Paperwork

Employee Tax Paperwork Frequency

Introduction to Employee Tax Paperwork

When it comes to managing a business, especially one with a significant number of employees, understanding the frequency and types of employee tax paperwork is crucial. This knowledge helps in ensuring compliance with tax laws and regulations, avoiding penalties, and maintaining a smooth operation of the business. In this context, tax paperwork refers to all the documents and forms required for tax purposes, including but not limited to, income tax returns, tax deductions, and benefits reporting.

Understanding Tax Paperwork Frequency

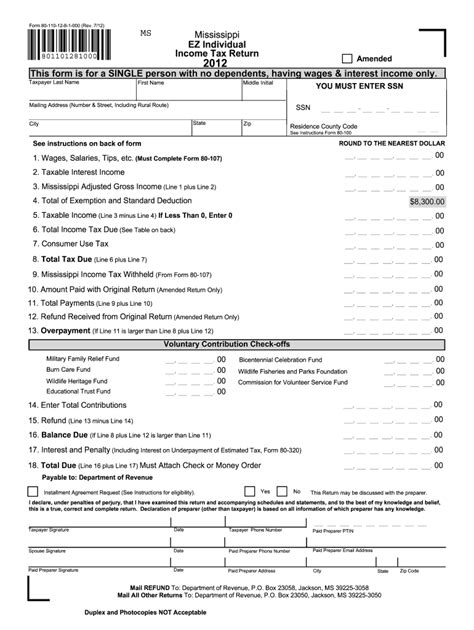

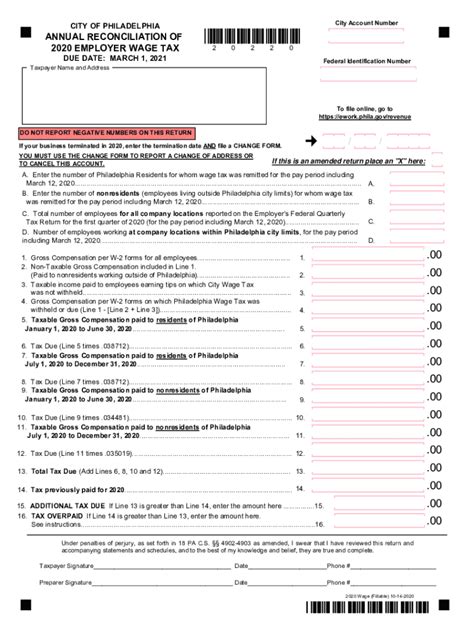

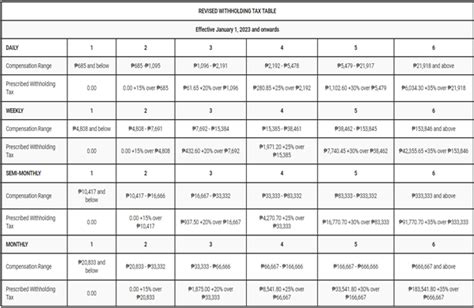

The frequency of tax paperwork can vary significantly depending on several factors, including the size of the business, the number of employees, and the nature of the business operations. Generally, tax paperwork can be categorized into monthly, quarterly, and annual submissions. - Monthly submissions might include payroll tax deposits and certain benefits reporting. - Quarterly submissions often involve filing employment tax returns and reporting on tax withheld from employee wages. - Annual submissions include filing of annual income tax returns, W-2 forms for employees, and other year-end tax reporting.

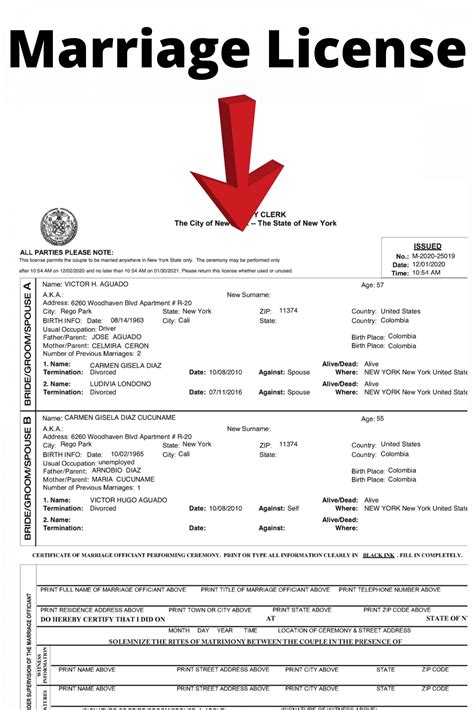

Key Tax Paperwork for Employees

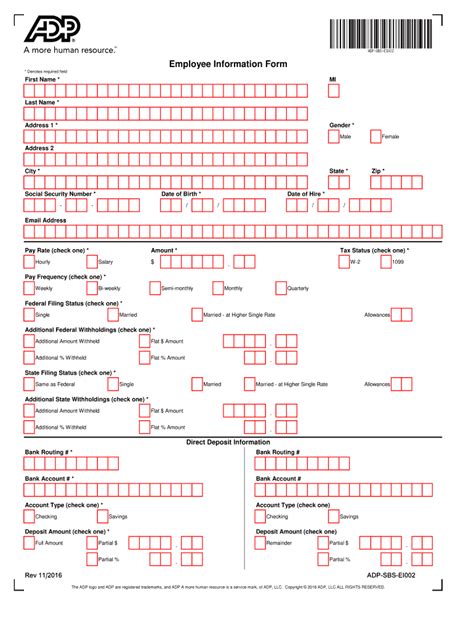

Some of the key tax paperwork that employees and employers need to be aware of includes:

- W-4 Form: Completed by employees to determine the amount of taxes to be withheld from their paycheck.

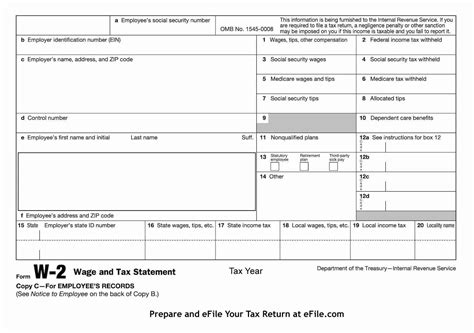

- W-2 Form: Provided by employers to employees and the IRS, detailing the employee’s income and taxes withheld for the year.

- Form 941: Employers use this form to report employment taxes, tax withheld from employee wages, and pay their portion of Social Security and Medicare taxes.

- Form 940: This form is used by employers to report and pay the federal unemployment tax.

Importance of Compliance

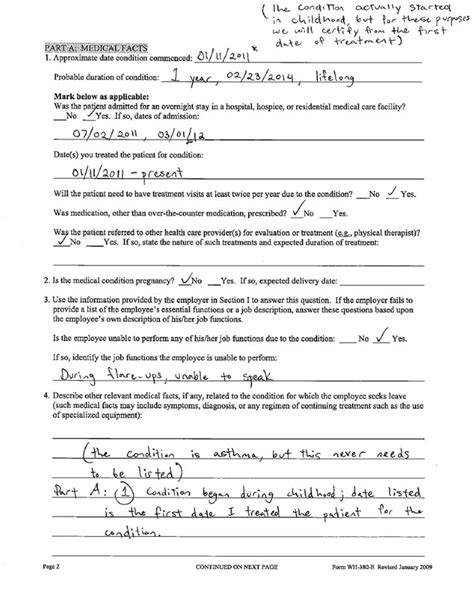

Compliance with tax laws and regulations is paramount for both employees and employers. Failure to submit tax paperwork on time or accurately can result in penalties, fines, and interest on the amount owed. Moreover, it can lead to audits and more severe legal actions in extreme cases. Therefore, understanding the frequency and requirements of tax paperwork is essential for maintaining a healthy and compliant business environment.

Managing Tax Paperwork Efficiently

To manage tax paperwork efficiently, employers can:

- Implement a robust accounting system that automates tax calculations and submissions.

- Stay updated with tax law changes to ensure compliance with the latest regulations.

- Provide clear communication to employees about tax paperwork requirements and deadlines.

- Consider hiring a tax professional or using tax preparation services for complex tax situations.

📝 Note: It's essential for employers to maintain accurate and detailed records of all tax-related documents and submissions to facilitate audits and ensure compliance.

Conclusion and Future Outlook

In summary, understanding the frequency and types of employee tax paperwork is vital for businesses to operate smoothly and comply with tax regulations. By implementing efficient management strategies and staying informed about tax law changes, employers can minimize the risk of penalties and ensure a compliant tax environment. As tax laws continue to evolve, the importance of diligence and knowledge in this area will only continue to grow.

What is the purpose of the W-4 form for employees?

+

The W-4 form is used by employees to inform their employers of the amount of taxes to be withheld from their paycheck, ensuring the correct amount of income tax is withheld.

How often must employers file Form 941?

+

Employers typically need to file Form 941 on a quarterly basis to report employment taxes and taxes withheld from employee wages.

What are the consequences of not complying with tax paperwork requirements?

+

Non-compliance can lead to penalties, fines, interest on owed amounts, audits, and in severe cases, legal actions. It’s crucial for employers to prioritize compliance to avoid these consequences.