5 Mortgage Paperwork Costs

Understanding Mortgage Paperwork Costs

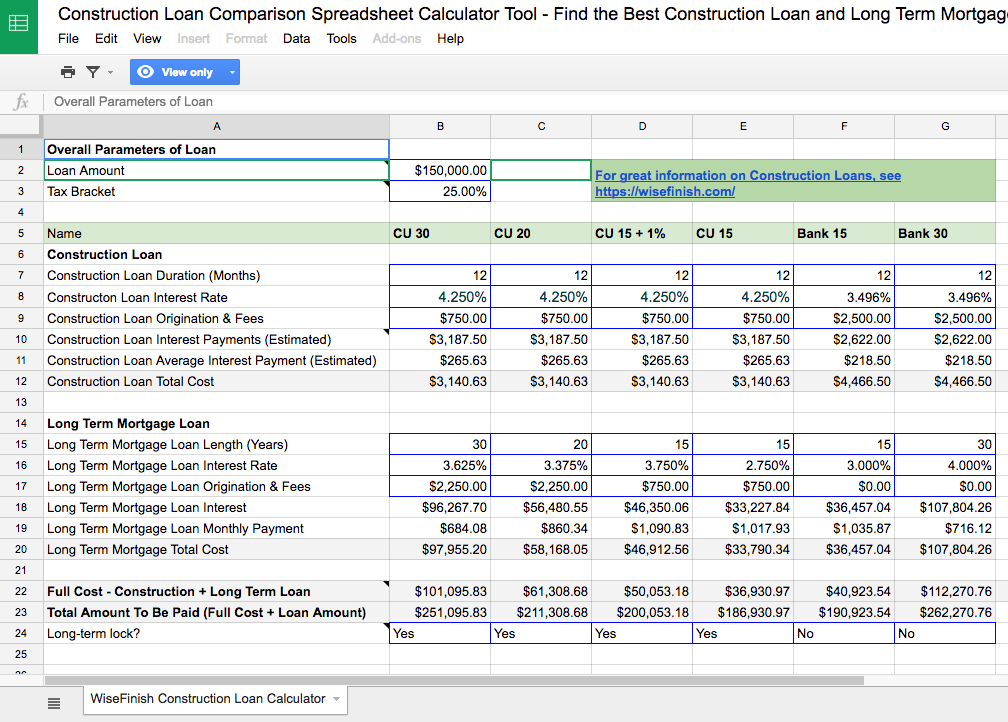

When purchasing a home, there are various costs associated with the mortgage process. One of the often-overlooked expenses is the cost of mortgage paperwork. These costs can add up quickly, and it’s essential to understand what they entail and how to navigate them. In this article, we’ll delve into the world of mortgage paperwork costs, exploring the top 5 costs you should be aware of.

1. Application Fees

The first cost to consider is the application fee. This fee is charged by the lender to process your mortgage application. It can range from 100 to 500, depending on the lender and the type of mortgage you’re applying for. The application fee covers the lender’s administrative costs, including credit checks and document preparation. It’s essential to note that this fee is non-refundable, even if your application is denied.

2. Appraisal Fees

An appraisal fee is another cost associated with mortgage paperwork. This fee is paid to a third-party appraiser who evaluates the value of the property you’re purchasing. The appraiser’s report provides the lender with an independent assessment of the property’s value, ensuring that the lender is not lending more than the property is worth. Appraisal fees can range from 300 to 1,000, depending on the location and type of property.

3. Credit Report Fees

Credit report fees are another expense to consider. Lenders use credit reports to assess your creditworthiness and determine the interest rate you’ll qualify for. The cost of a credit report can range from 30 to 150, depending on the type of report and the credit reporting agency used. It’s essential to note that you may be able to negotiate with the lender to have this fee waived or reduced.

4. Inspection and Testing Fees

Inspection and testing fees are additional costs associated with mortgage paperwork. These fees cover the cost of inspecting the property for potential issues, such as termite damage or environmental hazards. The cost of these fees can range from 500 to 2,000, depending on the type of inspection and the location of the property. Some common inspections include: * Termite inspections * Mold inspections * Septic inspections * Well water testing

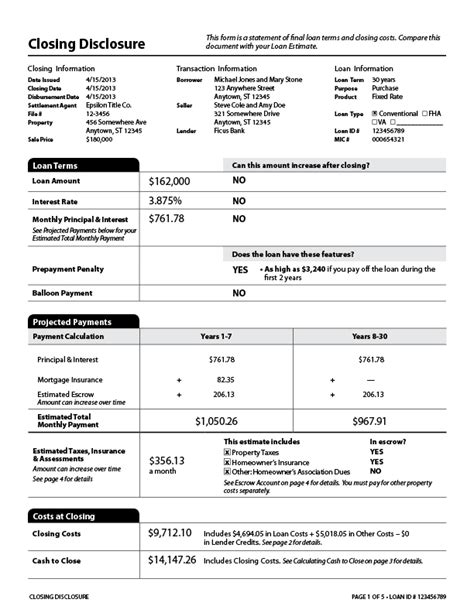

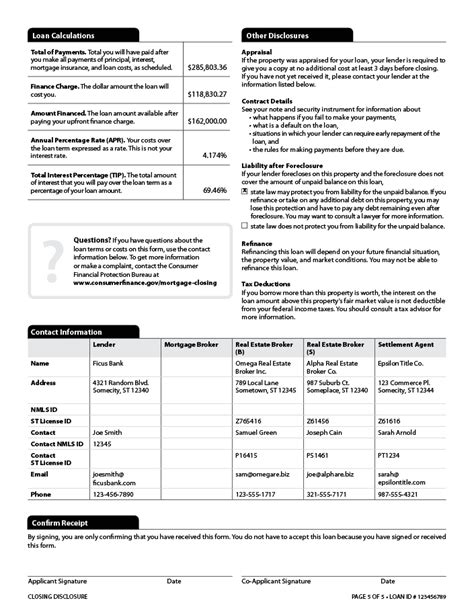

5. Closing Costs

Closing costs are the final expenses associated with mortgage paperwork. These costs cover the fees associated with finalizing the mortgage, including title insurance, escrow fees, and recording fees. Closing costs can range from 2% to 5% of the purchase price, depending on the location and type of property. It’s essential to factor these costs into your budget when purchasing a home.

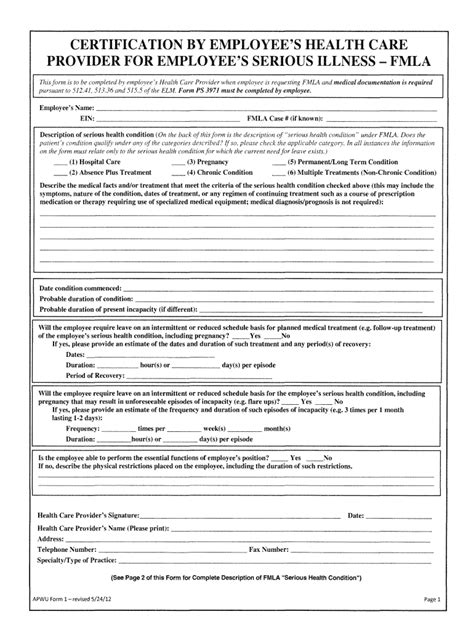

📝 Note: It's essential to carefully review your mortgage paperwork to ensure you understand all the costs involved. Don't hesitate to ask your lender about any fees you're unsure about.

To give you a better understanding of the costs involved, here is a table summarizing the top 5 mortgage paperwork costs:

| Cost | Range |

|---|---|

| Application Fees | 100 - 500 |

| Appraisal Fees | 300 - 1,000 |

| Credit Report Fees | 30 - 150 |

| Inspection and Testing Fees | 500 - 2,000 |

| Closing Costs | 2% - 5% of purchase price |

In summary, mortgage paperwork costs can add up quickly, and it’s essential to understand what they entail. By being aware of these costs, you can better navigate the mortgage process and avoid any unexpected expenses. Remember to carefully review your mortgage paperwork and don’t hesitate to ask your lender about any fees you’re unsure about.

What are mortgage paperwork costs?

+

Mortgage paperwork costs refer to the fees associated with the mortgage process, including application fees, appraisal fees, credit report fees, inspection and testing fees, and closing costs.

How much do mortgage paperwork costs typically range?

+

Mortgage paperwork costs can range from 2% to 5% of the purchase price, depending on the location and type of property.

Can I negotiate with the lender to reduce mortgage paperwork costs?

+

Yes, you may be able to negotiate with the lender to reduce or waive certain fees, such as credit report fees or application fees.