Organizing Paperwork Fees

Introduction to Organizing Paperwork Fees

When it comes to managing a business or personal finances, one of the most critical aspects is organizing paperwork fees. This includes understanding the various types of fees associated with different financial transactions, maintaining accurate records, and ensuring compliance with regulatory requirements. Effective management of paperwork fees can help reduce costs, improve efficiency, and minimize the risk of errors or penalties. In this article, we will delve into the world of organizing paperwork fees, exploring the key concepts, benefits, and best practices for individuals and businesses alike.

Understanding Different Types of Fees

There are numerous types of fees associated with financial transactions, each serving a specific purpose. Some of the most common types of fees include: * Transaction fees: Charged for processing payments or transfers * Service fees: Applied for maintaining accounts, providing customer support, or offering additional services * Interest fees: Levied on borrowed amounts or outstanding balances * Late payment fees: Imposed for delayed or missed payments * Penalty fees: Assessed for non-compliance with regulatory requirements or contractual obligations

Benefits of Organizing Paperwork Fees

Organizing paperwork fees offers several benefits, including: * Cost savings: Accurate tracking and management of fees can help reduce unnecessary expenses * Improved efficiency: Streamlined processes and automated systems can minimize manual errors and increase productivity * Enhanced compliance: Proper documentation and record-keeping can ensure adherence to regulatory requirements and avoid penalties * Better decision-making: Access to accurate and up-to-date fee information can inform strategic decisions and optimize financial performance

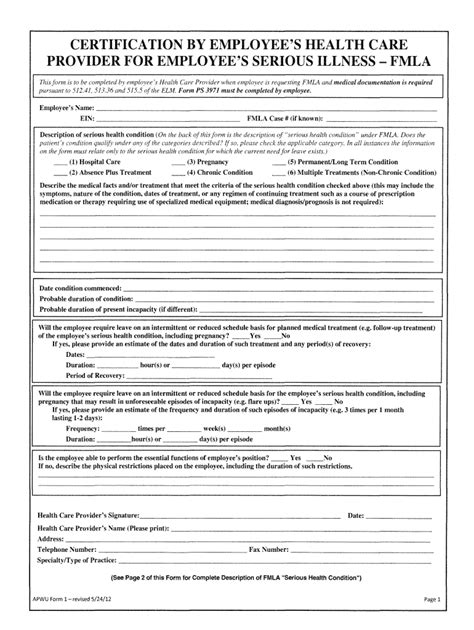

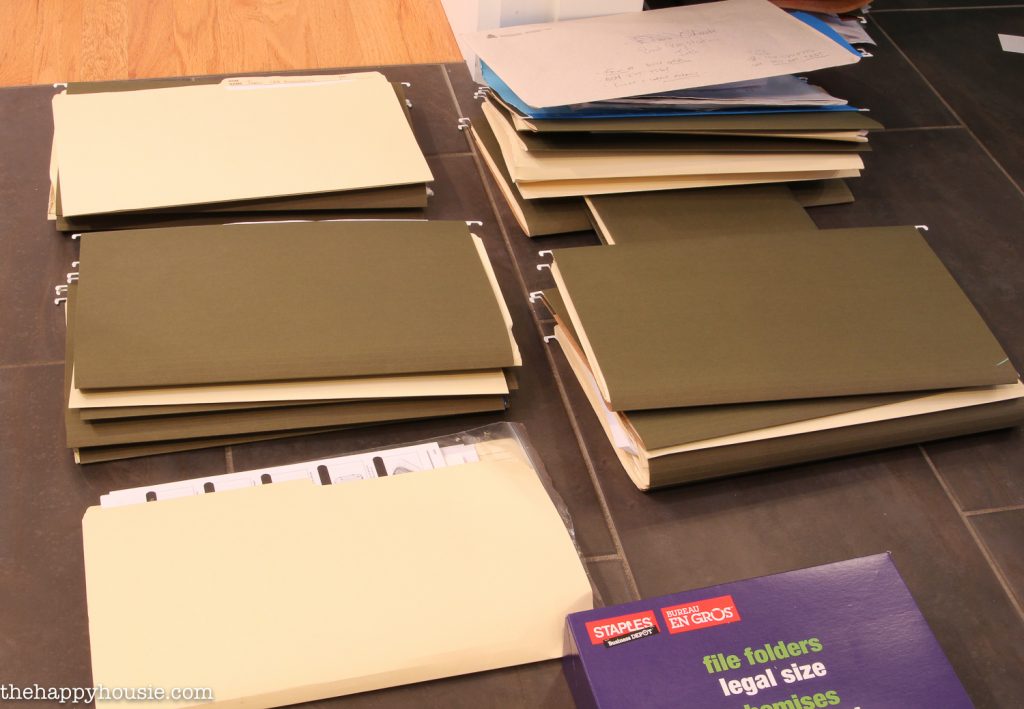

Best Practices for Organizing Paperwork Fees

To effectively organize paperwork fees, consider the following best practices: * Implement a centralized system: Utilize a single platform or software to manage and track all fee-related information * Establish clear policies and procedures: Develop and communicate guidelines for fee management, including payment terms, deadlines, and dispute resolution * Assign responsibilities: Designate specific individuals or teams to oversee fee management, ensuring accountability and expertise * Regularly review and update records: Ensure accuracy and completeness of fee information, reflecting changes in regulations, contracts, or business operations

Tools and Technologies for Organizing Paperwork Fees

Leveraging technology can significantly enhance the efficiency and effectiveness of paperwork fee management. Some popular tools and technologies include: * Accounting software: Integrated platforms for managing financial transactions, including fee tracking and payment processing * Spreadsheets: Customizable templates for organizing and analyzing fee data * Document management systems: Secure and accessible repositories for storing and retrieving fee-related documents * Automated payment systems: Streamlined solutions for processing payments and reducing manual errors

Common Challenges and Solutions

Despite the benefits of organizing paperwork fees, individuals and businesses may encounter challenges, such as: * Inaccurate or incomplete records: Implementing regular audits and data validation can help ensure accuracy and completeness * Insufficient resources or expertise: Outsourcing fee management to specialized professionals or investing in training and development can address knowledge gaps * Complex regulatory requirements: Staying up-to-date with regulatory changes, seeking professional advice, and maintaining open communication with relevant authorities can facilitate compliance

| Fee Type | Description | Benefits |

|---|---|---|

| Transaction fees | Charged for processing payments or transfers | Convenience, speed, and security |

| Service fees | Applied for maintaining accounts, providing customer support, or offering additional services | Access to premium services, personalized support, and account management |

| Interest fees | Levied on borrowed amounts or outstanding balances | Flexible payment terms, access to credit, and incentivized repayment |

📝 Note: Effective management of paperwork fees requires ongoing attention to regulatory changes, technological advancements, and evolving business needs.

As we reflect on the importance of organizing paperwork fees, it becomes clear that this critical aspect of financial management can have a significant impact on both personal and business finances. By understanding the different types of fees, implementing best practices, and leveraging technology, individuals and businesses can optimize their financial performance, reduce costs, and minimize the risk of errors or penalties. Ultimately, the key to successful paperwork fee management lies in adopting a proactive and adaptive approach, staying informed, and continuously seeking opportunities for improvement.