Paperwork

Etsy Shop Paperwork Made Easy

Introduction to Etsy Shop Paperwork

Setting up an Etsy shop can be an exciting venture, allowing you to turn your passion into a business. However, amidst the creativity and product development, it’s easy to overlook the importance of paperwork. Proper documentation and legal compliance are crucial for the success and legitimacy of your Etsy shop. In this guide, we’ll walk through the essential paperwork you need to get started and maintain a thriving Etsy business.

Understanding Legal Requirements

Before diving into the specifics of paperwork, it’s vital to understand the legal requirements for running an Etsy shop. These can vary depending on your location, the type of products you sell, and your business structure. Key legal considerations include: - Business Registration: Registering your business, whether as a sole proprietorship, LLC, or other structures, is essential for legal and tax purposes. - Taxes: Understanding your tax obligations, including sales tax, income tax, and potentially VAT if you’re selling internationally. - Licenses and Permits: Depending on your products and location, you may need specific licenses or permits to operate legally.

Essential Paperwork for Etsy Sellers

The following documents are critical for Etsy sellers: - Business License: Required for legal operation, this license is obtained from your local government. - Sales Tax Permit: Necessary if you sell tangible goods and meet certain sales thresholds. - Resale Certificate: If you purchase products for resale, this certificate can help you avoid paying sales tax on those items. - Insurance: Consider liability insurance to protect yourself and your business in case of accidents or product issues. - Privacy Policy and Terms of Service: Essential for your shop’s website or profile, outlining how you handle customer data and the terms of sale.

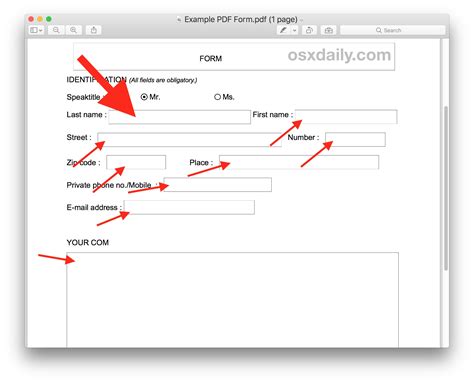

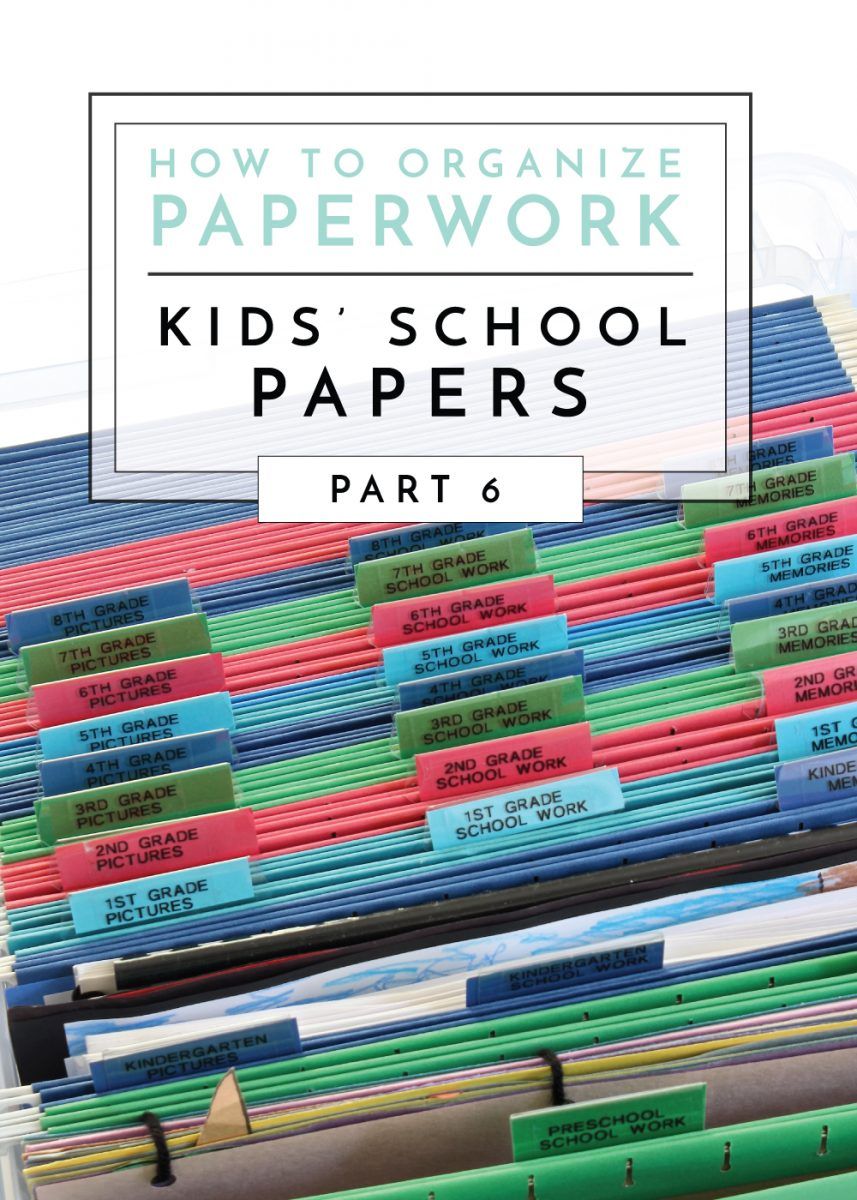

Organizing Your Paperwork

Staying organized is key to managing your Etsy shop’s paperwork efficiently. Here are some tips: - Digital Storage: Use cloud storage services like Google Drive or Dropbox to keep your documents accessible and backed up. - Physical Files: Maintain a physical file for original documents or those that require a hard copy. - Regular Updates: Schedule regular reviews of your paperwork to ensure everything is up to date and compliant with current laws and regulations.

Tax Considerations

Taxes can be one of the most overwhelming aspects of running a business. For Etsy sellers, understanding sales tax and income tax is crucial: - Sales Tax: You may need to collect sales tax on your sales, depending on your state’s laws and your business location. - Income Tax: Your business income will be subject to income tax. Keeping accurate records of expenses and income is vital for tax filing.

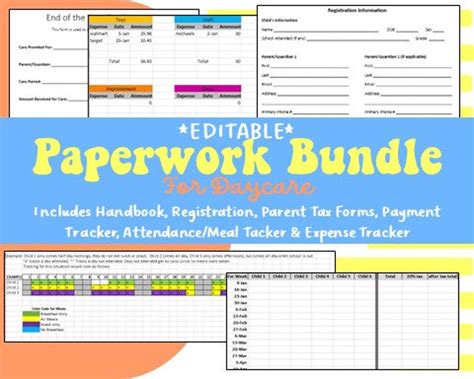

Record Keeping

Accurate and detailed record keeping is essential for managing your Etsy shop’s finances and complying with tax laws. This includes: - Expense Tracking: Log all business expenses to claim deductions on your tax return. - Sales Records: Keep records of all sales, including dates, amounts, and details of products sold. - Customer Information: Maintain a record of customer interactions, especially for custom orders or refunds.

| Document | Purpose | Frequency |

|---|---|---|

| Business License | Legal Operation | Annual Renewal |

| Sales Tax Permit | Sales Tax Collection | Annual Renewal |

| Resale Certificate | Avoid Sales Tax on Resale Items | As Needed |

📝 Note: The frequency of updating or renewing these documents can vary based on your location and business specifics, so it's crucial to check with local authorities for precise requirements.

Conclusion and Final Thoughts

In conclusion, while paperwork might seem like the less glamorous side of running an Etsy shop, it’s a critical component of ensuring your business operates smoothly and legally. By understanding the essential documents, maintaining good record-keeping practices, and staying compliant with tax laws, you can focus on what matters most - creating and selling your products. Remember, staying organized and seeking professional advice when needed can make all the difference in navigating the world of Etsy shop paperwork.

What is the first step in setting up an Etsy shop’s paperwork?

+

The first step is to register your business and obtain any necessary licenses and permits to operate legally in your area.

How often should I review my Etsy shop’s paperwork?

+

It’s a good practice to review your paperwork regularly, such as every 6 months, to ensure everything is up to date and compliant with current laws and regulations.

Do I need a resale certificate for my Etsy shop?

+

If you purchase products for resale, a resale certificate can help you avoid paying sales tax on those items. However, the necessity of this document can depend on your location and the specifics of your business.