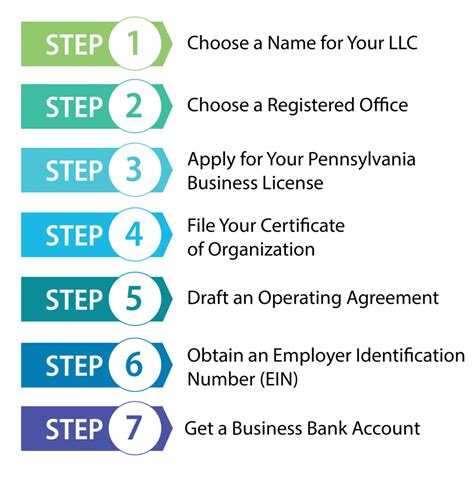

5 Steps To File LLC

Introduction to Forming an LLC

Forming a Limited Liability Company (LLC) is a significant step for entrepreneurs and small business owners, offering a unique combination of liability protection and tax benefits. The process of filing an LLC can seem daunting, but breaking it down into manageable steps makes it more accessible. This guide will walk you through the essential steps to file an LLC, ensuring you understand the requirements and can navigate the process with confidence.

Step 1: Choose a Business Name

The first step in filing an LLC is to choose a business name. This name must be unique and comply with the state’s naming requirements. It’s crucial to ensure the name isn’t already in use by searching the state’s business database. Additionally, the name must include a designator that indicates it’s an LLC, such as “LLC” or “Limited Liability Company.” It’s also a good idea to check if the desired business name has an available web domain and social media handles to maintain brand consistency across all platforms.

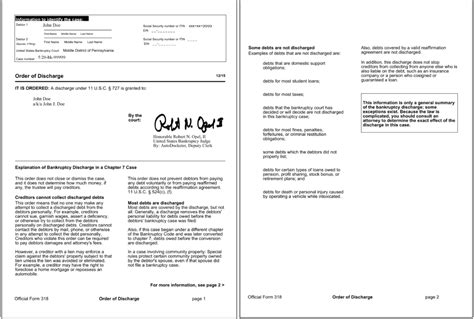

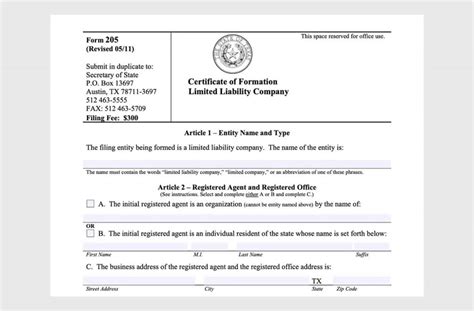

Step 2: Prepare and File Articles of Organization

The next step involves preparing and filing the Articles of Organization with the state. This document provides basic information about the LLC, including its name, address, and the names of its members or managers. The specific requirements for the Articles of Organization can vary by state, so it’s essential to check with the state’s business registration office for the most accurate and up-to-date information. Filing fees also vary by state, ranging from a couple of hundred to several hundred dollars.

Step 3: Obtain an EIN and Open a Business Bank Account

After the LLC is officially formed, the next step is to obtain an Employer Identification Number (EIN) from the IRS. The EIN is used for tax purposes and is required to open a business bank account. Having a separate business bank account is crucial for maintaining the financial separation between personal and business assets, which is a key benefit of forming an LLC. To open a business bank account, you’ll typically need the EIN, a copy of the Articles of Organization, and a business license or other identification.

Step 4: Create an Operating Agreement

An operating agreement outlines the ownership and operating structure of the LLC. While not all states require an operating agreement, it’s highly recommended to have one in place. This document can help prevent misunderstandings and disputes among members by clearly defining roles, responsibilities, and profit-sharing arrangements. The operating agreement should be tailored to the specific needs and goals of the business and its members.

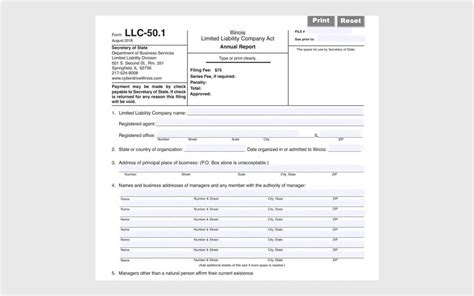

Step 5: Comply with Ongoing Requirements

The final step involves complying with the ongoing requirements for maintaining an LLC. These requirements can include filing annual reports with the state, maintaining a registered agent, and adhering to local business licenses and permits. Compliance with these requirements is essential to avoid fines, penalties, and even the dissolution of the LLC. It’s a good practice to keep detailed records and set reminders for upcoming deadlines to ensure the LLC remains in good standing.

💡 Note: The specific requirements for forming and maintaining an LLC can vary significantly by state, so it's important to consult with a legal or business advisor to ensure all steps are correctly followed.

As you navigate the process of filing an LLC, remember that each step is crucial for establishing a strong foundation for your business. By carefully choosing a business name, filing the necessary documents, obtaining an EIN, creating an operating agreement, and complying with ongoing requirements, you can set your business up for success and protect your personal assets.

In wrapping up the process of forming an LLC, it’s clear that while the steps may seem complex, they are manageable with the right guidance. Understanding and complying with these steps is essential for any entrepreneur or small business owner looking to establish a solid legal and financial foundation for their venture. By following these steps and seeking professional advice when needed, you can ensure your business is well-positioned for growth and success.

What are the benefits of forming an LLC?

+

Forming an LLC offers several benefits, including liability protection, tax benefits, and flexibility in management structure. It helps protect personal assets in case the business is sued and can provide pass-through taxation, avoiding double taxation.

How long does it take to form an LLC?

+

The time it takes to form an LLC can vary by state. In some states, it’s possible to form an LLC in as little as 24 hours with expedited processing, while in others, it may take several weeks or even months for the state to process the filing.

Do I need a lawyer to form an LLC?

+

While it’s possible to form an LLC without a lawyer, seeking legal advice can be beneficial, especially for complex business structures or when there are multiple members involved. A lawyer can help ensure all paperwork is correctly filed and that the operating agreement is comprehensive and fair.