Claim PPI Without Paperwork

Introduction to PPI Claims

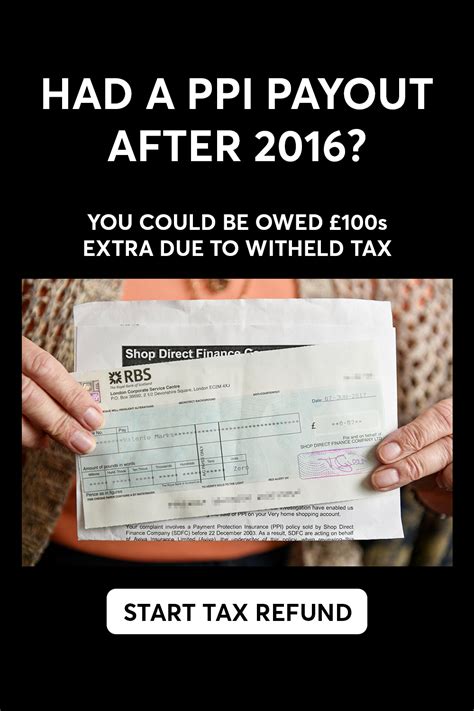

The Payment Protection Insurance (PPI) scandal has been one of the most significant financial mis-selling scandals in the UK, affecting millions of consumers. PPI was designed to cover loan or credit card payments if the policyholder became unable to work due to illness, accident, or unemployment. However, many policies were mis-sold to people who did not need them or would not be eligible to claim. If you believe you were mis-sold PPI, you might be eligible for a refund, even without the original paperwork.

Understanding the PPI Claims Process

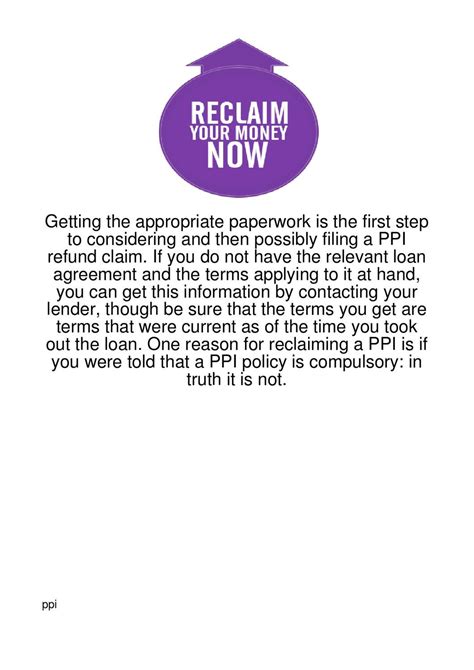

The process of claiming back PPI can seem daunting, especially if you no longer have the paperwork related to your loan or credit card. However, it’s essential to remember that the lack of paperwork does not necessarily mean you cannot make a claim. Many people have successfully claimed PPI without the original documents. The first step in the process is to check if you had PPI on any of your loans or credit cards. This can often be done by checking old bank statements or contacting your bank directly.

Steps to Claim PPI Without Paperwork

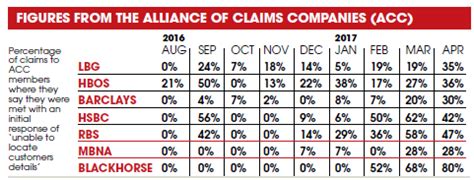

To claim PPI without paperwork, follow these steps: - Contact Your Bank: Reach out to your bank or lender and ask if they have any records of PPI being added to your account. They may be able to provide you with information or direct you to someone who can help with your claim. - Check Old Statements: If you have kept any old bank statements or loan documents, check them for any references to PPI. Sometimes, the premiums were deducted directly from your loan or credit card payments. - Use a Claims Management Company: If you’re not sure where to start or prefer someone to handle your claim on your behalf, consider using a reputable claims management company. They can help navigate the process and may have access to resources that can aid in locating missing information. - Submit a Formal Complaint: If your bank or lender agrees that you were mis-sold PPI, they will typically offer a refund. If they disagree, you can submit a formal complaint to the Financial Ombudsman Service (FOS), who will investigate your claim.

Benefits of Claiming PPI

Claiming back mis-sold PPI can have significant financial benefits. Many people have received thousands of pounds in refunds, which can be a substantial sum, especially for those who were struggling financially due to the mis-sold policies. Additionally, the process of claiming can help bring closure and a sense of justice to those who were wrongly sold these policies.

Common Reasons for Mis-selling

PPI was often mis-sold for several reasons, including: - The policyholder was not eligible to claim (e.g., they were self-employed or retired). - The policyholder was not fully informed about the policy’s terms and conditions. - The policy was added without the consumer’s knowledge or consent. - The consumer was told it was compulsory to have PPI to secure the loan.

Timeline for PPI Claims

It’s essential to be aware of the timeline for making PPI claims. In the past, there was a deadline for submitting claims, but this deadline has passed. However, if you believe you were mis-sold PPI and have not yet made a claim, it’s crucial to start the process as soon as possible, as new deadlines or changes in regulations could affect your ability to claim in the future.

📝 Note: The lack of paperwork should not deter you from pursuing a claim. Banks and lenders have a legal obligation to keep records, and claims management companies or the Financial Ombudsman Service can help you navigate the process.

Conclusion Summary

In summary, claiming PPI without paperwork is possible and has been successfully done by many individuals. The key is to be diligent in your search for information, persistent in your approach to your bank or lender, and open to seeking help from claims management companies or the Financial Ombudsman Service. Remember, you do not need the original paperwork to start the claims process, and the potential refund could significantly impact your financial situation.

What is PPI, and how does it work?

+

PPI, or Payment Protection Insurance, is a type of insurance that covers loan or credit card payments if the policyholder becomes unable to work due to illness, accident, or unemployment. It was often added to loans or credit cards as an extra protection, but many policies were mis-sold.

Can I claim PPI without the original paperwork?

+

Yes, you can claim PPI without the original paperwork. Banks and lenders are required to keep records, and you can contact them directly to inquire about any PPI policies associated with your accounts. Additionally, using a claims management company can help in locating missing information and navigating the claims process.

What are the common reasons for PPI mis-selling?

+

PPI was often mis-sold for several reasons, including the policyholder not being eligible to claim, not being fully informed about the policy’s terms, the policy being added without consent, or being told it was compulsory for securing the loan.