5 Tips Closing Paperwork

Introduction to Closing Paperwork

When it comes to finalizing a real estate transaction, closing paperwork is a crucial step that requires attention to detail and a thorough understanding of the process. The closing process involves the transfer of ownership of a property from the seller to the buyer, and it is essential to ensure that all paperwork is completed accurately and efficiently. In this article, we will provide 5 tips for closing paperwork to help you navigate this complex process.

Tip 1: Review and Understand the Contract

Before starting the closing process, it is essential to review and understand the contract. The contract outlines the terms and conditions of the sale, including the price, payment terms, and any contingencies. Make sure you understand all the clauses and provisions, including any inspections, appraisals, or financing conditions. If you have any questions or concerns, do not hesitate to ask your real estate agent or attorney for clarification.

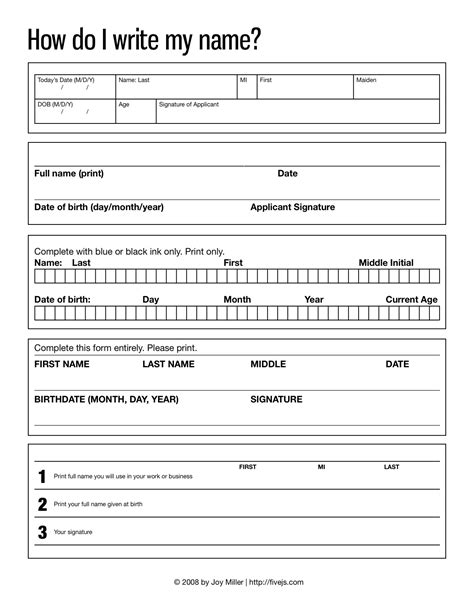

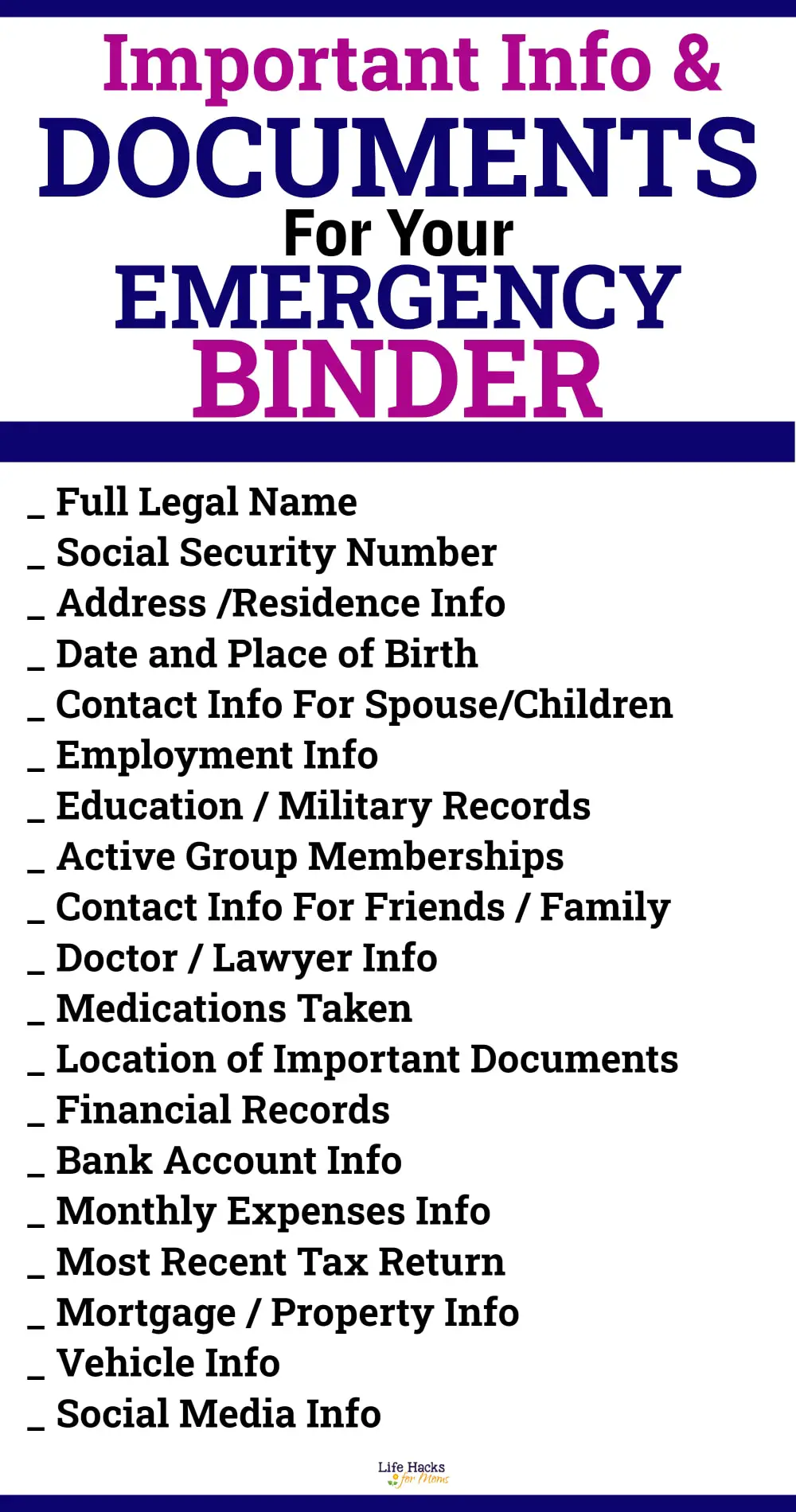

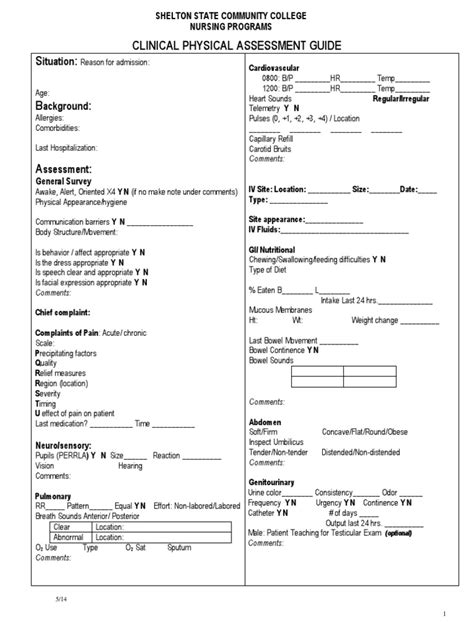

Tip 2: Gather All Necessary Documents

To ensure a smooth closing process, it is crucial to gather all necessary documents. These may include: * Identification documents, such as a driver’s license or passport * Proof of income, such as pay stubs or tax returns * Proof of insurance, such as a homeowner’s insurance policy * Title report, which shows the ownership history of the property * Appraisal report, which provides an independent assessment of the property’s value Make sure you have all the required documents in order to avoid any delays in the closing process.

Tip 3: Conduct a Final Walk-Through

Before closing, it is essential to conduct a final walk-through of the property to ensure that it is in the expected condition. Check for any damage or issues that may have arisen since the inspection, and make sure that all appliances and fixtures are in working order. This is also an opportunity to verify that all repairs agreed upon in the contract have been completed.

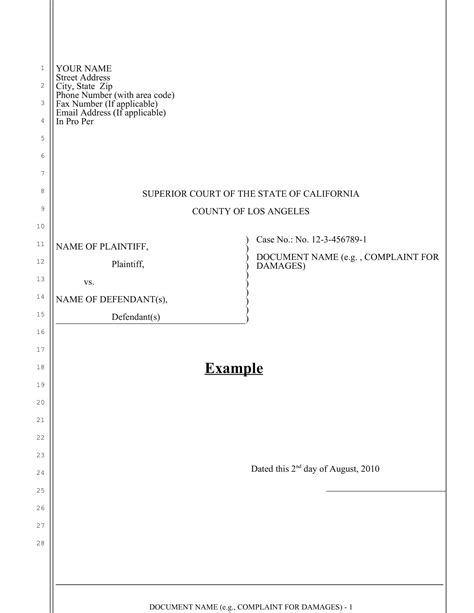

Tip 4: Review and Sign the Closing Documents

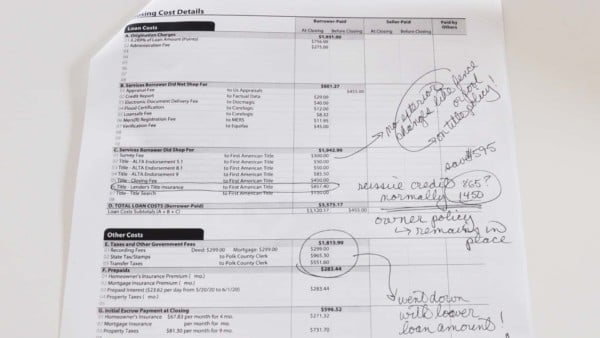

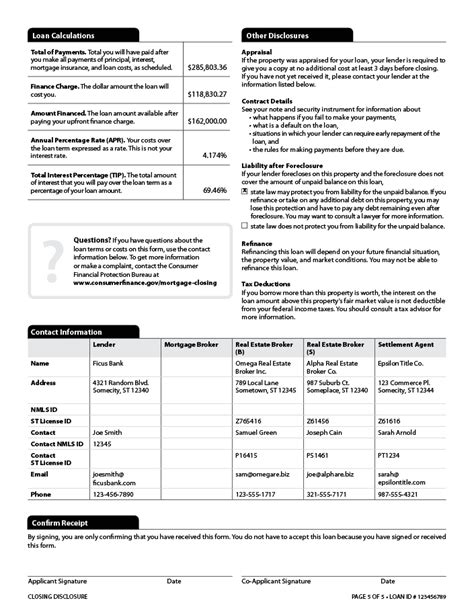

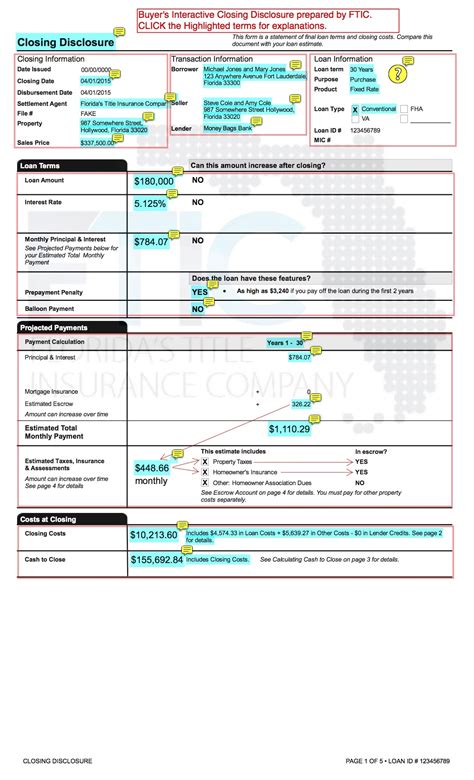

At the closing meeting, you will be required to review and sign the closing documents. These documents may include: * Deed, which transfers ownership of the property * Mortgage note, which outlines the terms of the loan * Security instrument, such as a mortgage or deed of trust * Title insurance policy, which protects against any defects in the title Make sure you understand all the documents and ask questions if you are unsure about any aspect of the closing process.

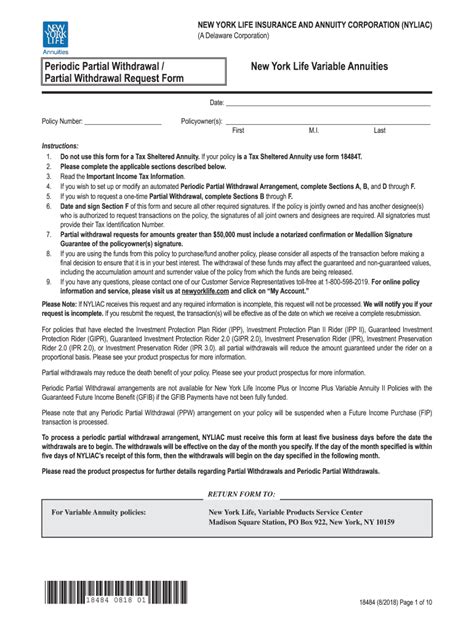

Tip 5: Ensure Funding and Payment

Finally, it is essential to ensure funding and payment for the purchase. This may involve wiring funds to the title company or bringing a cashier’s check to the closing meeting. Make sure you have sufficient funds to cover all closing costs, including title insurance, appraisal fees, and loan origination fees.

| Document | Description |

|---|---|

| Contract | Outlines the terms and conditions of the sale |

| Identification documents | Proof of identity, such as a driver's license or passport |

| Proof of income | Documentation of income, such as pay stubs or tax returns |

| Proof of insurance | Homeowner's insurance policy |

| Title report | Shows the ownership history of the property |

| Appraisal report | Independent assessment of the property's value |

📝 Note: It is essential to review and understand all documents before signing, and to ask questions if you are unsure about any aspect of the closing process.

As we have discussed, closing paperwork is a critical step in the real estate transaction process. By following these 5 tips for closing paperwork, you can ensure a smooth and efficient closing process. Remember to review and understand the contract, gather all necessary documents, conduct a final walk-through, review and sign the closing documents, and ensure funding and payment. With careful attention to detail and a thorough understanding of the process, you can navigate the closing process with confidence and ensure a successful transaction.

What is the purpose of a title report?

+

The purpose of a title report is to show the ownership history of the property and to identify any potential issues with the title.

What is the difference between a mortgage note and a security instrument?

+

A mortgage note outlines the terms of the loan, while a security instrument, such as a mortgage or deed of trust, provides security for the loan by pledging the property as collateral.

What is the purpose of a final walk-through?

+

The purpose of a final walk-through is to ensure that the property is in the expected condition and to verify that all repairs agreed upon in the contract have been completed.