Calculate QDRO 401k Without Paperwork

Understanding QDRO and 401k

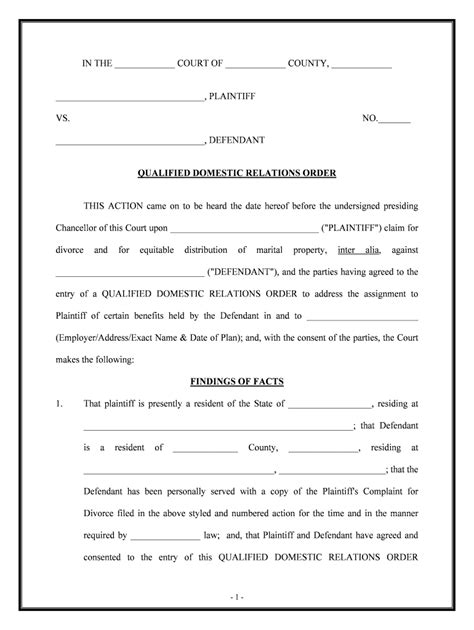

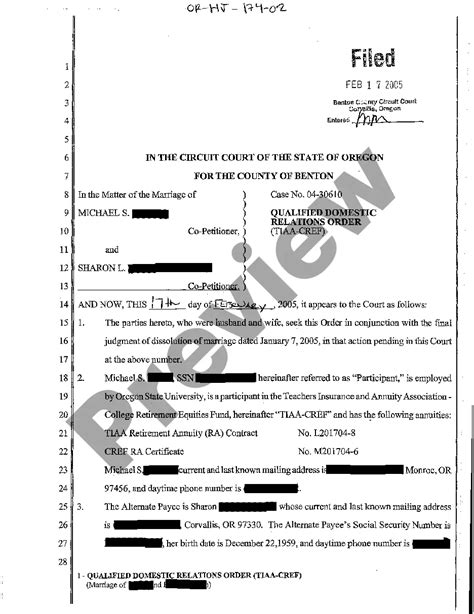

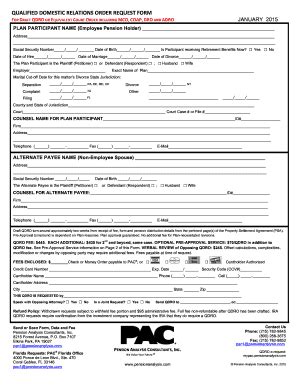

Calculating a QDRO (Qualified Domestic Relations Order) for a 401k without paperwork can be a challenging task, but it’s essential to grasp the basics of both concepts. A QDRO is a court order that assigns a portion of a 401k or other retirement plan to an alternate payee, usually a former spouse. The 401k, on the other hand, is a type of retirement savings plan that many employers offer to their employees. In this context, understanding how QDROs interact with 401ks is crucial for divorce proceedings or other situations where retirement assets are divided.

QDRO Calculation Basics

To calculate a QDRO for a 401k without paperwork, one must consider several factors, including the type of plan, the participant’s (employee’s) benefits, and the terms of the divorce or separation agreement. Generally, a QDRO calculation involves determining the percentage of the retirement plan benefits that the alternate payee is entitled to receive. This percentage is often based on the length of the marriage and the contributions made during that period. It’s essential to note that QDRO calculations can be complex and may require the assistance of a financial advisor or attorney.

Step-by-Step QDRO Calculation Process

While it’s not recommended to calculate a QDRO without proper documentation, here’s a simplified step-by-step guide to help understand the process: - Determine the total value of the 401k plan at the time of the divorce or separation. - Calculate the portion of the plan that was accrued during the marriage. - Apply the percentage agreed upon in the divorce or separation agreement to the marital portion of the 401k. - Consider any loans or withdrawals made from the plan during the marriage. - Adjust the calculation based on the terms of the QDRO, if any.

Challenges of Calculating QDRO Without Paperwork

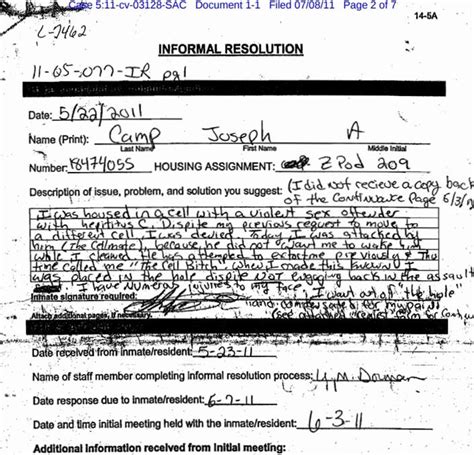

Calculating a QDRO without paperwork poses several challenges, including: * Lack of access to detailed plan information * Difficulty in determining the marital portion of the plan * Inability to verify the accuracy of the calculation * Potential for disputes over the calculation method or results * Risk of miscalculation, which could lead to legal or financial repercussions

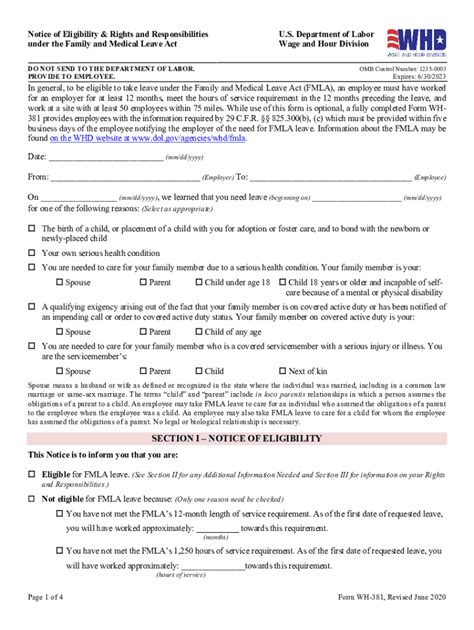

🚨 Note: It's highly recommended to obtain all relevant paperwork and consult with a financial advisor or attorney to ensure accurate QDRO calculations and compliance with legal requirements.

Importance of Accuracy in QDRO Calculations

Accurate QDRO calculations are critical to ensure that both parties receive their rightful share of the retirement benefits. Inaccurate calculations can lead to delays, disputes, or even legal action. Furthermore, QDROs must comply with the Employee Retirement Income Security Act (ERISA) and other relevant laws, making it even more crucial to approach these calculations with precision and care.

Tools and Resources for QDRO Calculations

Several tools and resources are available to assist with QDRO calculations, including: * Online QDRO calculators * Financial planning software * Retirement plan administrators * Professional services from attorneys or financial advisors specializing in QDROs Using these resources can help streamline the calculation process and reduce the risk of errors.

Best Practices for QDRO Calculations

To ensure accurate and efficient QDRO calculations, consider the following best practices: * Gather all relevant paperwork and documentation * Consult with a financial advisor or attorney * Use established calculation methods and formulas * Verify the accuracy of the calculation * Document all steps and assumptions made during the calculation process

| QDRO Calculation Step | Description |

|---|---|

| Determine total plan value | Calculate the total value of the 401k plan at the time of divorce or separation |

| Calculate marital portion | Determine the portion of the plan accrued during the marriage |

| Apply percentage | Apply the agreed-upon percentage to the marital portion of the plan |

In summary, calculating a QDRO for a 401k without paperwork is a complex task that requires careful consideration of various factors. While it’s possible to understand the basics of QDRO calculations, it’s essential to approach these calculations with precision and care, using established methods and seeking professional assistance when necessary. By following best practices and utilizing available tools and resources, individuals can ensure accurate and efficient QDRO calculations, ultimately leading to a more successful division of retirement assets.

As we reflect on the key points discussed, it becomes clear that QDRO calculations are a critical aspect of divorce proceedings or other situations where retirement assets are divided. By understanding the basics of QDROs, the challenges of calculating without paperwork, and the importance of accuracy, individuals can better navigate these complex calculations and ensure a more equitable division of retirement benefits.

What is a QDRO, and how does it relate to 401k plans?

+

A QDRO is a court order that assigns a portion of a 401k or other retirement plan to an alternate payee, usually a former spouse. It’s used to divide retirement assets in divorce proceedings or other situations.

Can I calculate a QDRO without paperwork, and what are the risks?

+

While it’s possible to understand the basics of QDRO calculations without paperwork, it’s not recommended. The risks include inaccurate calculations, disputes, and potential legal or financial repercussions.

What tools and resources are available to assist with QDRO calculations?

+

Several tools and resources are available, including online QDRO calculators, financial planning software, retirement plan administrators, and professional services from attorneys or financial advisors specializing in QDROs.