5 Tips Retirement

Introduction to Retirement Planning

Retirement planning is a crucial aspect of securing a comfortable and stress-free life after one stops working. It involves creating a comprehensive plan that covers various aspects, including financial security, healthcare, and personal fulfillment. With the increasing cost of living and the uncertainty of social security, it’s essential to start planning for retirement early. In this article, we will discuss five tips to help you plan for a successful retirement.

Tip 1: Start Early and Be Consistent

Starting to plan for retirement early is vital to ensure that you have enough time to save and invest for the future. Consistency is key when it comes to retirement planning. It’s essential to make regular contributions to your retirement account, such as a 401(k) or an IRA, to take advantage of compound interest. Even small, consistent contributions can add up over time, providing a significant nest egg for retirement.

Tip 2: Set Clear Financial Goals

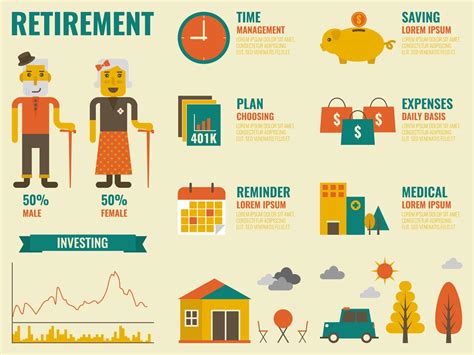

Setting clear financial goals is crucial to retirement planning. You need to determine how much money you’ll need to live comfortably in retirement, considering factors such as living expenses, healthcare costs, and travel. Creating a budget can help you understand your financial situation and make informed decisions about your retirement goals. Consider the following factors when setting your financial goals: * Estimated retirement age * Desired lifestyle in retirement * Anticipated expenses, such as healthcare and living costs * Sources of income, such as social security and pensions

Tip 3: Diversify Your Investments

Diversifying your investments is essential to managing risk and ensuring a stable income stream in retirement. A diversified portfolio can help you weather market fluctuations and provide a consistent return on investment. Consider the following investment options: * Stocks: Provide potential for long-term growth, but come with higher risk * Bonds: Offer a relatively stable income stream, but with lower potential for growth * Real estate: Can provide a steady income stream and potential for long-term growth * Alternative investments: Such as gold, commodities, or cryptocurrencies, can provide a hedge against market volatility

Tip 4: Plan for Healthcare Costs

Healthcare costs can be a significant expense in retirement, and it’s essential to plan for them accordingly. Understanding your healthcare options can help you make informed decisions about your retirement plan. Consider the following factors: * Medicare: Understand the different parts of Medicare, including Part A, Part B, and Part D * Medigap: Consider purchasing a Medigap policy to supplement your Medicare coverage * Long-term care: Plan for potential long-term care costs, such as nursing home care or home health care * Health savings account: Consider contributing to a health savings account to save for healthcare expenses

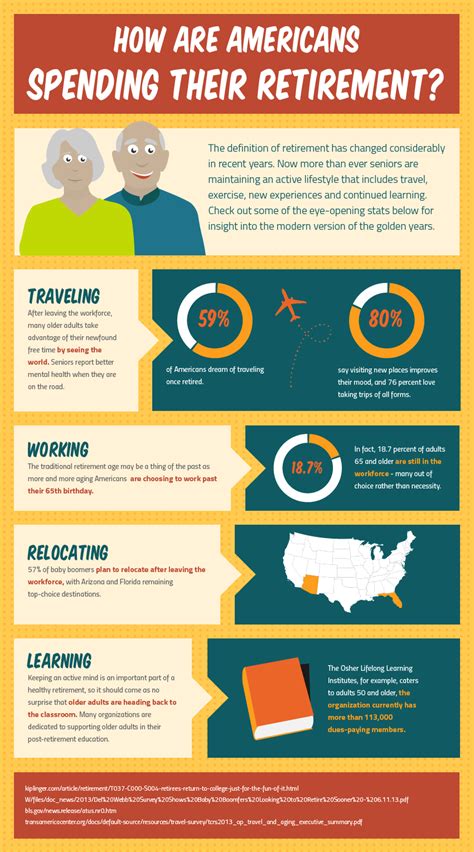

Tip 5: Consider Your Lifestyle in Retirement

Your lifestyle in retirement can have a significant impact on your financial planning. Thinking about your retirement goals can help you create a comprehensive plan that meets your needs. Consider the following factors: * Travel: Plan for potential travel expenses, such as transportation, accommodation, and food * Hobbies: Consider the costs associated with your hobbies, such as golfing or painting * Social activities: Plan for potential social activities, such as dining out or attending events * Personal fulfillment: Consider how you’ll stay engaged and fulfilled in retirement, such as through volunteering or mentoring

📝 Note: It's essential to review and update your retirement plan regularly to ensure it remains aligned with your changing needs and goals.

In summary, planning for retirement requires careful consideration of various factors, including financial security, healthcare, and personal fulfillment. By starting early, setting clear financial goals, diversifying your investments, planning for healthcare costs, and considering your lifestyle in retirement, you can create a comprehensive plan that meets your needs and ensures a comfortable and stress-free life after you stop working.

What is the best age to start planning for retirement?

+

The best age to start planning for retirement is as early as possible, ideally in your 20s or 30s. This allows you to take advantage of compound interest and create a significant nest egg for retirement.

How much money do I need to save for retirement?

+

The amount of money you need to save for retirement depends on various factors, including your desired lifestyle, estimated retirement age, and anticipated expenses. A general rule of thumb is to aim to replace 70% to 80% of your pre-retirement income in retirement.

What are the best investments for retirement?

+

The best investments for retirement depend on your individual financial goals and risk tolerance. A diversified portfolio that includes a mix of stocks, bonds, and other investments can help you manage risk and ensure a stable income stream in retirement.