File Reciprocal Tax Paperwork Easily

Introduction to Reciprocal Tax

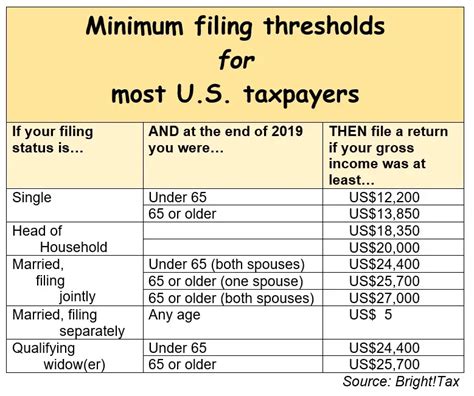

When it comes to managing finances, particularly for individuals who work in multiple states or countries, understanding and navigating tax laws can be complex. One aspect of this complexity is reciprocal tax, which affects how income earned in different jurisdictions is taxed. Reciprocal tax agreements are designed to simplify this process by eliminating the need for individuals to file tax returns in multiple states or countries, thereby reducing the burden of double taxation. In this article, we will delve into the world of reciprocal tax, explore its implications, and provide a step-by-step guide on how to file reciprocal tax paperwork easily.

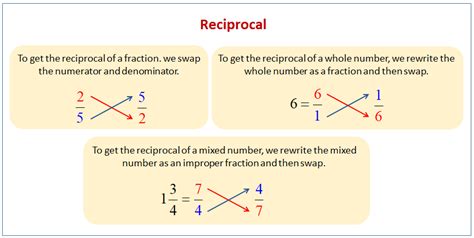

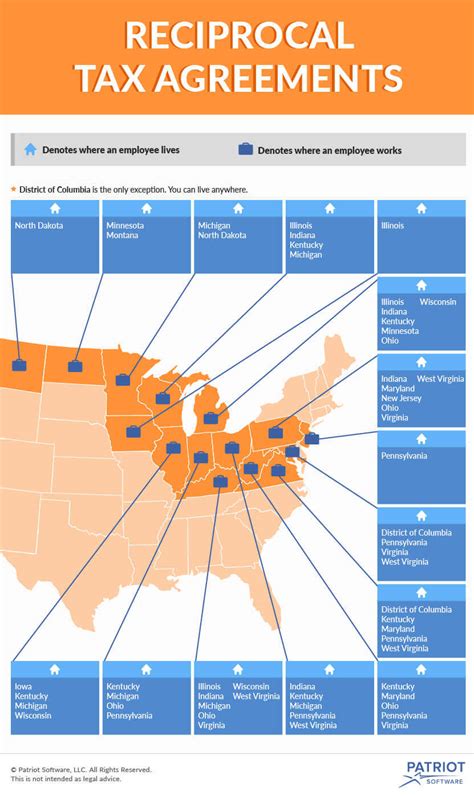

Understanding Reciprocal Tax Agreements

Reciprocal tax agreements are essentially treaties between two or more states or countries that aim to avoid double taxation and fiscal evasion. These agreements outline which country has the right to tax different types of income, ensuring that individuals and businesses are not subjected to taxation on the same income in more than one jurisdiction. For instance, if an individual lives in one state but works in another, a reciprocal tax agreement between those states can determine which state is entitled to tax the individual’s income, thus preventing double taxation.

Benefits of Reciprocal Tax Agreements

The benefits of reciprocal tax agreements are multifaceted: - Reduction in Tax Liability: By avoiding double taxation, individuals and businesses can reduce their overall tax liability. - Simplification of Tax Compliance: Reciprocal tax agreements simplify the tax filing process, as individuals may only need to file a tax return in one jurisdiction. - Promotion of Cross-Border Investment and Employment: These agreements can encourage investment and employment across borders by eliminating the complexity and cost associated with navigating multiple tax systems.

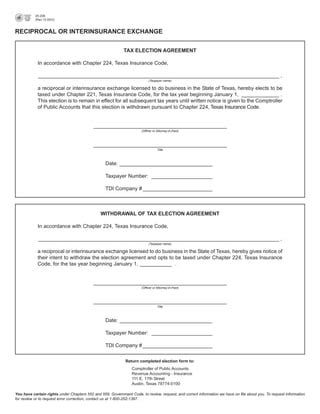

Filing Reciprocal Tax Paperwork: A Step-by-Step Guide

Filing reciprocal tax paperwork involves several steps that individuals must carefully follow to ensure compliance with tax laws and to benefit from the agreements in place.

- Determine Eligibility: The first step is to determine if you are eligible for reciprocal tax benefits. This involves checking if there is a reciprocal tax agreement between your country or state of residence and the country or state where you earn income.

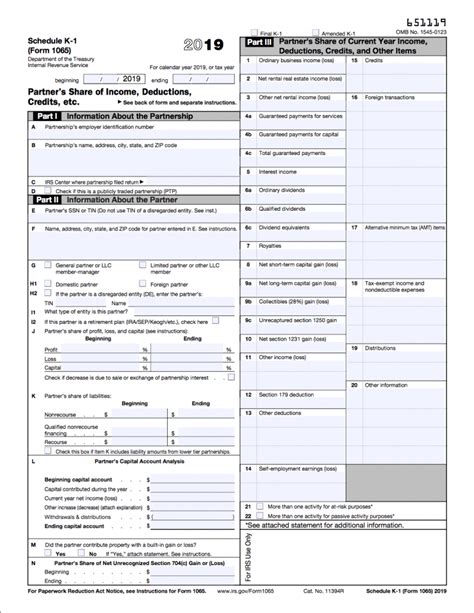

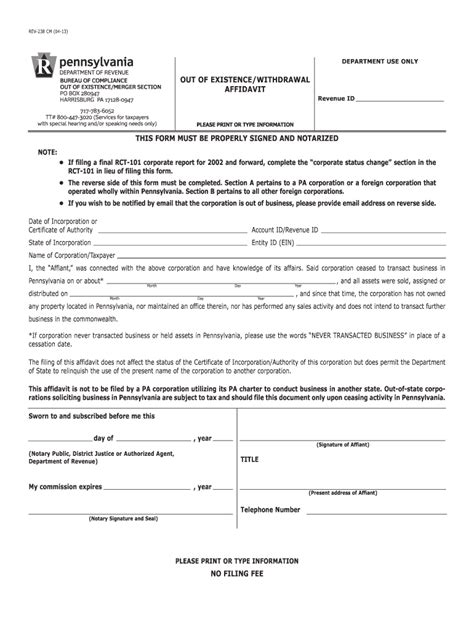

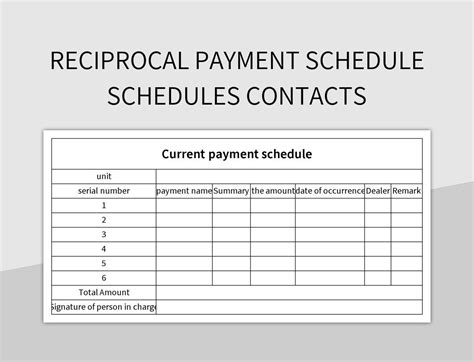

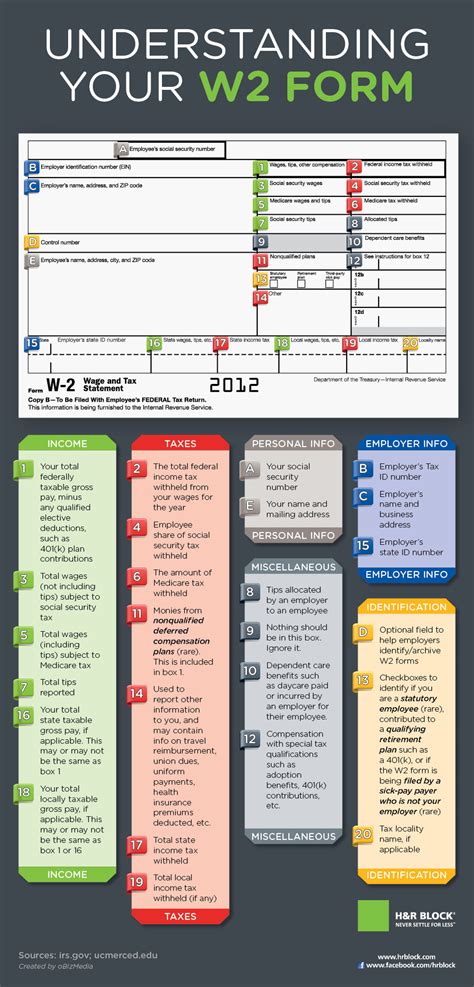

- Gather Necessary Documents: You will need to gather all relevant documents, including proof of residency, income statements, and any other documentation required by the tax authorities in the jurisdictions involved.

- Complete Tax Forms: Fill out the tax forms for the jurisdiction that has the right to tax your income, according to the reciprocal tax agreement. Ensure that you claim the appropriate credits or exemptions for taxes paid in other jurisdictions.

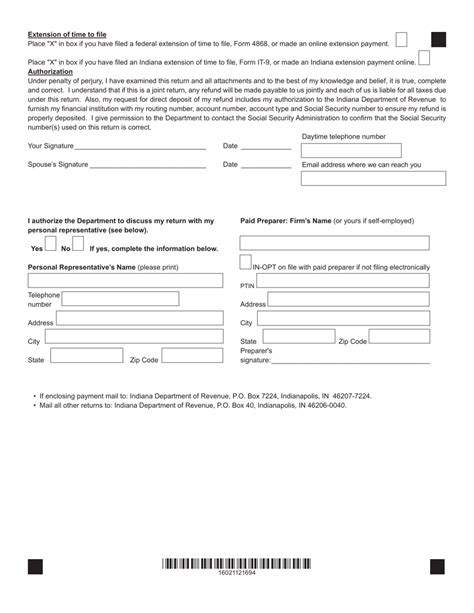

- Submit Tax Returns: Submit your tax returns to the relevant tax authority, ensuring that you meet the deadline to avoid penalties.

- Claim Refunds: If you have overpaid taxes in any jurisdiction due to double taxation, you may be eligible for a refund. Follow the procedures outlined by the tax authority to claim your refund.

Important Considerations

When dealing with reciprocal tax agreements, it is crucial to be aware of the following: - Deadlines: Be mindful of tax filing deadlines in all relevant jurisdictions to avoid late filing penalties. - Documentation: Keep detailed records of all income and taxes paid, as these will be essential for filing tax returns and claiming refunds. - Professional Advice: Given the complexity of tax laws, consider seeking advice from a tax professional to ensure you are taking full advantage of reciprocal tax agreements and complying with all tax obligations.

📝 Note: The specifics of reciprocal tax agreements and the process for filing reciprocal tax paperwork can vary significantly between jurisdictions. It is essential to consult the tax authorities' websites or seek professional advice for the most accurate and up-to-date information.

Conclusion and Future Outlook

In conclusion, navigating the world of reciprocal tax requires a deep understanding of the agreements in place and the steps necessary to comply with tax laws while minimizing tax liability. As the global economy continues to evolve, the importance of reciprocal tax agreements will only grow, providing a framework for individuals and businesses to operate across borders with clarity and efficiency. By following the guidelines outlined in this article and staying informed about developments in tax laws and agreements, individuals can ensure they are well-equipped to manage their tax obligations effectively.

What is the purpose of a reciprocal tax agreement?

+

The purpose of a reciprocal tax agreement is to avoid double taxation and fiscal evasion by determining which country has the right to tax different types of income.

How do I determine if I am eligible for reciprocal tax benefits?

+

To determine eligibility, check if there is a reciprocal tax agreement between your country or state of residence and the country or state where you earn income. Then, review the agreement’s terms to see if your situation qualifies for benefits.

What documents do I need to file reciprocal tax paperwork?

+

You will need proof of residency, income statements, and any other documentation required by the tax authorities in the jurisdictions involved. The specific documents needed can vary, so it’s essential to check with the relevant tax authorities.