5 Merger Paperwork Tips

Introduction to Merger Paperwork

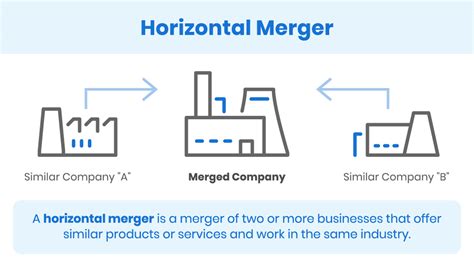

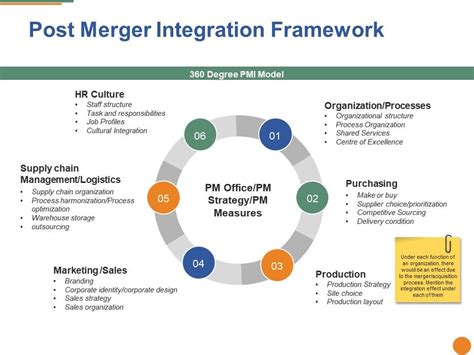

When two companies decide to merge, the process involves a significant amount of paperwork. This paperwork is crucial as it outlines the terms of the merger, including the valuation of the companies, the ownership structure after the merger, and the responsibilities of each party. Merger paperwork can be complex and requires careful attention to detail to ensure that all aspects of the merger are properly documented. In this article, we will discuss five tips for handling merger paperwork effectively.

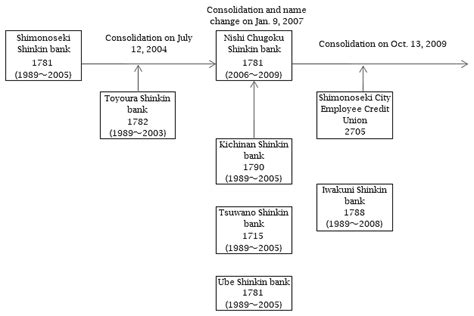

Tip 1: Understand the Types of Merger Documents

There are several types of documents involved in a merger, including merger agreements, asset purchase agreements, and stock purchase agreements. Each of these documents serves a specific purpose and must be carefully drafted to reflect the terms of the merger. For example, a merger agreement outlines the general terms of the merger, including the purchase price and the closing conditions. Understanding the purpose and content of each document is essential for navigating the merger process.

Tip 2: Ensure Compliance with Regulatory Requirements

Mergers are subject to various regulatory requirements, including those related to antitrust law and securities law. Companies must ensure that their merger paperwork complies with these requirements to avoid legal issues. This may involve filing notifications with regulatory agencies, such as the Federal Trade Commission (FTC), and obtaining approvals before the merger can be completed.

Tip 3: Conduct Thorough Due Diligence

Due diligence is a critical step in the merger process. It involves a thorough review of the target company’s financial condition, legal status, and business operations. This review helps the acquiring company to identify potential risks and liabilities, which can then be addressed in the merger paperwork. Some key areas to focus on during due diligence include: * Financial statements and accounting records * Contracts and agreements with suppliers, customers, and employees * Intellectual property rights and potential infringement issues * Pending or threatened legal proceedings

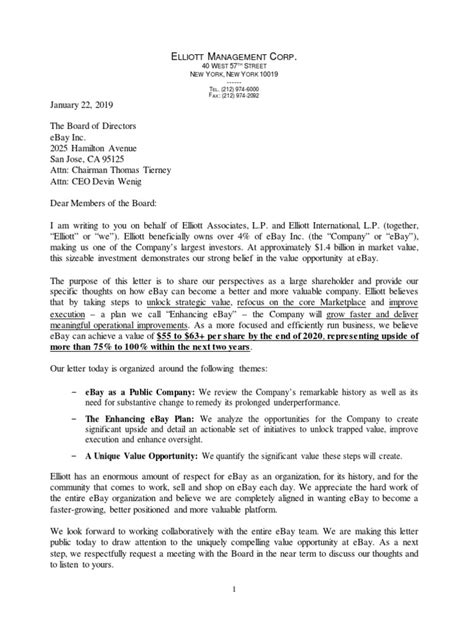

Tip 4: Negotiate the Terms of the Merger

The merger paperwork should reflect the terms of the merger that have been negotiated between the parties. This includes the purchase price, the payment structure, and any conditions that must be met before the merger can be completed. Negotiation is a critical aspect of the merger process, and companies should be prepared to advocate for their interests while also being flexible and open to compromise.

Tip 5: Seek Professional Advice

Merger paperwork can be complex and requires specialized knowledge and expertise. Companies should seek the advice of lawyers, accountants, and other professionals to ensure that their merger paperwork is accurate and comprehensive. These advisors can help companies to navigate the merger process, identify potential issues, and negotiate the best possible terms.

💡 Note: It is essential to have a clear understanding of the merger process and the associated paperwork to avoid potential pitfalls and ensure a successful outcome.

The process of merging two companies involves a significant amount of paperwork, which must be carefully prepared and negotiated to ensure a successful outcome. By understanding the types of merger documents, ensuring compliance with regulatory requirements, conducting thorough due diligence, negotiating the terms of the merger, and seeking professional advice, companies can navigate the merger process with confidence.

In wrapping things up, it’s clear that merger paperwork is a critical component of the merger process. Companies must be diligent in their preparation and negotiation of these documents to ensure that their interests are protected and that the merger is successful. With the right approach and expertise, companies can overcome the challenges of merger paperwork and achieve their strategic objectives.

What is the purpose of a merger agreement?

+

A merger agreement outlines the general terms of the merger, including the purchase price and the closing conditions.

Why is due diligence important in a merger?

+

Due diligence is important because it allows the acquiring company to identify potential risks and liabilities, which can then be addressed in the merger paperwork.

What are some common types of merger documents?

+

Common types of merger documents include merger agreements, asset purchase agreements, and stock purchase agreements.