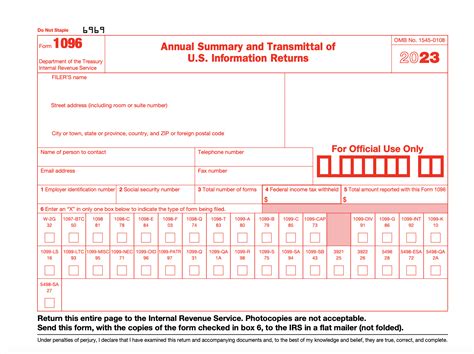

Complete 1096 Form Paperwork Easily

Introduction to 1096 Form

The 1096 form is an annual information return that the Internal Revenue Service (IRS) requires from certain filers. It is used to report various types of income, such as dividends, capital gains, and interest, as well as backup withholding. In this article, we will guide you through the process of completing the 1096 form paperwork easily and efficiently.

Who Needs to File 1096 Form

The 1096 form is typically required for payers of income who are obligated to report certain types of income to the IRS. This includes:

- Businesses that pay dividends, interest, or capital gains to their shareholders or investors

- Financial institutions that pay interest on deposits or investments

- Brokers who facilitate the sale of securities and pay proceeds to their clients

- Other entities that are required to report income to the IRS, such as estates and trusts

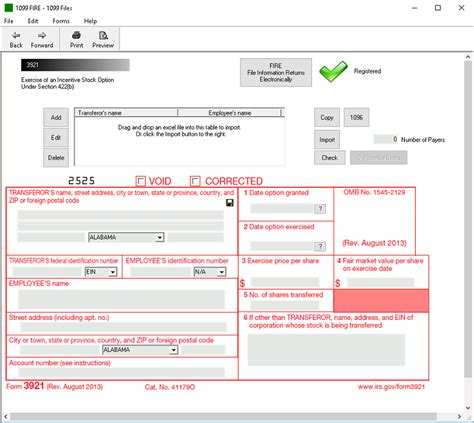

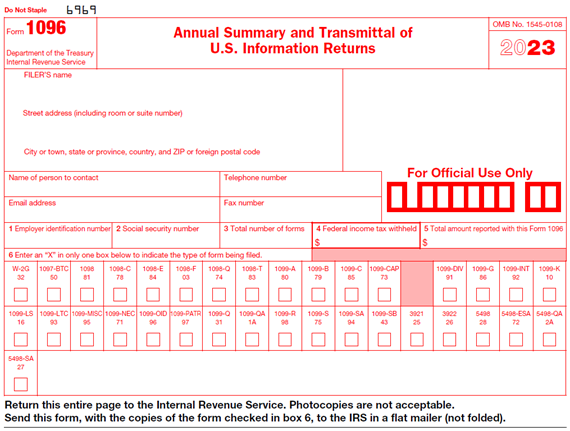

How to Complete 1096 Form

Completing the 1096 form requires careful attention to detail and accuracy. Here are the steps to follow:

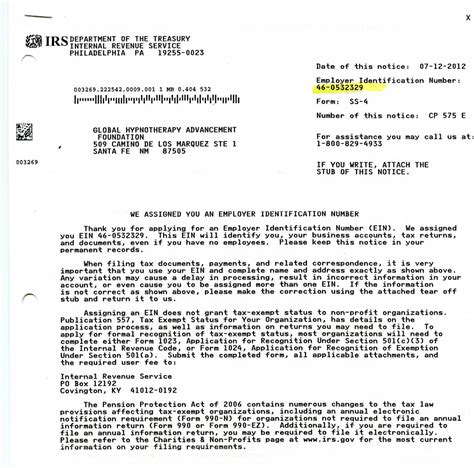

- Gather required information: You will need to gather information about the income you are reporting, including the type of income, the amount of income, and the recipient’s name and address

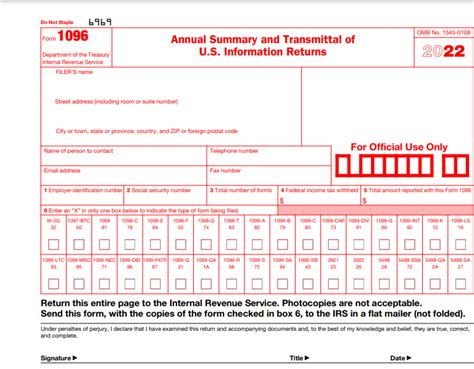

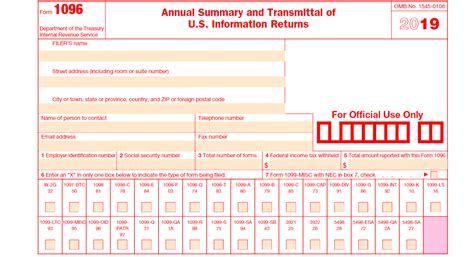

- Fill out the form: The 1096 form has several boxes and lines that need to be completed. Make sure to fill out the form accurately and legibly

- Report income: Report the income you are required to report, using the correct codes and boxes on the form

- Calculate backup withholding: If you are required to withhold backup withholding, calculate the amount and report it on the form

- Sign and date the form: Once you have completed the form, sign and date it to certify that the information is accurate and complete

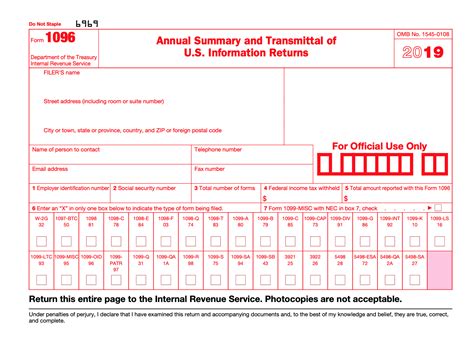

Table of 1096 Form Boxes

The 1096 form has several boxes that need to be completed. Here is a table summarizing the boxes and their corresponding information:

| Box Number | Description |

|---|---|

| 1 | Payer’s name, address, and ZIP code |

| 2 | Payer’s TIN (Taxpayer Identification Number) |

| 3 | Recipient’s name, address, and ZIP code |

| 4 | Recipient’s TIN (Taxpayer Identification Number) |

| 5 | Amount of income reported |

| 6 | Backup withholding amount |

💡 Note: Make sure to complete all required boxes and lines on the form, and to report the correct type and amount of income.

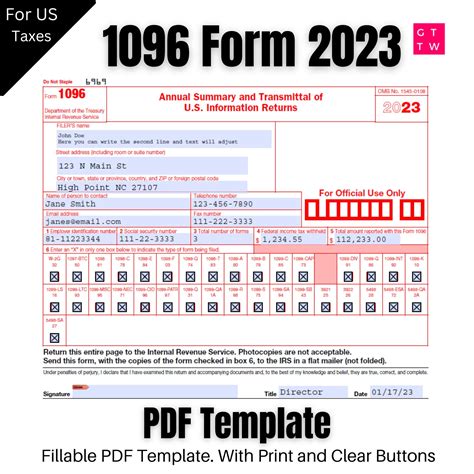

Tips for Completing 1096 Form

Here are some tips to help you complete the 1096 form easily and efficiently:

- Use the correct form: Make sure to use the correct version of the 1096 form, which can be downloaded from the IRS website or obtained from a tax professional

- Read the instructions: Read the instructions carefully before completing the form, to ensure that you understand what information is required

- Use a pen: Complete the form using a pen, as pencil marks may not be accepted by the IRS

- Keep a copy: Keep a copy of the completed form for your records, in case you need to refer to it later

Final Check

Before submitting the 1096 form, make sure to review it carefully for accuracy and completeness. Check that:

- All required boxes and lines are completed

- The form is signed and dated

- The information is accurate and complete

To finalize the process of completing the 1096 form paperwork, it is essential to ensure that all information is accurate and complete. By following the steps outlined in this article and taking the time to review the form carefully, you can complete the 1096 form easily and efficiently.

What is the purpose of the 1096 form?

+

The 1096 form is used to report various types of income, such as dividends, capital gains, and interest, as well as backup withholding.

Who needs to file the 1096 form?

+

The 1096 form is typically required for payers of income, such as businesses, financial institutions, and brokers, who are obligated to report certain types of income to the IRS.

How do I complete the 1096 form?

+

To complete the 1096 form, gather required information, fill out the form accurately and legibly, report income, calculate backup withholding, and sign and date the form.