Paperwork

Equity Grant Paperwork Explained

Introduction to Equity Grant Paperwork

When it comes to equity grants, the paperwork involved can be overwhelming, especially for those who are new to the concept. Equity grants are a type of compensation that companies offer to their employees, giving them a stake in the company’s ownership. This can be in the form of stock options, restricted stock units (RSUs), or performance-based stock units. Understanding the paperwork associated with equity grants is crucial to making the most out of this benefit. In this article, we will delve into the details of equity grant paperwork, explaining each component in a clear and concise manner.

Types of Equity Grants and Their Paperwork

There are several types of equity grants, each with its unique characteristics and associated paperwork. Here are some of the most common types:

- Stock Options: These give the holder the right to buy a certain number of company shares at a predetermined price (strike price). The paperwork for stock options includes the stock option agreement, which outlines the terms and conditions of the grant, including the number of shares, vesting schedule, and expiration date.

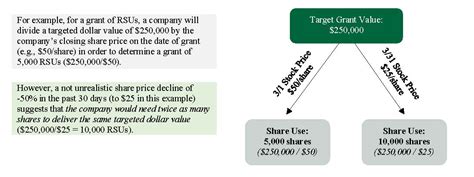

- Restricted Stock Units (RSUs): RSUs are promises to give the recipient shares of stock in the future, subject to certain conditions, such as vesting periods. The paperwork for RSUs typically includes the RSU award agreement, detailing the number of units granted, vesting schedule, and any performance conditions.

- Performance-Based Stock Units: These are similar to RSUs but are tied to specific performance metrics. The paperwork will include detailed descriptions of these metrics and how they impact the vesting of the units.

Key Components of Equity Grant Paperwork

Regardless of the type of equity grant, there are several key components that are typically included in the paperwork:

- Grant Date and Number of Shares: This specifies when the grant was made and how many shares or units are involved.

- Vesting Schedule: This outlines when the shares or units will become available to the recipient, often based on time (e.g., 25% per year over four years) or performance conditions.

- Expiration Date: For stock options, this is the last date on which the options can be exercised.

- Strike Price (for Stock Options): The predetermined price at which the shares can be bought.

- Conditions for Vesting: This could include continued employment, performance targets, or other requirements that must be met for the shares or units to vest.

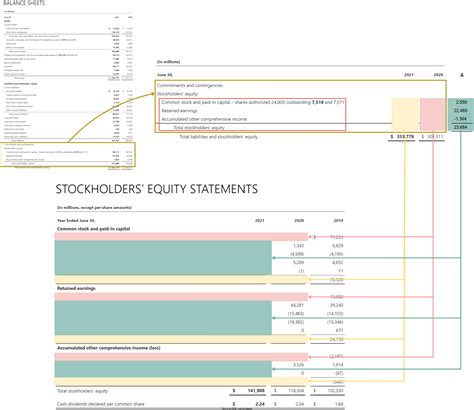

- Tax Implications: While not always detailed in the grant paperwork, understanding the tax implications of equity grants is crucial. For example, incentive stock options (ISOs) have different tax implications compared to non-qualified stock options (NSOs).

Understanding the Paperwork Process

The process of receiving and completing equity grant paperwork typically involves the following steps:

- Receipt of Grant Notification: The employee is notified of the grant, usually through an email or an online platform, with instructions on how to access the grant documents.

- Review of Grant Documents: It’s essential to carefully review the documents to understand the terms and conditions of the grant.

- Acknowledgment and Acceptance: The recipient must acknowledge and accept the terms of the grant, often by signing and returning the documents or confirming electronically.

- Compliance with Vesting Conditions: To ensure that the shares or units vest, the recipient must comply with all vesting conditions, such as remaining employed by the company for a specified period.

Best Practices for Managing Equity Grant Paperwork

To ensure that equity grant paperwork is managed effectively, consider the following best practices:

- Keep Detailed Records: Maintain a record of all grant documents and communications.

- Seek Professional Advice: If unsure about any aspect of the grant, consider consulting with a financial advisor or attorney.

- Understand Tax Implications: Be aware of the tax implications of your equity grants to plan accordingly.

- Monitor Vesting Schedules: Keep track of vesting dates to ensure that you do not miss out on vested shares or units.

💡 Note: Always review the terms and conditions carefully before accepting any equity grant to ensure you understand all the implications and requirements.

Conclusion and Final Thoughts

Equity grant paperwork may seem complex, but understanding its components and the process involved can empower recipients to make informed decisions about their compensation packages. By being aware of the types of equity grants, key components of the paperwork, and best practices for management, individuals can navigate this aspect of their employment with confidence. Whether you’re a seasoned executive or just starting your career, equity grants can be a valuable part of your overall compensation, offering a unique opportunity to share in the success and growth of your company.

What are the main types of equity grants?

+

The main types of equity grants include stock options, restricted stock units (RSUs), and performance-based stock units. Each has its unique characteristics and terms.

How do I manage my equity grant paperwork effectively?

+

To manage your equity grant paperwork effectively, keep detailed records of all grant documents, seek professional advice when needed, understand the tax implications, and monitor your vesting schedules closely.

What are the key components of equity grant paperwork?

+

The key components include the grant date, number of shares or units, vesting schedule, expiration date (for stock options), strike price (for stock options), and conditions for vesting.