NJ Veteran Exemption Status Check

New Jersey Veteran Exemption Status Check: A Comprehensive Guide

The state of New Jersey offers various benefits and exemptions to its veterans, aiming to honor their service and sacrifice. One of these benefits is the Veteran Exemption, which can significantly reduce a veteran’s property tax burden. To take advantage of this exemption, veterans must meet specific eligibility criteria and follow a straightforward application process. This guide will walk you through the steps to check your New Jersey Veteran Exemption status, ensuring you understand the process and can successfully apply for this valuable benefit.

Eligibility Criteria for the New Jersey Veteran Exemption

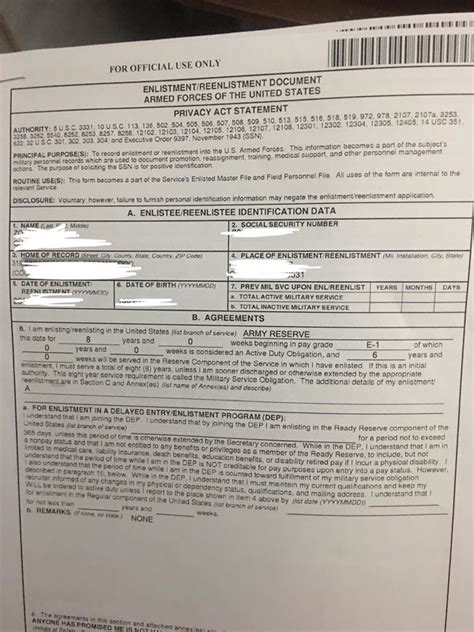

Before applying for the Veteran Exemption, it’s essential to determine if you meet the eligibility criteria set by the state of New Jersey. These criteria include: - Active Duty Service: You must have served in the United States Armed Forces during a time of war or other eligible periods. - Honorable Discharge: Your military discharge must be under honorable conditions. - New Jersey Residency: You must be a resident of New Jersey. - Ownership of Property: You or your spouse must own the property for which you are claiming the exemption.

These criteria are subject to change, so it’s crucial to verify them with the relevant authorities or the official New Jersey government website.

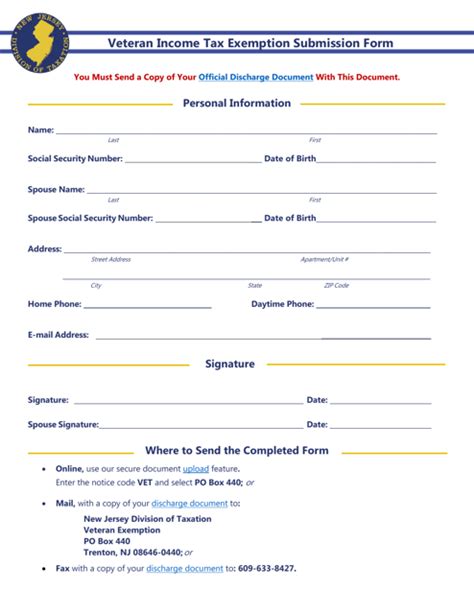

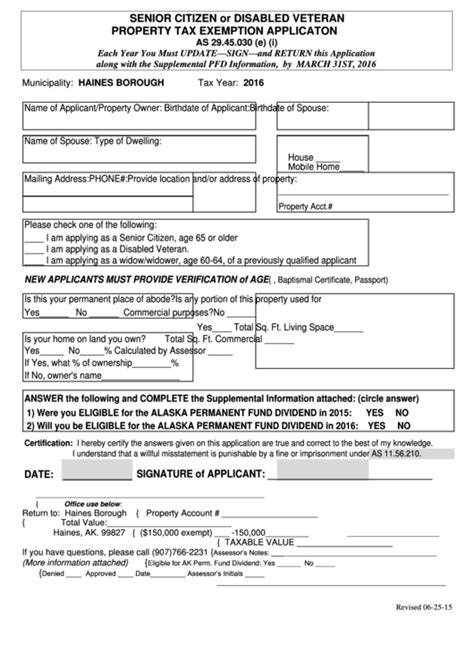

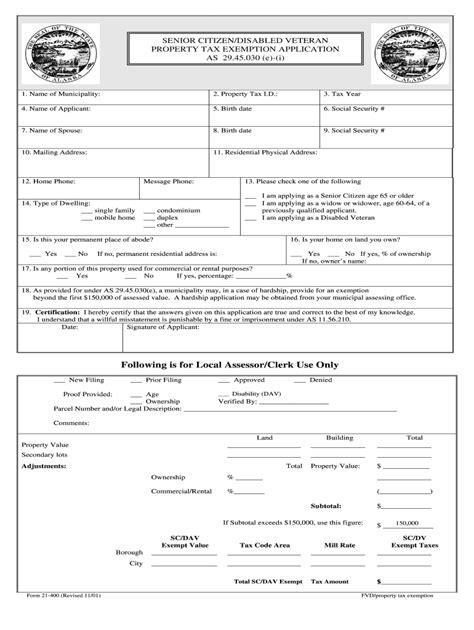

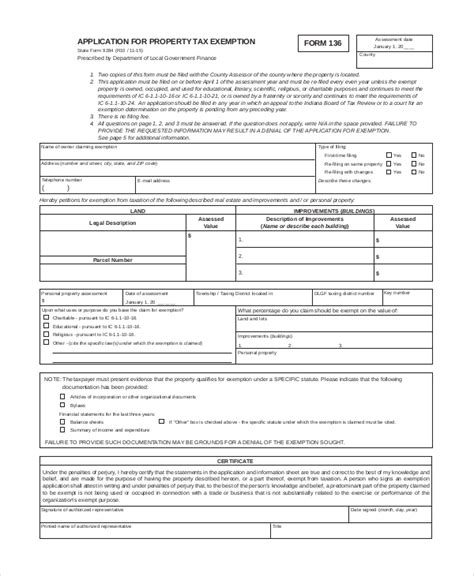

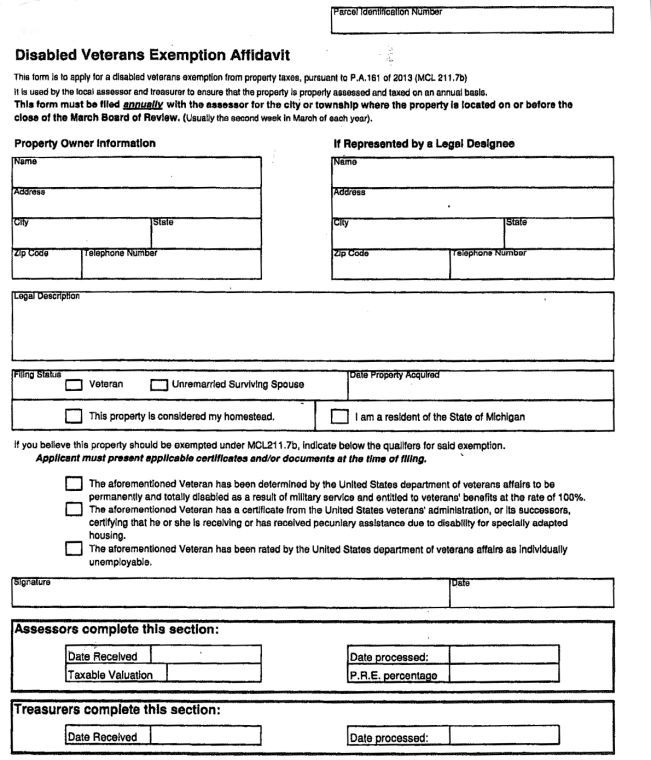

Steps to Apply for the New Jersey Veteran Exemption

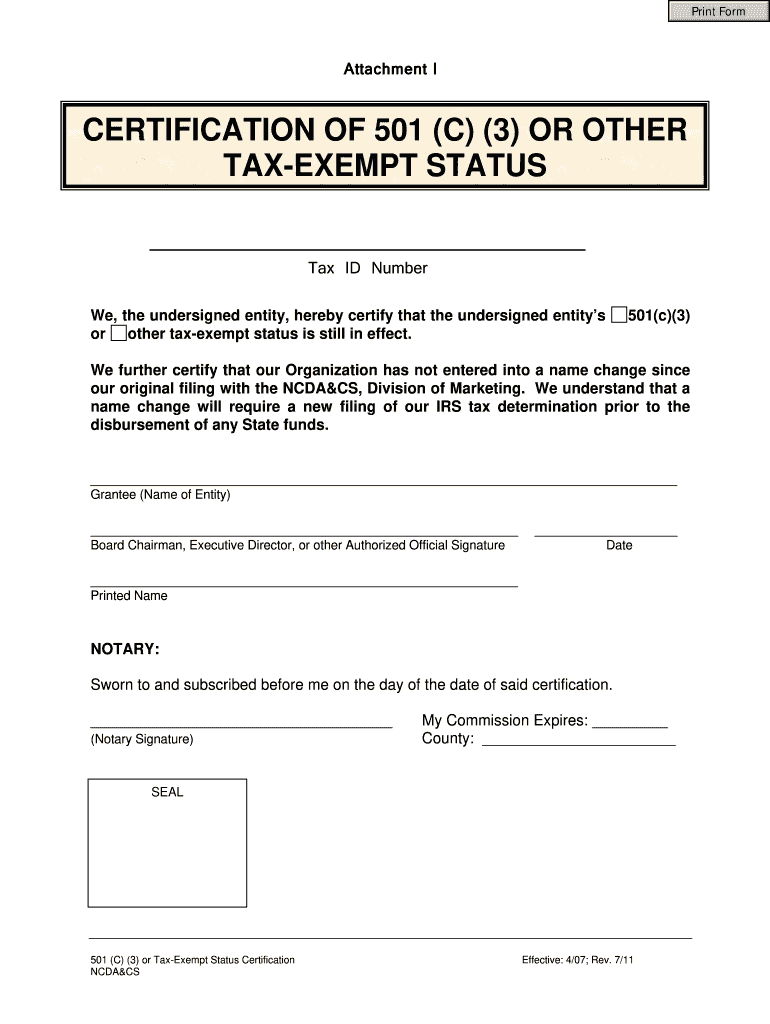

Applying for the Veteran Exemption in New Jersey involves several steps: - Gather Required Documents: This includes your DD Form 214 (discharge papers), proof of New Jersey residency, and proof of property ownership. - Obtain the Application Form: You can usually find the application form on the website of your local tax assessor’s office or by visiting their office in person. - Fill Out the Application: Carefully complete the application form, ensuring all information is accurate and complete. - Submit the Application: Return the application, along with the required supporting documents, to your local tax assessor’s office.

Checking Your New Jersey Veteran Exemption Status

After submitting your application, you might wonder how to check the status of your Veteran Exemption. Here are the steps: - Contact Your Local Tax Assessor: The most direct way to check the status of your application is by contacting your local tax assessor’s office. They can provide you with the most current information regarding your application. - Online Portal: Some municipalities offer online portals where you can check the status of your applications, including the Veteran Exemption. Check your local government’s website for this option. - Follow-Up: If you haven’t received a decision within the expected timeframe, consider following up with a phone call or visit to the tax assessor’s office.

Benefits of the New Jersey Veteran Exemption

The New Jersey Veteran Exemption offers significant benefits to eligible veterans, including: - Property Tax Reduction: The exemption can lead to a substantial reduction in property taxes, providing financial relief to veterans. - Increased Affordability: By reducing the property tax burden, the exemption can make homeownership more affordable for veterans. - Recognition of Service: The exemption serves as a form of recognition and appreciation for the service and sacrifices made by veterans.

Common Issues and Solutions

During the application process, you might encounter some issues. Here are a few common ones and their solutions: - Incomplete Application: Ensure all parts of the application are filled out, and all required documents are submitted. - Eligibility Concerns: If there are questions about your eligibility, consult with your local tax assessor or a veterans’ service organization. - Application Delay: If your application is delayed, follow up with the tax assessor’s office to check on the status.

📝 Note: Keeping detailed records of your application, including submission dates and communication with the tax assessor's office, can be helpful in tracking the status of your exemption and resolving any issues that may arise.

Conclusion and Final Thoughts

In conclusion, the New Jersey Veteran Exemption is a valuable benefit that recognizes the sacrifices of the state’s veterans. By understanding the eligibility criteria, application process, and how to check your exemption status, you can ensure you receive the benefits you deserve. Remember, the application process might vary slightly depending on your location within New Jersey, so always verify the specific requirements and procedures with your local tax assessor’s office.

What is the New Jersey Veteran Exemption?

+

The New Jersey Veteran Exemption is a property tax exemption available to eligible veterans who own property in New Jersey, aimed at reducing their property tax burden.

How do I apply for the New Jersey Veteran Exemption?

+

To apply, gather the required documents, obtain and fill out the application form, and submit it along with your documents to your local tax assessor’s office.

How long does it take to process the Veteran Exemption application?

+

The processing time can vary, but it’s generally a few weeks to a few months. It’s a good idea to follow up with your local tax assessor’s office if you haven’t received a decision within the expected timeframe.