Complete 1099 Paperwork Easily

Introduction to 1099 Paperwork

The 1099 form is a series of documents used by the Internal Revenue Service (IRS) to report various types of income that do not come from an employer. This can include freelance work, independent contracting, and other types of non-employment income. If you are self-employed or have worked as an independent contractor, you will need to complete 1099 paperwork to report your income and claim deductions.

Types of 1099 Forms

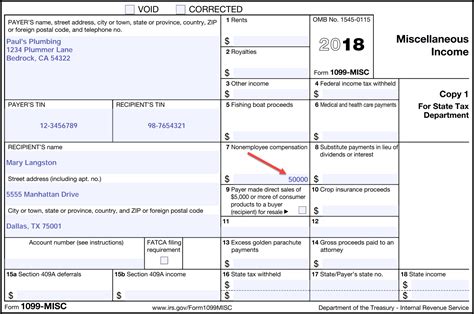

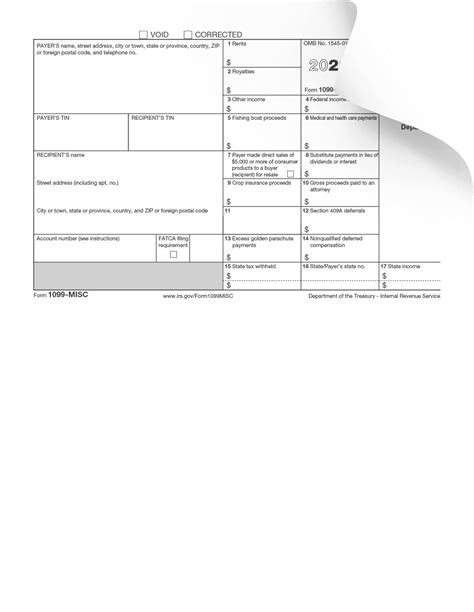

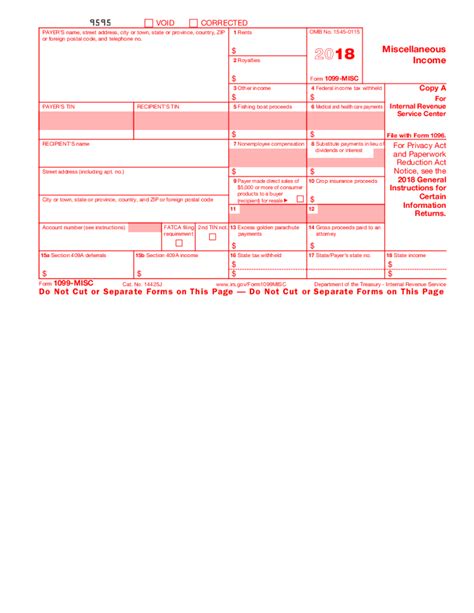

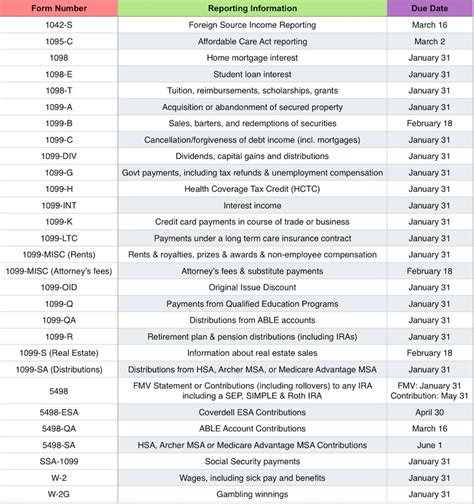

There are several types of 1099 forms, each used to report different types of income. Some of the most common types of 1099 forms include: * 1099-MISC: Used to report miscellaneous income, such as freelance work or independent contracting. * 1099-INT: Used to report interest income, such as interest earned from a savings account. * 1099-DIV: Used to report dividend income, such as income earned from owning stocks. * 1099-B: Used to report income from the sale of securities, such as stocks or bonds.

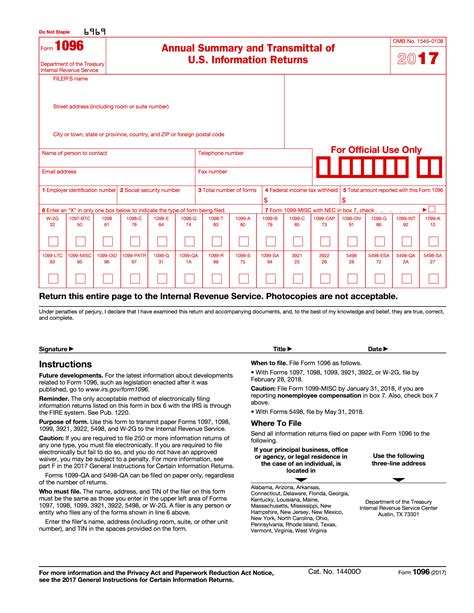

Completing 1099 Paperwork

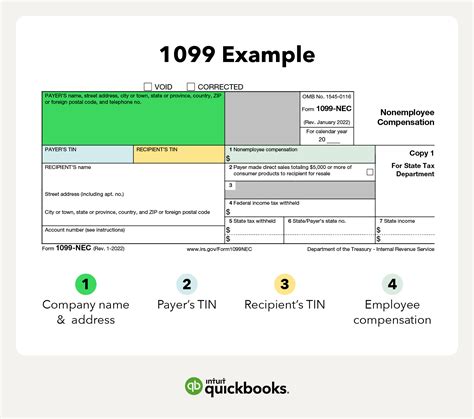

To complete 1099 paperwork, you will need to gather certain information and follow a series of steps. Here are the steps to follow: * Gather your income statements and expense records for the tax year. * Determine which type of 1099 form you need to complete. * Fill out the form with your personal and business information, including your name, address, and tax identification number. * Report your income and expenses on the form, using the information from your income statements and expense records. * Calculate your tax liability and claim any deductions you are eligible for.

Tips for Completing 1099 Paperwork

Here are some tips to help you complete 1099 paperwork easily: * Keep accurate records of your income and expenses throughout the year. * Use tax software to help you complete the form and calculate your tax liability. * Consult with a tax professional if you are unsure about how to complete the form or claim deductions. * File your paperwork on time to avoid penalties and fines.

💡 Note: Make sure to keep a copy of your completed 1099 paperwork for your records, in case you need to refer to it later.

Common Mistakes to Avoid

Here are some common mistakes to avoid when completing 1099 paperwork: * Failing to report all income, including income from freelance work or independent contracting. * Claiming incorrect deductions, such as claiming business expenses that are not eligible for deduction. * Filing paperwork late, which can result in penalties and fines. * Not keeping accurate records, which can make it difficult to complete the form and claim deductions.

Benefits of Completing 1099 Paperwork Correctly

Completing 1099 paperwork correctly can have several benefits, including: * Avoiding penalties and fines for filing late or incorrectly. * Claiming eligible deductions, which can reduce your tax liability. * Ensuring accurate reporting of your income and expenses. * Reducing stress and anxiety related to tax season.

| Type of 1099 Form | Purpose |

|---|---|

| 1099-MISC | Report miscellaneous income, such as freelance work or independent contracting. |

| 1099-INT | Report interest income, such as interest earned from a savings account. |

| 1099-DIV | Report dividend income, such as income earned from owning stocks. |

| 1099-B | Report income from the sale of securities, such as stocks or bonds. |

To summarize, completing 1099 paperwork can seem daunting, but by following the steps and tips outlined above, you can make the process easier and less stressful. Remember to keep accurate records, use tax software, and consult with a tax professional if you are unsure about how to complete the form or claim deductions. By completing 1099 paperwork correctly, you can avoid penalties and fines, claim eligible deductions, and ensure accurate reporting of your income and expenses.

What is the purpose of the 1099 form?

+

The 1099 form is used to report various types of income that do not come from an employer, such as freelance work or independent contracting.

How do I complete 1099 paperwork?

+

To complete 1099 paperwork, gather your income statements and expense records, determine which type of 1099 form you need to complete, fill out the form with your personal and business information, report your income and expenses, and calculate your tax liability.

What are the benefits of completing 1099 paperwork correctly?

+

Completing 1099 paperwork correctly can help you avoid penalties and fines, claim eligible deductions, ensure accurate reporting of your income and expenses, and reduce stress and anxiety related to tax season.