5 Steps Domestic Partner Filing

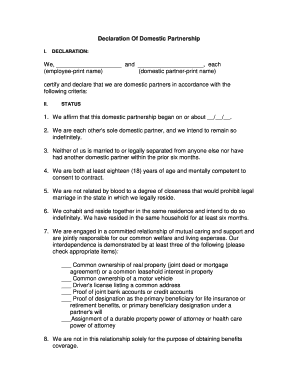

Understanding Domestic Partner Filing

When it comes to filing taxes, domestic partners have several options to consider. The process can be complex, but understanding the steps involved can help make it more manageable. In this article, we will explore the 5 steps to domestic partner filing, providing a comprehensive guide to help you navigate the process.

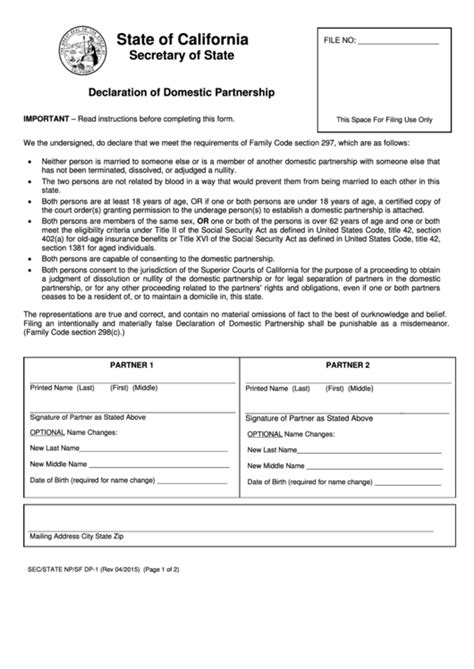

Step 1: Determine Your Filing Status

The first step in domestic partner filing is to determine your filing status. This will depend on the laws of your state and the type of partnership you are in. Some states recognize domestic partnerships, while others do not. If you are in a state that recognizes domestic partnerships, you may be able to file jointly. However, if you are in a state that does not recognize domestic partnerships, you may need to file separately. It is essential to consult with a tax professional to determine the best filing status for your situation.

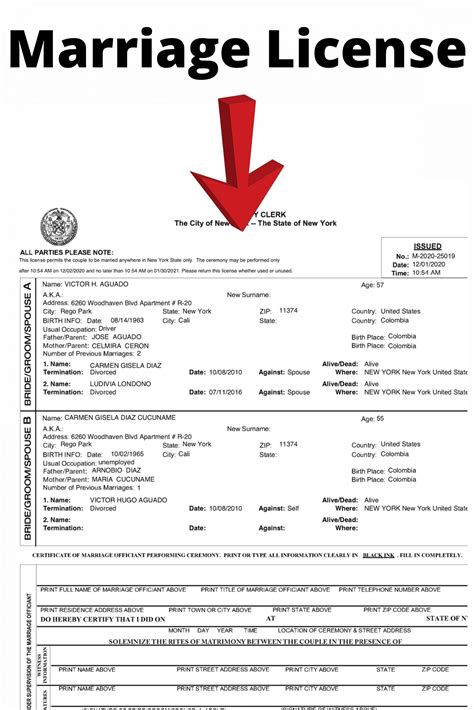

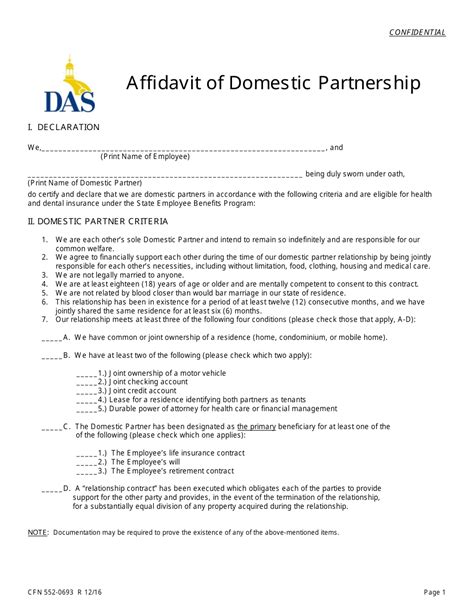

Step 2: Gather Required Documents

To file taxes as domestic partners, you will need to gather several important documents. These may include: * W-2 forms from your employer * 1099 forms for any freelance or contract work * Interest statements from banks and investments * Charitable donation receipts * Medical expense receipts * Any other relevant tax documents It is crucial to have all of these documents organized and readily available to ensure a smooth filing process.

Step 3: Choose a Filing Method

There are several filing methods to choose from, including: * E-filing: This is the fastest and most convenient method, allowing you to file your taxes electronically. * Paper filing: This method involves mailing your tax return to the IRS. * Tax software: You can use tax software, such as TurboTax or H&R Block, to guide you through the filing process. * Tax professional: You can also hire a tax professional to handle your filing for you. Consider your comfort level with tax law and your personal preferences when choosing a filing method.

Step 4: Report Income and Deductions

When filing taxes as domestic partners, you will need to report your income and deductions. This includes: * Reporting all income, including wages, salaries, and tips * Claiming deductions, such as charitable donations and medical expenses * Claiming credits, such as the earned income tax credit It is essential to accurately report your income and deductions to avoid any potential penalties or audits.

Step 5: File and Pay Taxes

The final step in domestic partner filing is to file and pay your taxes. Make sure to submit your tax return by the deadline, which is typically April 15th. You can pay any owed taxes online, by phone, or by mail. If you are due a refund, you can expect to receive it within a few weeks of filing.

📝 Note: It is crucial to keep accurate records of your tax filing, including receipts and documentation, in case of an audit or if you need to reference your return in the future.

In addition to these steps, it is essential to consider the tax implications of domestic partnership. This may include: * Joint ownership of property * Shared financial responsibilities * Tax benefits, such as joint filing and shared deductions Consult with a tax professional to understand the tax implications of your domestic partnership and to ensure you are taking advantage of all available benefits.

The following table provides a summary of the 5 steps to domestic partner filing:

| Step | Description |

|---|---|

| 1 | Determine your filing status |

| 2 | Gather required documents |

| 3 | Choose a filing method |

| 4 | Report income and deductions |

| 5 | File and pay taxes |

As you navigate the process of domestic partner filing, it is essential to stay organized and informed. By following these 5 steps and considering the tax implications of your domestic partnership, you can ensure a smooth and successful filing experience. In the end, it is crucial to review and understand your tax return to ensure accuracy and compliance with tax law.

What is the deadline for filing taxes as domestic partners?

+

The deadline for filing taxes as domestic partners is typically April 15th.

Can domestic partners file jointly in all states?

+

No, domestic partners can only file jointly in states that recognize domestic partnerships.

What are the tax benefits of domestic partnership?

+

The tax benefits of domestic partnership include joint filing, shared deductions, and potential tax credits.