5 Tips Send IRS Paperwork

Introduction to IRS Paperwork

When it comes to dealing with the Internal Revenue Service (IRS), one of the most critical aspects is ensuring that all paperwork is handled correctly and efficiently. The IRS requires various forms and documents to be filed for tax purposes, and any mistakes or delays can lead to penalties, fines, or even audits. In this article, we will explore five essential tips for sending IRS paperwork, aiming to make the process smoother and less daunting for individuals and businesses alike.

Understanding IRS Requirements

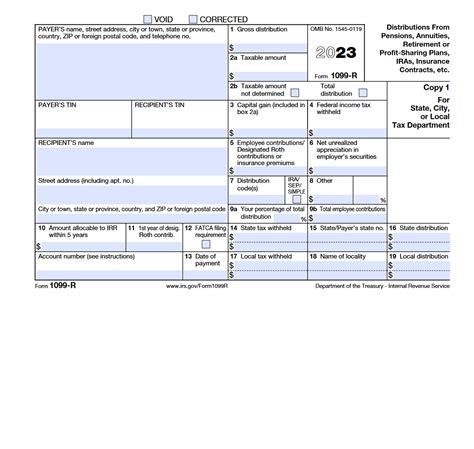

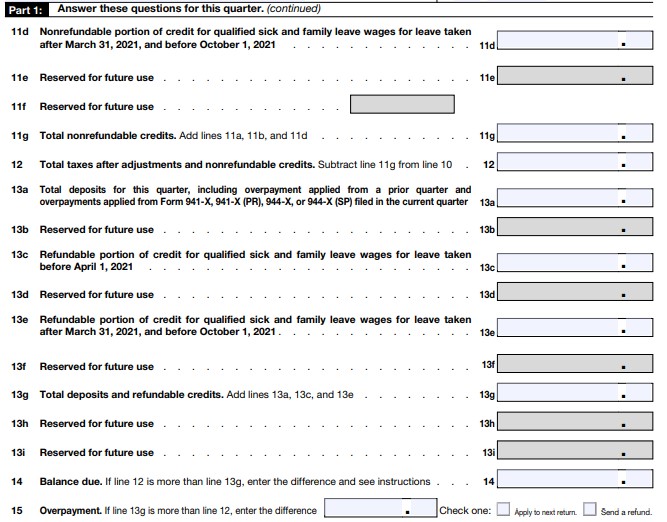

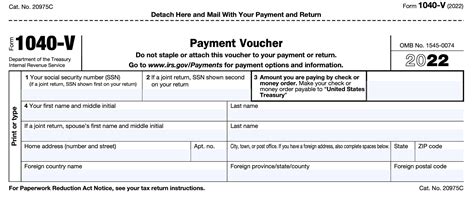

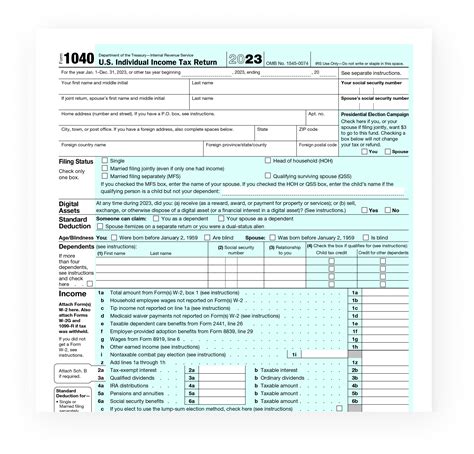

Before diving into the tips, it’s crucial to understand what the IRS requires in terms of paperwork. This includes but is not limited to, tax returns (Form 1040 for individuals, Form 1120 for corporations), employment tax returns (Form 941), and various information returns (like Form 1099 for independent contractors). The IRS also mandates electronic filing for certain forms and sizes of businesses, emphasizing the importance of staying updated with the latest regulations.

Tips for Sending IRS Paperwork

The following tips are designed to help navigate the complex world of IRS paperwork efficiently:

- Tip 1: Ensure Accuracy and Completeness

- Double-check all forms for accuracy and completeness before submission.

- A single mistake can lead to delays or even the rejection of your filing.

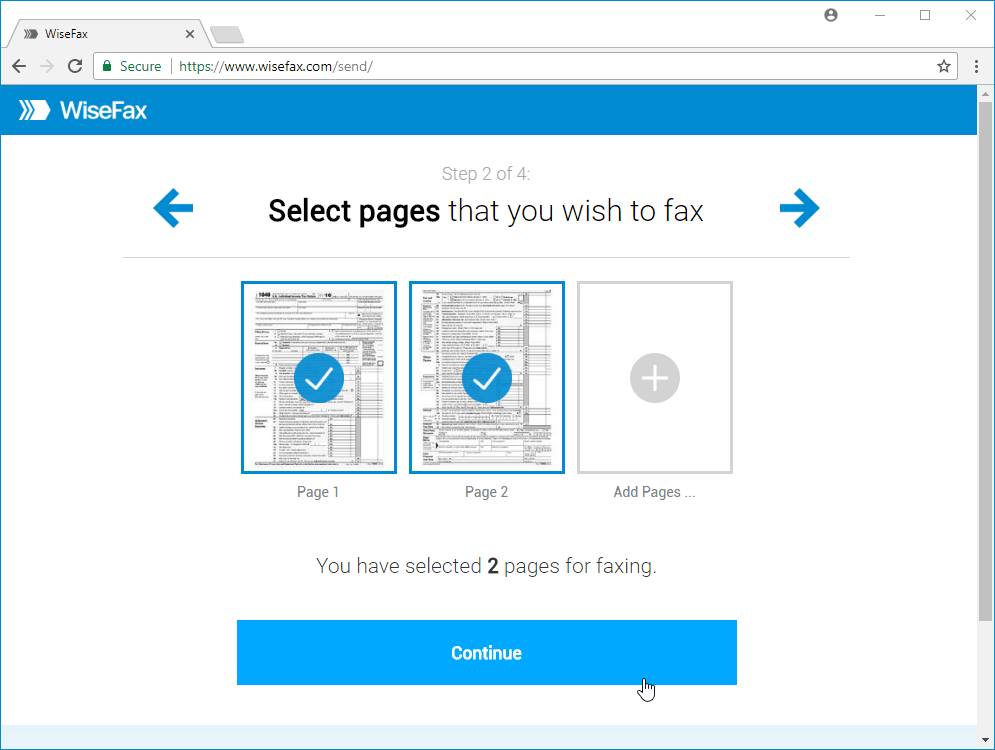

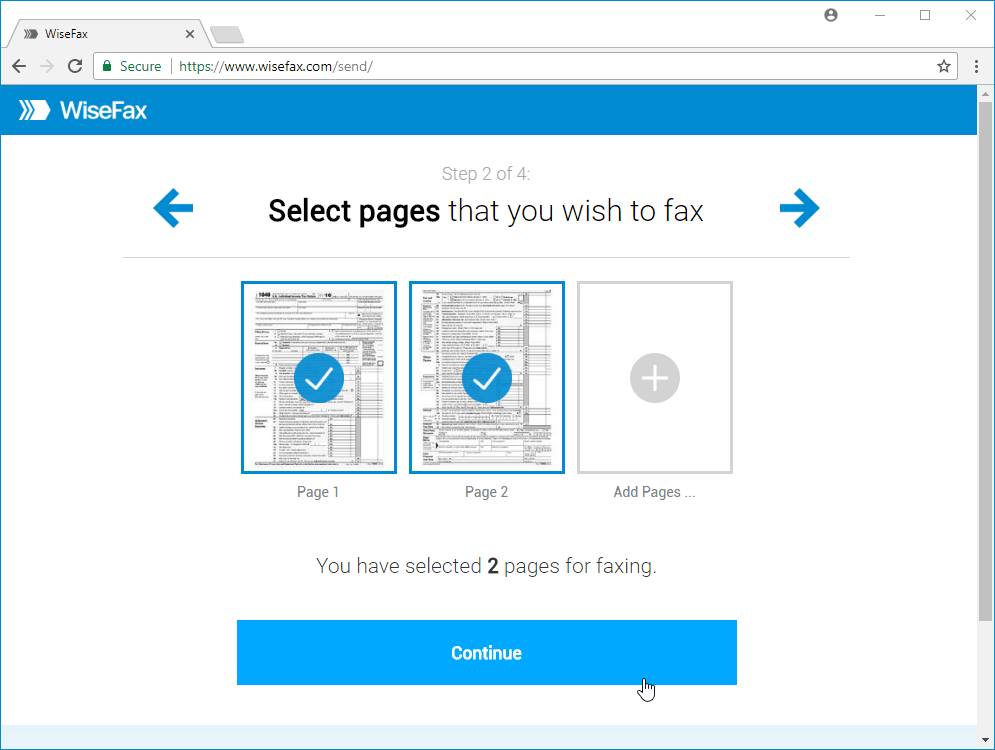

- Tip 2: Use Approved Methods for Filing

- The IRS specifies approved methods for filing different types of returns and forms.

- For many, electronic filing (e-filing) is not only preferred but sometimes mandatory.

- Tip 3: Meet Deadlines

- Missing a deadline can result in penalties and interest on the amount owed.

- Keep track of all relevant IRS deadlines, including extensions if applicable.

- Tip 4: Keep Records

- It’s essential to keep detailed records of all IRS paperwork, including receipts for mailed documents and confirmation numbers for e-filed forms.

- These records can be crucial in case of an audit or if the IRS claims not to have received your paperwork.

- Tip 5: Seek Professional Help When Needed

- Tax laws and regulations are complex and constantly evolving.

- If you’re unsure about any aspect of the process, consider consulting a tax professional or accountant who can guide you through the process and ensure compliance with all IRS requirements.

Benefits of Efficient IRS Paperwork Handling

Efficiently handling IRS paperwork not only avoids potential legal and financial issues but also contributes to a smoother overall experience with tax compliance. By following the tips outlined above, individuals and businesses can reduce stress, save time, and focus on their core activities, knowing that their tax obligations are being met accurately and on time.

Common Challenges and Solutions

Despite the best intentions, challenges can arise when dealing with IRS paperwork. These might include misunderstandings of tax laws, technical issues with e-filing, or simply the overwhelming volume of paperwork. Solutions often involve seeking professional advice, utilizing IRS resources such as the official IRS website or contact centers, and staying organized throughout the process.

💡 Note: The IRS offers various tools and resources on its website to help with the filing process, including detailed instructions for each form, FAQs, and even live chat support for certain topics.

In the realm of IRS paperwork, knowledge is power. By understanding the requirements, following the outlined tips, and being prepared to address any challenges that may arise, individuals and businesses can navigate this complex landscape with confidence. Whether you’re a seasoned tax professional or handling IRS paperwork for the first time, the key to success lies in attention to detail, timely action, and a willingness to seek help when needed.

To summarize the key points: understanding IRS requirements, ensuring accuracy and completeness, using approved filing methods, meeting deadlines, keeping records, and seeking professional help when needed are all crucial for efficient and compliant IRS paperwork handling. By adopting these strategies, individuals and businesses can ensure a smoother and more compliant experience with the IRS, avoiding unnecessary penalties and stress while focusing on their core activities and growth.

What are the consequences of missing an IRS deadline?

+

Missing an IRS deadline can result in penalties and interest on the amount owed. It’s crucial to keep track of all relevant deadlines and consider filing for an extension if necessary.

How can I ensure the accuracy of my IRS paperwork?

+

To ensure accuracy, double-check all forms for completeness and correctness before submission. Consider seeking professional help if you’re unsure about any aspect of the process.

What resources does the IRS offer for help with paperwork and filing?

+

The IRS offers various tools and resources on its website, including detailed instructions for each form, FAQs, and even live chat support for certain topics. Utilizing these resources can significantly simplify the filing process.