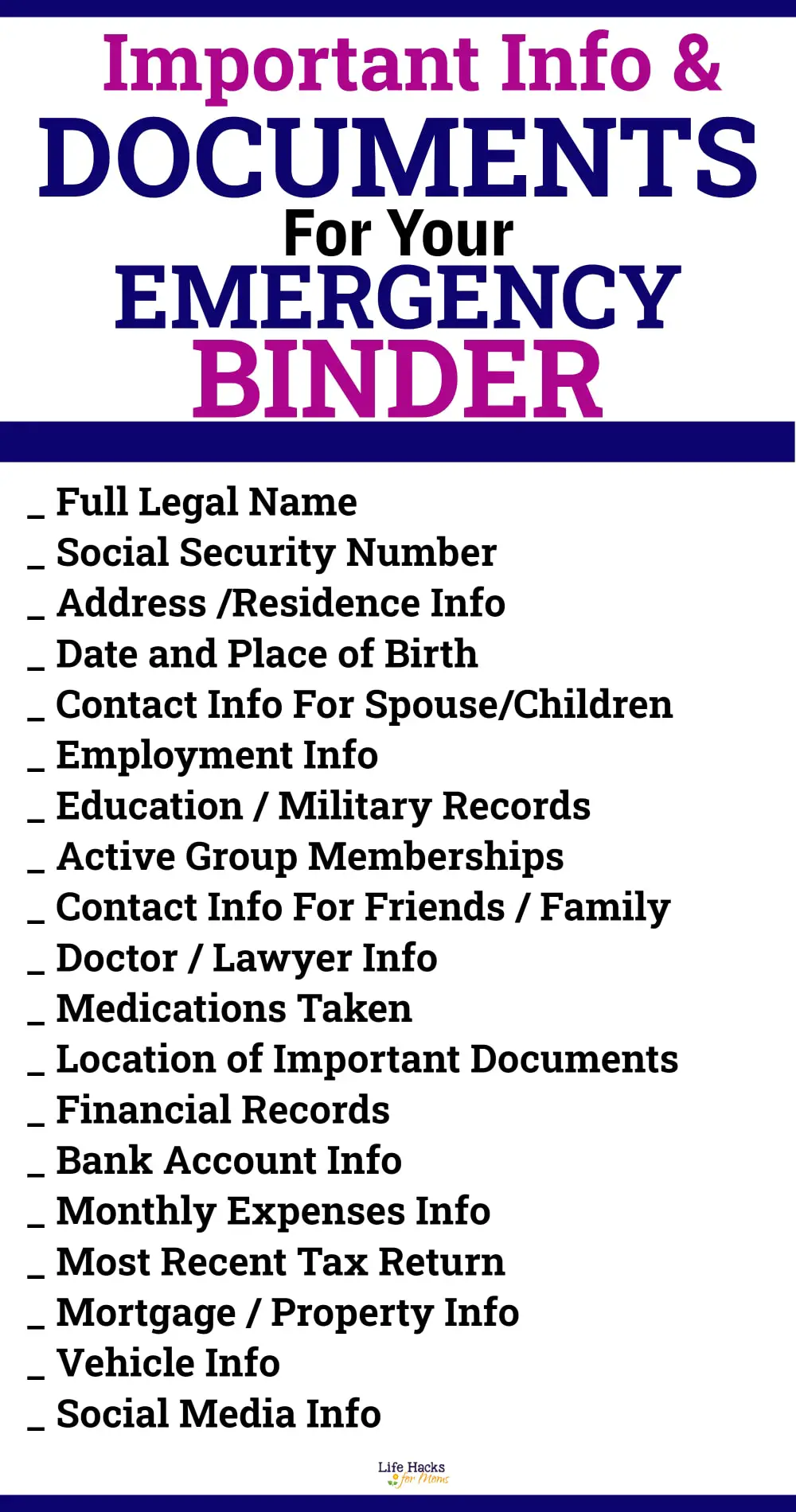

Types of Essential Documents

There are numerous types of documents that require long-term retention, including but not limited to: * Financial documents: tax returns, receipts, invoices, bank statements, and investment records * Identification documents: passports, driver’s licenses, social security cards, and birth certificates * Insurance documents: health, life, auto, and home insurance policies * Property documents: property deeds, titles, and mortgage documents * Employment documents: employment contracts, pay stubs, and benefit information * Medical documents: medical records, prescriptions, and test results

Benefits of Document Retention

Maintaining a robust document management system offers numerous benefits, including: * Compliance with regulatory requirements: many industries are subject to strict regulations regarding document retention, and failing to comply can result in severe penalties * Protection of personal and financial information: securely storing sensitive documents helps prevent identity theft and financial fraud * Easy access to information: a well-organized documentation system enables quick retrieval of essential documents, saving time and reducing stress * Reduced risk of document loss or damage: storing documents in a safe and secure location minimizes the risk of loss or damage due to natural disasters, fire, or theft

How to Create a Document Management Plan

Developing a document management plan involves several steps, including: * Identifying essential documents: determining which documents require long-term retention * Categorizing documents: organizing documents into categories, such as financial, personal, or employment-related * Assigning retention periods: establishing how long each document should be retained * Designating storage locations: selecting secure and accessible storage locations for documents * Implementing a document destruction policy: establishing procedures for securely destroying documents that are no longer required

| Document Type | Retention Period |

|---|---|

| Tax Returns | 7 years |

| Bank Statements | 2 years |

| Pay Stubs | 1 year |

| Medical Records | 10 years |

📝 Note: The retention periods listed in the table are general guidelines and may vary depending on individual circumstances and regulatory requirements.

Best Practices for Document Storage

To ensure the safe and secure storage of essential documents, consider the following best practices: * Use fireproof safes or secure filing cabinets: protect documents from fire, water, and theft * Store documents in a cool, dry location: minimize the risk of damage due to humidity or extreme temperatures * Use acid-free materials: prevent documents from deteriorating over time * Label and organize documents clearly: facilitate quick retrieval and reduce the risk of document loss

In summary, maintaining a robust document management system is crucial for both personal and professional purposes. By understanding the types of documents that require long-term retention, the benefits of document retention, and implementing a document management plan, individuals can ensure the safe and secure storage of essential paperwork. By following best practices for document storage and retention, individuals can minimize the risk of document loss or damage, protect sensitive information, and comply with regulatory requirements. Ultimately, a well-organized documentation system provides peace of mind, saves time, and reduces stress, allowing individuals to focus on more important aspects of their lives.

What is the recommended retention period for tax returns?

+

The recommended retention period for tax returns is 7 years.

How often should I review and update my document management plan?

+

It is recommended to review and update your document management plan at least once a year, or whenever there are significant changes in your personal or professional life.

What is the best way to store digital documents?

+

The best way to store digital documents is to use a secure cloud storage service, such as Google Drive or Dropbox, and to make sure to encrypt sensitive information.