5 Tips Deed Transfer

Understanding the Process of Deed Transfer

When it comes to transferring the ownership of a property, the process can be complex and involves several legal steps. A deed transfer is a legal document that is used to transfer the ownership of a property from one person to another. It is a crucial document that must be prepared and executed correctly to ensure a smooth transfer of ownership. In this article, we will discuss five tips that can help you navigate the process of deed transfer.

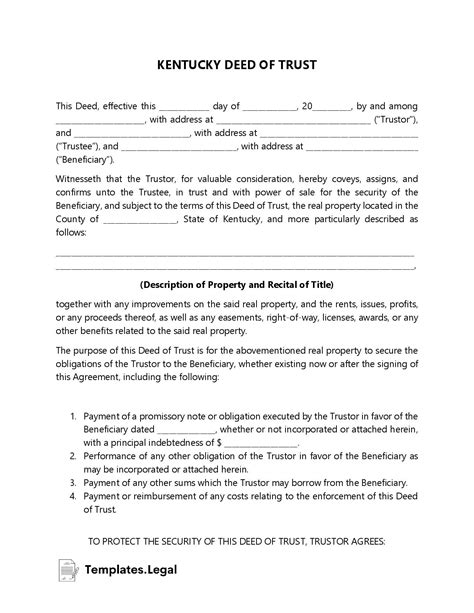

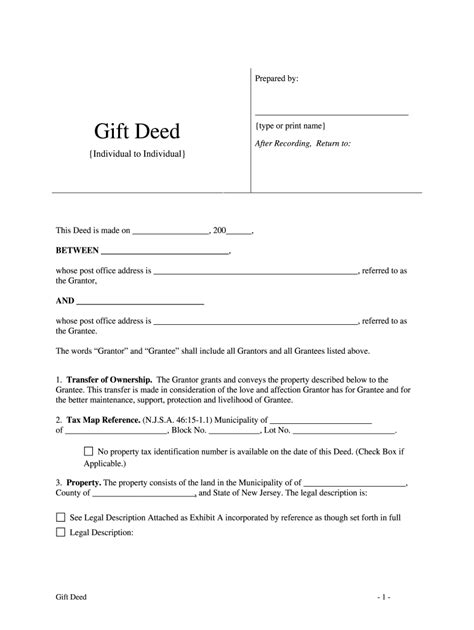

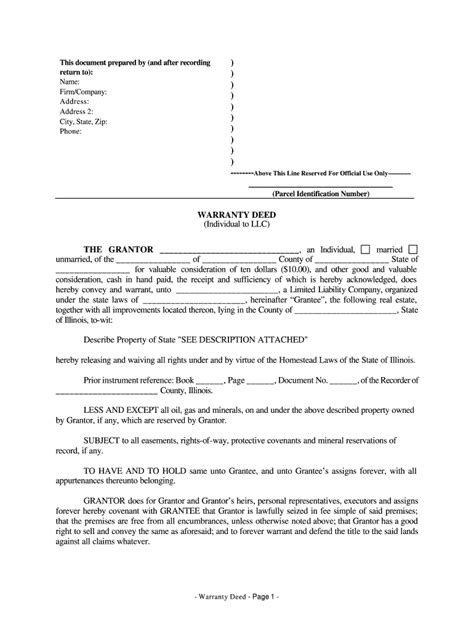

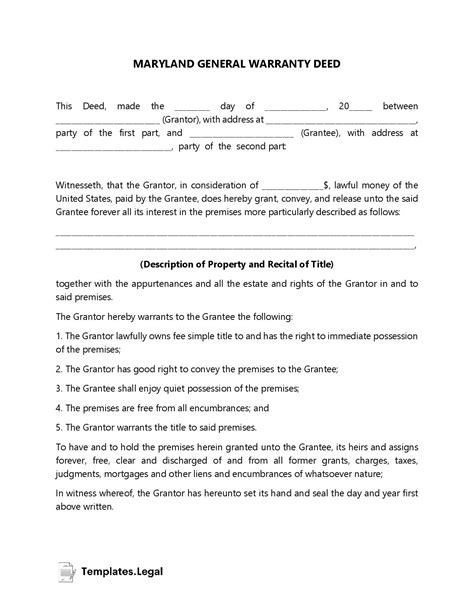

Tip 1: Choose the Right Type of Deed

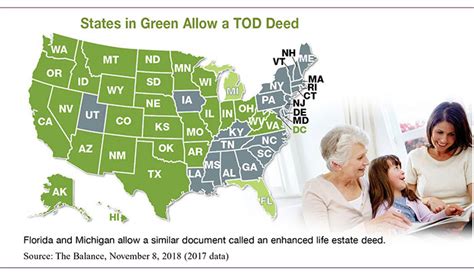

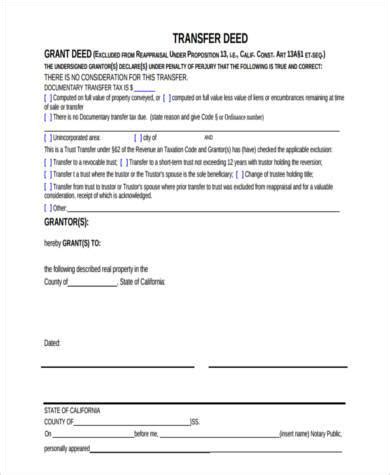

There are several types of deeds that can be used to transfer ownership of a property, including general warranty deeds, special warranty deeds, and quitclaim deeds. Each type of deed offers different levels of protection for the buyer and seller, so it is essential to choose the right type of deed for your specific situation. A general warranty deed is the most common type of deed and offers the highest level of protection for the buyer, as it guarantees that the seller has clear title to the property and that there are no unexpected liens or encumbrances.

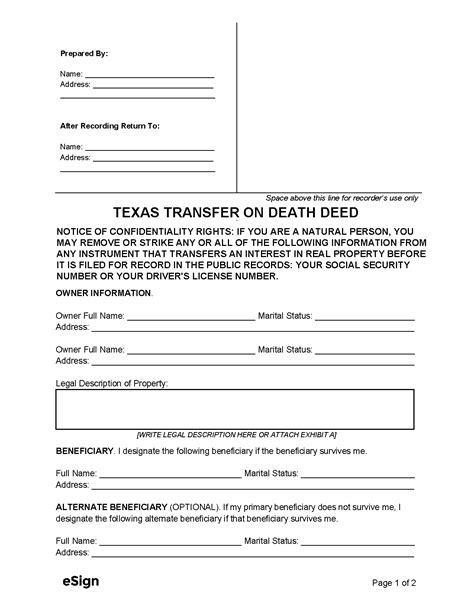

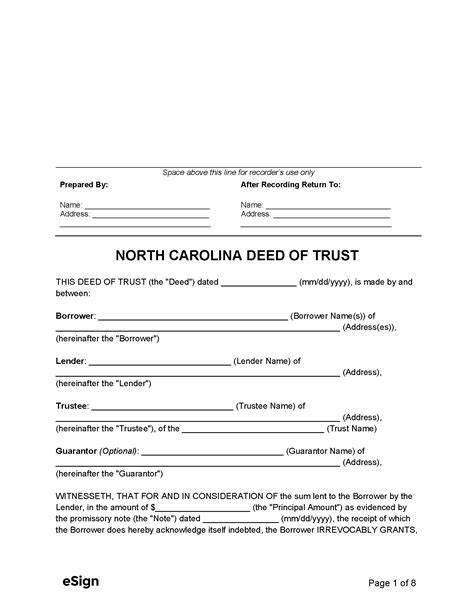

Tip 2: Ensure the Deed is Properly Executed

To be valid, a deed must be properly executed, which means that it must be signed by the seller in the presence of a notary public. The notary public verifies the identity of the seller and ensures that they are signing the deed voluntarily. It is also essential to ensure that the deed is acknowledged, which means that the seller must acknowledge that they signed the deed in the presence of the notary public.

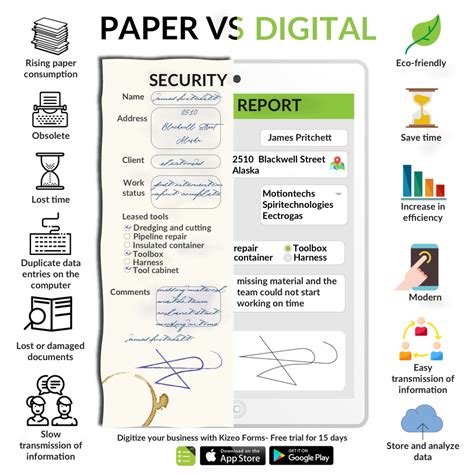

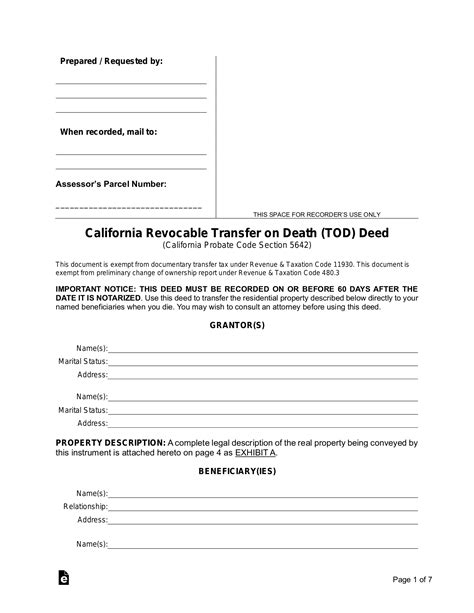

Tip 3: Record the Deed

After the deed has been executed, it must be recorded with the county recorder’s office in the county where the property is located. Recording the deed provides public notice of the transfer of ownership and helps to prevent fraudulent transactions. It is essential to record the deed as soon as possible after it has been executed to ensure that the transfer of ownership is valid.

Tip 4: Understand the Tax Implications

Transferring ownership of a property can have significant tax implications, both for the buyer and the seller. For example, the seller may be subject to capital gains tax on the profit from the sale of the property, while the buyer may be subject to property tax on the value of the property. It is essential to understand the tax implications of the transfer and to seek the advice of a tax professional if necessary.

Tip 5: Seek Professional Advice

Finally, it is essential to seek professional advice when transferring ownership of a property. A real estate attorney can help to ensure that the deed is prepared and executed correctly and that the transfer of ownership is valid. They can also help to resolve any disputes that may arise during the transfer process.

📝 Note: It is essential to keep a record of all documents related to the deed transfer, including the deed itself, the acknowledgment, and the recording information.

In summary, transferring ownership of a property can be a complex process, but by following these five tips, you can help to ensure a smooth and valid transfer of ownership. Remember to choose the right type of deed, ensure the deed is properly executed, record the deed, understand the tax implications, and seek professional advice.

What is a deed transfer?

+

A deed transfer is a legal document that is used to transfer the ownership of a property from one person to another.

What are the different types of deeds?

+

There are several types of deeds, including general warranty deeds, special warranty deeds, and quitclaim deeds. Each type of deed offers different levels of protection for the buyer and seller.

Why is it essential to record the deed?

+

Recording the deed provides public notice of the transfer of ownership and helps to prevent fraudulent transactions.