SBR Paperwork Requirements

Introduction to SBR Paperwork Requirements

The Standard Business Reporting (SBR) initiative has been introduced to simplify the process of submitting financial reports to government agencies. This is achieved by enabling businesses to lodge their reports directly from their accounting software, thereby reducing the need for manual data entry and the associated risks of errors. To ensure compliance with SBR requirements, it is essential to understand the necessary paperwork and the steps involved in the reporting process.

Benefits of SBR

The implementation of SBR has numerous benefits for businesses, including: * Reduced compliance costs: By automating the reporting process, businesses can minimize the time and resources spent on preparing and submitting reports. * Improved accuracy: SBR reduces the likelihood of errors, as financial data is extracted directly from the accounting system. * Enhanced efficiency: The streamlined reporting process enables businesses to focus on their core operations, rather than dedicating resources to manual reporting.

Key SBR Paperwork Requirements

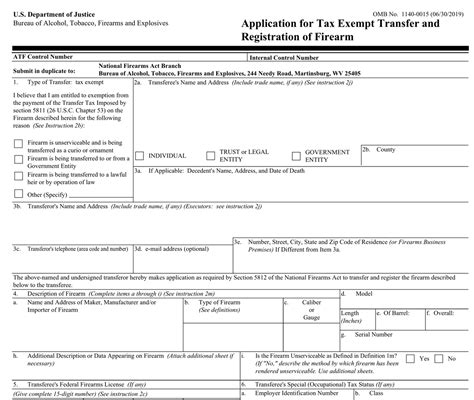

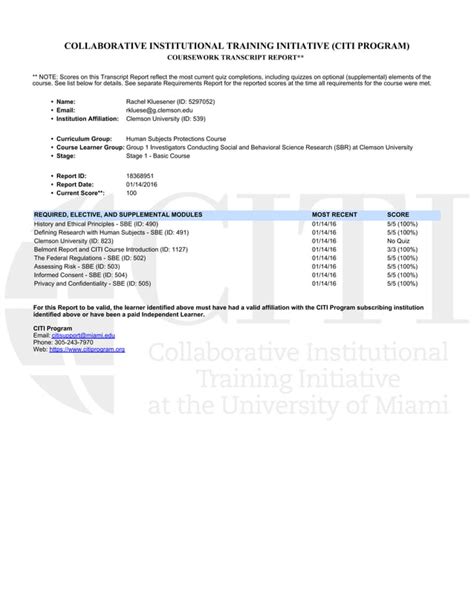

To ensure successful SBR implementation, businesses must meet the following paperwork requirements: * Registration: Businesses must register for an Australian Business Number (ABN) and ensure their accounting software is SBR-enabled. * Authentication: Businesses must obtain a digital certificate, which is used to authenticate their identity when lodging reports. * Report preparation: Businesses must prepare their financial reports in accordance with SBR requirements, using approved accounting software.

Approved Accounting Software

To participate in SBR, businesses must use approved accounting software that meets the necessary requirements. Some of the approved software includes: * MYOB: A popular accounting software that supports SBR reporting. * Xero: A cloud-based accounting platform that enables SBR reporting. * QuickBooks: A comprehensive accounting software that supports SBR reporting.

Steps Involved in SBR Reporting

The SBR reporting process involves the following steps: * Prepare financial reports: Businesses must prepare their financial reports in accordance with SBR requirements. * Lodge reports: Businesses must lodge their reports directly from their accounting software. * Verify reports: Businesses must verify their reports to ensure accuracy and completeness.

Common SBR Reporting Errors

To avoid common errors, businesses should be aware of the following: * Inaccurate data: Ensure that financial data is accurate and up-to-date. * Incorrect reporting: Ensure that reports are lodged in accordance with SBR requirements. * Technical issues: Ensure that accounting software is compatible with SBR requirements and that technical issues are resolved promptly.

📝 Note: Businesses should consult with their accounting software provider or a qualified accountant to ensure they meet the necessary SBR paperwork requirements and avoid common reporting errors.

Conclusion and Next Steps

In summary, SBR paperwork requirements are designed to simplify the process of submitting financial reports to government agencies. By understanding the benefits, key requirements, and steps involved in SBR reporting, businesses can ensure compliance and reduce the risk of errors. To get started, businesses should register for an ABN, obtain a digital certificate, and prepare their financial reports in accordance with SBR requirements.

What is Standard Business Reporting (SBR)?

+

Standard Business Reporting (SBR) is an initiative that enables businesses to lodge their financial reports directly from their accounting software, reducing the need for manual data entry and associated errors.

What are the benefits of SBR for businesses?

+

The benefits of SBR for businesses include reduced compliance costs, improved accuracy, and enhanced efficiency, as the streamlined reporting process enables businesses to focus on their core operations.

What is required to participate in SBR?

+

To participate in SBR, businesses must register for an Australian Business Number (ABN), obtain a digital certificate, and use approved accounting software that meets the necessary requirements.